I have talked about this already but now it seems more important than ever. I have done research about how to calculate one's absolute wealth, since we live in a very relativistic Einsteinian world, and the only way to extract the absolute from it is to compare pretty much everything against everything else.

All these portfolio calculation methods are worthless really. I have tried to estimate wealth but it's pretty hard so I have been doing research on this, but progressing slowly since I have been pretty busy this summer, but it's one of my main priorities to put this into an easy step by step tutorial so that anyone can basically estimate his or her own wealth, very easily.

- https://steemit.com/money/@profitgenerator/research-measuring-absolute-wealth-1

- https://steemit.com/money/@profitgenerator/research-measuring-absolute-wealth-2-value-theory

- https://steemit.com/money/@profitgenerator/research-measuring-absolute-wealth-3-basic-logic

- https://steemit.com/money/@profitgenerator/how-to-calculate-your-net-worth

- https://steemit.com/economics/@profitgenerator/research-measuring-absolute-wealth-4-quantifying-inflation

- https://steemit.com/economy/@profitgenerator/honest-theory-of-inflation

The methodology is not complete, I am still working on it, but I am getting close to it, so it will be pretty easy to estimate your own wealth, and actually see if you are really making money, stagnating, or losing money, on a Year-by-Year or Month-by-Month basis.

Prototype Methodology

Well this methodology of accounting your own wealth is not formal. So how you are doing your taxes or financial statements is absolutely incorrect, but it's legally required so you pretty much have to do those as it's required.

What I am proposing here is actually the correct way to estimate your wealth, regardless of how the government says it's right or wrong. Of course you cant use this methodology for official things, it is just for your own personal use and nothing more, but it gives you a clear view about your own portfolio, more than any other method out there. Okay without further talk let me tell you how to do it in general, and again this is not the final version yet, I am still working out some details.

1) Calculate your Net Worth relative to USD

So you need to calculate your net worth, meaning the total assets that you have - the total liabilities (the recorded liabilities like debt, not the potential ones) relative to the USD. Even if you are not American, I have found the USD based market information to be more accurate than other currencies. Besides the Euro is fairly new,and there is no historical data to trace it back, and the DEM<>EUR conversions was kind of rough. Better stick to USD for now.

It's enough if you calculate it once in a month, since the data has 1 month resolution. So once in a month you calculate your net worth in your own currency and then convert that into USD, and record it in a spreadsheet. Or basically if you have records of your assets back to the past, then you can calculate this back historically.

2) Calculate the Inflation rate of the USD

This is fairly simple, we need to know, the Month-by-Month inflation rate of the USD. Now this might sound easy, you would just look it up on the FED's website. But it's not. The CPI numbers are pretty crappy, and don't really reflect the true inflation rate. In most cases the true inflation can be x2 or x3 times higher than the CPI difference.

I have done research about this, I post here later how to estimate inflation more correctly. Then you basically after you have the true inflation index, you put it in the next column next to your net worth data.

3) Calculate the absolute Forex values of the USD

The last step is to calculate the absolute Forex value of the USD, meaning, comparing the USD to all other currencies in the world. Mostly just the like top 10, the others hardly weigh in. So basically: EUR,GBP,JPY,CNY,CAD,AUD,CHF,SEK,NZD,MXN,SGD,HKD,NOK,KRW.

Now this is tricky again because of many reasons, I have to research this method more, but it's roughly what it needs to be done. Again this should be in column C, next to the 2 other data series.

4) Calculate the Log Differences and add them all up

Now that we have 3 columns, we will calculate the logarithmic difference between each datapoint in all series, preferably with the LN() function. And add them all up. Then multiply the first column with the result for each datapoint.

That's all, now you will know Month-by-Month whether you are really making money or not.

Of course this is the theoretical calculation, in practice, taxes and other expenses need to be subtracted from the Month-by-Month data, but only in the period when the taxes are paid.

So the accounting can get really complicated, but it can probably be coded into a software, in fact I might even do that myself after I figure out a few more things.

Example

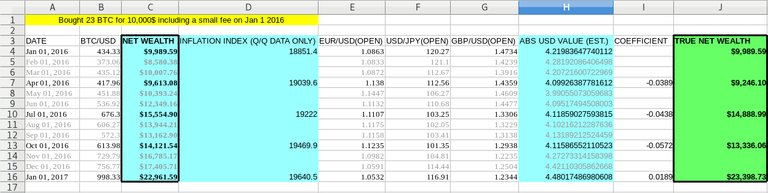

Ok this methodology might sound too complex, so let me give you a very simple example how it would be done. Let's say you are a young guy living in a rent apartment, and all you have is 10,000$. So all you have is 10,000$ right in your hands, tangible cash, and you have no debt just to make it simple. So you bought BTC with the 10,000$ in January 1st 2016, and let's calculate how much your wealth has gone up by January 1st 2017 during a 1 year period.

It would look something like this, the guy would have bought like 23 BTC with 10,000$ given some fees, which would be worth instantly 9,989.59$ by the end of the year turning it into 22,961.59$. But we have to correct that for inflation and the absolute value of the USD, which interestingly has increased by 2017.

So we have the inflation index, which I believe is the more accurate inflation. Unfortunately it's only quarterly data. I used the GDB indicator for now which really estimates inflation correctly between the M1 and M2 money supply, that I have explained already.

Then we calculate the absolute value of the USD, only using 3 pairs for now for simplicity: EUR/USD,USD/JPY,GBP/USD, who’s formula is:

Basically taking the n-th root of the product of the multiplication, but always making sure that the USD is in the dividend, above the fraction line, so divide 1 by the pair when USD is at the bottom. So we compare the USD to the product of the other currencies, and take the n-th root of it to get the absolute value.

Then just take the log of the differences compared to a benchmark point, in this case to the first point, and calculate the coefficient. The inflation difference is subtracted from the absolute value difference, we can do that in logs.

Then just multiply the coefficient with the net wealth, to get the inflation corrected true purchasing power that you have now compared to the USD value of January 1st 2016. If it grows, then your wealth has grown, if it's smaller then the wealth has shrunk.

In this case the inflation effect only decreases the value by a few hundred bucks, but by January 2017 it surpasses it, given that the USD has gained value compared to the other currencies.

Then we would subtract taxes, which let's say are 50%, but they are of course subtracted from the "net wealth", which is the official statement. So we'd be left at the end with a net wealth of 16475.59$, but attention: the inflation has actually eroded some of the taxes, and if we subtract that from the true value of our money, our actual true net wealth remains: 16912.73$.

Taxes get eroded away too by inflation. So the less frequent taxes are paid, the better. A yearly tax payment is much better than a monthly tax, since in 1 year the tax has been eroded by 437.14$.

Conclusion

I am still analyzing this method, and it may have some flaws, but it's roughly like this. The funny thing is that inflation also erodes taxes. So if you are storing cryptocurrencies long term, and you only pay tax at withdrawal, long term capital gains, then the tax amount really gets eroded by a lot. And it might be eroded even more if you pay tax in a foreign currency.

So your actual true net worth, your purchasing power can even grow if the dollar is bullish. But obviously the biggest gains come from the bullish nature of Bitcoin itself. It doubled itself in value in 1 year, and it quadrupled itself in 2017.

I still have to do more research on this, but it's roughly like this. Good luck calculating your own purchasing power!

Sources:

https://pixabay.com

Good post. Some people might differ to the points mentioned, since a lot of things are varying factors. Please do share any new findings after research. Thank you.

Yes it's basically like this, but I do have a few more things to look up.