The combination of Trump tax plan (deficit spending into no bid bond market) + 1 trillion dollar infrastructure plan is either going to completely reverse the collapse in money velocity and ignite 1970's inflation to the moon, or the entire league of ivory tower, fraudulent economists will be completely bewildered that money velocity continues to collapse and do something like QE4 on top of that. Either way, they're going to force inflation somehow in the end no matter what and it's going to be yuge.

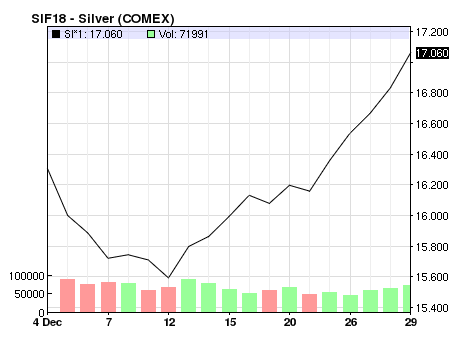

The metals market is already responding with people front running this right now:

The last time they did something like this, gold and silver both went up 10x in inflation adjusted dollars in the span of 8 years. I think this time the inflation might hit harder over a shorter time span (once they ever manage to get it started that is). If stocks collapse, all retirement funds collapse and the establishment gets overthrown by the boomercucks. Betting on stocks collapsing is probably not a good idea when they're clearly trying to engineer 1970's inflation to debase the unservicable debt + prop up the stock market.

In terms of metals price, gold should already be $2400-2600 or so right now when looking at gold to debt ratio charts. Silver would spike to around $75-85 when gold corrects there in current dollar purchasing power. Howerever, if they actually do ignite 70's inflation, the metals prices are going to go off the charts.

(img source: nasdaq.com & starz.com)