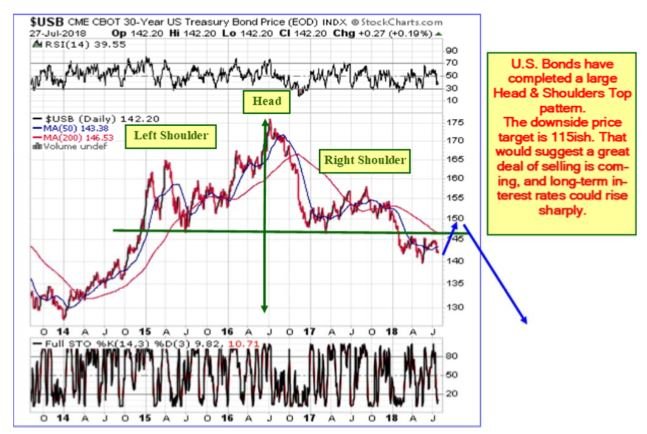

U.S. Bonds have completed a large Bearish Head & Shoulders Top pattern. The downside price target is 115ish, suggesting a ton of selling is about to hit the U.S. Bond market. Long-term interest rates could rise.

Could intense selling come from China as a weapon in the current trade wars? The timing for hitting that 115 level is likely a few years from now. This suggests the Fed will resist buying Bonds held by China, and will not be interested in keeping long term interest rates low. China holds about $1.2 trillion of U.S. Treasury Bills, Notes and Bonds, 7 percent of all U.S. Debt. They own about 21 percent of all foreign held U.S. debt obligations. With the Fed contemporaneously unwinding $4.0 trillion of

Securities from its ballooned balance sheet, Quantitative Tightening - selling $80.0 billion per month over the next four plus years, that is a lot of selling pressure coming to the U.S. Treasury market. This also will likely be one of many catalysts that send the stock market down hard once wave v-up for the rally from August 2015 completes. Short-term, Bonds are correcting the recent five-wave move down from the right shoulder peak in September 2017. A bounce could take Bonds back up toward 150ish before they resume their decline.

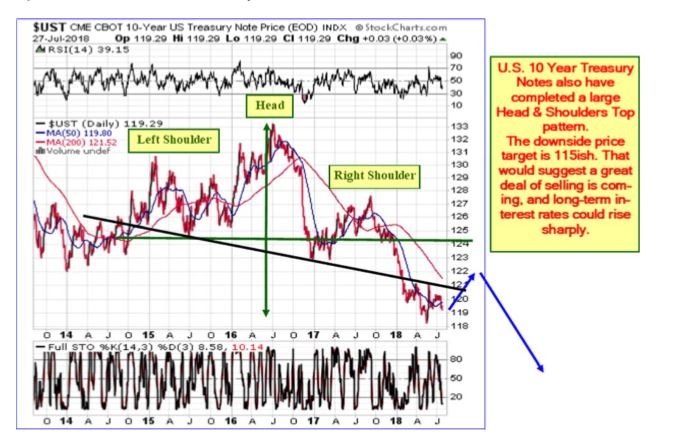

Same scenario for the 10-year U.S. Treasury. Since the 10-year interest rate is a driver for mortgage interest rates, this means mortgage interest rates are headed higher. The downside price target for the Head & Shoulders Top is 115ish. There is a second possible H&S top, which has a declining neckline. That pattern has a downside price target of 112ish.

Rising interest rates will slow economic growth, and eventually contribute to an economic recession. Once we see an inverted yield curve, we will be on high alert for the onset of the next recession. That point is typically a good place to purchase longer term notes and bonds, as that is often a sign that interest rates are peaking.

At McHugh’s Market Forecast Services at www.technicalindicatorindex.com we will be watching this development carefully and will report to our Subscribers updates on this trend. As traders and investors, we want to be ready and not miss this development

By Robert McHugh, Ph.D. July 30th, 2018