Each day, more and more traders find the ever expanding Forex market; make the shift from other asset classes for a variety of causes.

Around-the-clock trading availability, wide geographical dispersion, and pure unbridled opportunity have contributed to the growth in this market, as average daily volume in the FX Market nears $4 trillion dollars ($3.98 Trillion per the Bank of International Settlements).

That 's nearly $4 Trillion, in one day.

The goal of this article is to explain the nuances of the Forex market, highlighting key similarities and differences from other popular trading vehicles.

The FX Quote

The first thing that most new traders will notice is the FX quote.When trading stocks or futures, quotes can generally be read easily, as they are one-sided; meaning when you read a quote on Google, you are looking at the price at which traders can buy or sell Google.But when you want to trad If you want to trade the Euro, you can pick a variety of different ways of doing so.

You can choose to pair the Euro with the US Dollar.This will be the EUR/USD currency pair, which is the most common, liquid currency pair in the world.

Welcome to Forex

Or perhaps you want to make a different type of play and choose to marry the Euro with another currency, such as the Australian Dollar (abbreviated AUD), or the Japanese Yen (abbreviated JPY).

Traders can choose to trade the Euro in a wide variety of ways, based on their goals and prevailing opportunities in the market.

This really isn 't all that different than stocks.

Let's go back to our quote on Google.If GOOG is trading at $650.00, we can think of this in currency terms as GOOG/USD at $650 (Google quoted in terms of US Dollars is trading at $650).

We can also quote Google in terms of Euros.

Let's say that the spot quote on EUR/USD was $1.50, meaning that each Euro was worth One Dollar and Fifty Cents.We can then divide our $650.00 price on Google with the exchange rate of 1.5 Dollar s for every Euro (remember 1.50 is euro's quoted in terms of dollars) to get the equation ($650/1.5) = $433.33). So Google, quoted in terms of Euros with the above, with

GOOG/EUR = $433.33

Just like any other asset class, as the trader I want to look to buy low and sell high.Or sell high, and buy back to cover at a lower price for short positions.

When we sell a currency pair, we are selling it relative to another currency.Let's take our EUR/USD example from above.If I were to sell the EUR/USD currency pair, I would be selling Euro's.I would also be buying dollars.

My goal in this trade would be for Euro s to weaken, the Dollar to stre Ngthen, and price to go lower so that I could cover could

Five Digit Pricing

Another key difference in the quote of an FX pair is the fact that prices are offered, in many cases, to five digits. Most markets are denominated in a much more common sense, using prices that resemble those we see in our everyday lives, quoted to 2 decimal places. When I want to buy Some flour at the store, the price will be quoted 2 digits beyond the decimal place; like $4.56.If I want to buy a car, once again, prices are quoted 2 places past the decimal with a price such as $54,367.31.

But in the FX Market, more precision is needed, and prices are quoted up to 5 digits beyond the decimal.Let's look at a quote on EUR/USD for further examination.

Let 's assume that the bid on EUR/USD is 1.27218.

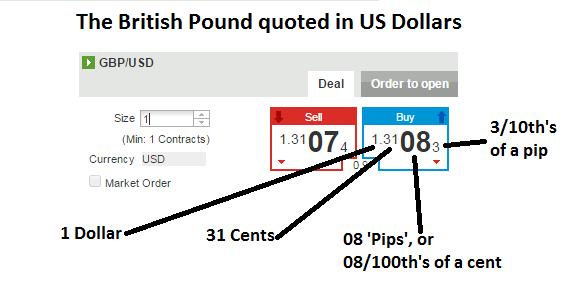

The first three digits of this number are just like any other price that we will see.In this case the Euro is worth One dollar, and 27 cents.The digits after help further define this quote.

The next 2 digits in this quote are called'pips,'which is short for'percentage in point.' In this quote, the Euro is trading at 1 dollar, 27 cents, and 21 pips, or 21/100 ths of a cent.

The fifth digit of this quote is called a'fractional pip,'and some Forex brokers do not offer this fifth digit.The fifth digit further helps define price, and Represents' tenths of a pip.'In the case of the above quote, it can be read One dollar, 27 cents, 21 pips, and 8/10 th of a pip.

Below is an example of another quote, with full annotation.

Many traders first enter FX wonder why this precision is needed with prices. That leads us into the next unique aspect of the FX market.

Leverage

The current average daily range (over the past 14 days) of the EUR / USD currency pair is approximately 115 pips. Using the EUR / USD current market price of (1.2726 as of this writing), the average range is approximately.9%, or less than 1%.

This is much less volatility than many traders, including myself, are myself.

In the FX market, leverage is available so that I can make these smaller moves in the way.