The capitalist, libertarian dream of free-market economies really only works if consumers have as much power as the businesses. When there is no transparency consumers get suckered into deals with companies that overcharge and businesses are rewarded for being inefficient and controlling of the market. They have excess cash to dominate their competition which is antithetical free market economies so loved by libertarians. Lazy, inefficient companies should be punished in the market, upstart competitors should be able to outdo them and grab market share. Companies should compete, efficiency should increase.

An example of this in the US is the multi-billion dollar insurance business - it appears that customers doing business with some of the biggest and most powerful insurance companies are drastically overpaying for their insurance.

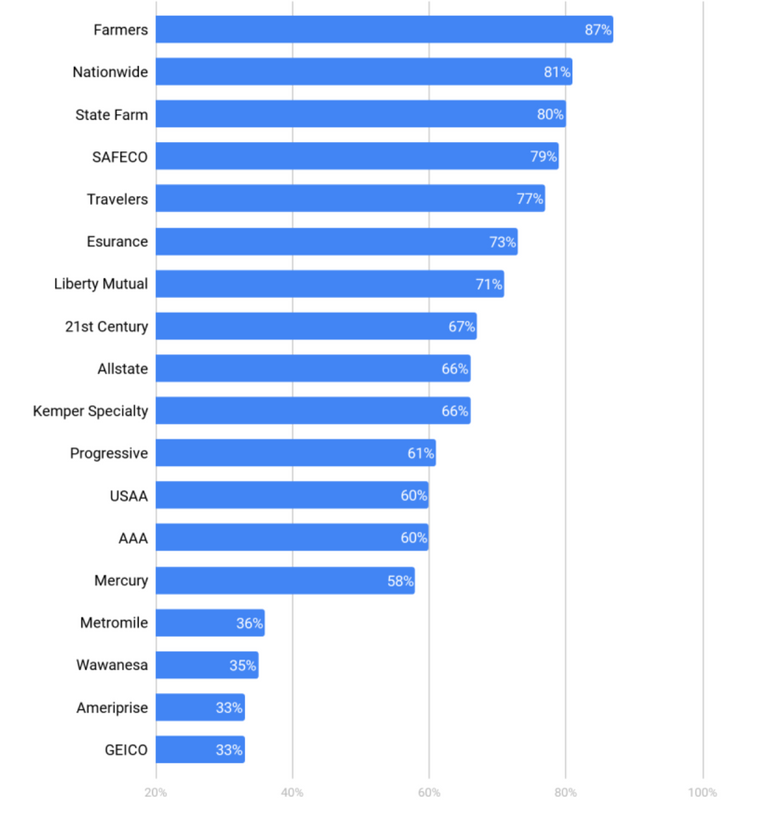

This chart from the Lifehacker article You're Probably Overpaying for Car Insurance shows that customers of Farmers Insurance are 87% likely to be overpaying.

I might feel smug about that because I switched from Farmers a couple of years back. However, it turns out I only switched from Farmers to Travellers in the #5 spot and 77% of Travellers customers are overpaying. Granted it doesn't actually mean I'm overpaying just that I'm more likely to be. However at the bottom of the chart less than one third of GEICO customers are overpaying.

If nothing else if you're with one of the companies near the top of this list you might want to consider shopping around to see if there are better deals. Some example places to do this would be NerdWallet or Insurify. I'm sure there are others - yay for consumer transparency right?

I was able to cut premium on homeowner by 40-50% by switching insurance companies, and save almost 40% bundling car insurance with my girlfriend (our combined cars was 60% of insuring each car separately). Free market seems to work only when making a switch!

Indeed - sounds like getting a good deal on cable TV. Take the equipment back and "cancel". Magically you get a great deal to come back.

I wonder how many people actually shop around - I know I didn't until I was in my mid 20's and had been driving for over a decade. I stayed with the company my parents had, and they'd been with the same company for decades before that. I think insurance, especially if you haven't really had to use it much, is very much a "legacy brand" - if it's what your parents had, it's probably what you'll have.

I'm with Geico now and love it, but before I switched I tried to maximize my discounts - paying for 6 months at a time instead of every month is a huge one, and in general trying to be a cautious and aware driver.

Also sometimes bundles can be more expensive - you might save money by bundling your car and renters insurance with one company, but they might charge twice as much for renters as a different company, so you're actually paying more than if you shopped around/had separate policies.

All good points. Someone recommended my previous company to me and I used them for 20 years. Like many I bought coverage through an agent who ultimately does almost nothing. Eventually after much promoting when Farmer's costs got crazy high due to a couple of claims (which in 20 years isn't bad) they suggested another company. As soon as our last claim is off the record I'll be ditching the agent and going direct to a company like GEICO.

Congratulations @o1o1o1o! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP