It's been around 10 years since I first did my Early Retirement Extreme calculations, back when I was still working and earning a very reasonable salary.

Back then I remember calculating that mortgage free I would be able to live off £1000 pretty comfortably, and I think I've done a pretty good job of keeping that figure up to date for inflation over the years.

I do income and expenditure checks at least once every few months, and so they've given me an idea of how much I need, and last time I checked I was looking at around £1300 a month to live comfortably.

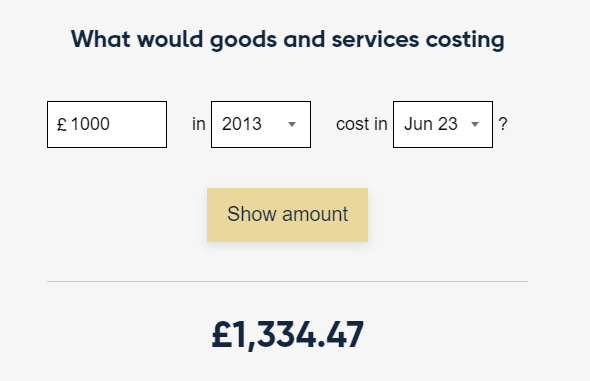

However I thought it was worth quickly checking how figures from 10 years ago stack up to figures today and The Bank of England have a handy calculator to do just that. You simply enter an amount and the relative years and it translates X amount of money Y amount of years ago and gives you the equivalent in today's money:

And low and behold the figure I get roughly stacks up to the figures I'd been coming up with in my expenditure trackings.

The BoE figures simply use the CPI and this is what my private teacher's pension is linked to, which covers food and most other basic expenditures and this will cover most of my basic outgoings from the time I can claim it at 60 (hopefully).

It's good to know that I haven't been suffering from frog in boiling water syndrome over my expenditure, and that my brain thing has been adjusting for inflation over the months and years.

And it's especially good to keep these reality checks in mind given the high inflation we've been experiencing over the last year, one wouldn't want to get caught out!

SO TOUGH. I needed 860 in 2016 with no mortgage, now is 1123.

It's not easy is it... that drip, drip inflation effect! Similar to me! 860 is pretty good going!

860 was good, by the time I reach financial independence 5 years from now, I may need 1500.

That's interesting, my calculations are almost exactly the same.

I'm doing a review next week several months after changing from employee status. It used to be easy to track what was going on: payday, divvy up the salary, and anything else went into savings. Now there's more income points, but also more pots to fill.

I get the feeling yr doing OK, just avoiding that upper tax bracket!

What is this mortgage free you all talk about?? No such thing in the Land Down Under!

We are all about buying and borrowing and investing and paying interest.....

Well once the main mortgage on the house is paid off, getting there!

Almost %33. It is yearly %48 (so called) in my country. I think, considering 10 year period, the calculator wouldn't work right for me :)

Yeah we don't have that ridiculous inflation here, well last year bad, but not that, super mental adjustment required there!

Yes knowing where you stand financially is rather important especially when you have retired.

Well, semi-retired!

Do you include the taxes on your property in your equation?

Yes of course!

Interesting stuff! Thank you!

It is a fact that over the last few years it has become so expensive that living has become very difficult, especially for people with lower incomes who used to live well because things are cheaper. It used to be that now things have become very expensive and now it has become very difficult, if not impossible, to make ends meet.

Congratulations @revisesociology! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: