This is a guest post by MustafaJr, bitcoin trader since 2013.

In my first 45 days trading bitcoin, I lost $21,492 in a margin call.

That was a big chunk of my savings. It hurt. I was devastated.

After a couple of weeks of reflection (and depression), I decided that I wanted to trade again. But this time, I needed to do it right.

I bought every book about trading I could find. I joined chat rooms and communities. I reached out to experts. I studied bitcoin’s price meticulously. I refined and tested my strategies.

Since 2014, I’ve made $184,788 trading bitcoin — a net return of almost 1,000% on my starting capital.

Below I share the simple but crucial lessons I’ve learned along the way.

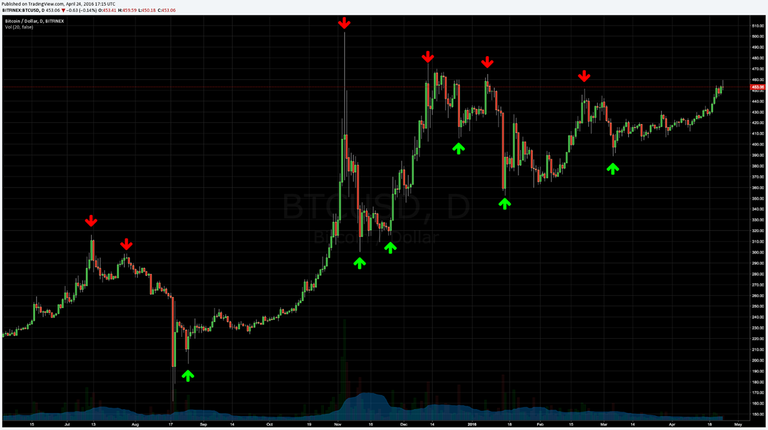

Bitcoin is a series of pumps and dumps

And it should be traded exclusively as such.

The market is filled with rookie players. That’s not likely to change any time soon. This is an opportunity for those who know what they’re doing.

The emotionality of rookie money is highest at the peaks and troughs.

No player knows where price will go next. But rookies want to “get rich quick” trying to guess.

So they follow everybody else until the price swings overextend irrationally. You want to be there when those market irrationalities occur.

Trade against exuberance and capitulation

Trading against prevailing sentiment, when it is extreme, is a very profitable strategy.

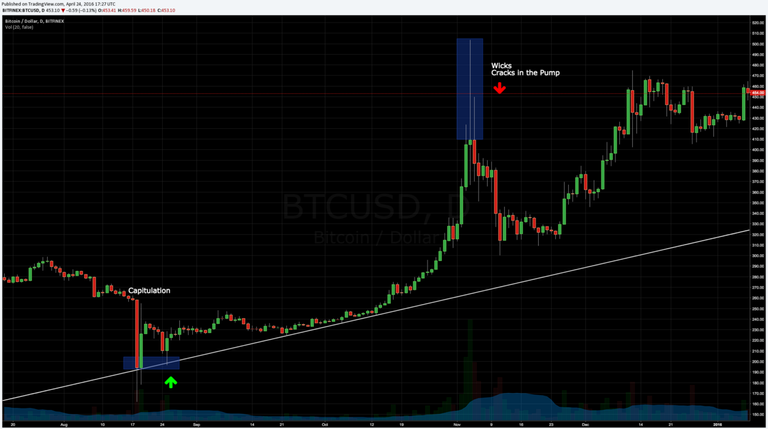

Trading the Bump, Pump, Dump & Run setup has been my single most profitable strategy. Price is amplified by exuberance and capitulation. So is the potential for profit.

My general rule of thumb:

Buy a double bottom on the daily timeframe after Capitulation (large red candles and significant selling). Then sell Exuberance (long wicks and engulfing candles).

Don’t exit too early. When price is consistently making higher highs and higher lows, that means the bears are trying, but failing, to bring price down.

That also means they are stacking up their short positions. Great fuel for a short squeeze.

“Trade the financial markets using bitcoin or dash on Whaleclub - no banks. Get a deposit bonus by signing up here.”

Buy the rumor, sell the news

A classic that applies well to bitcoin.

Bitcoin’s price is very sensitive to news. Especially blog posts by angry developers.

And bitcoin, being the wild west that it is, is very prone to insider trading.

By the time you hear a bullish or bearish rumor, you can be almost certain that insiders have already taken their positions.

And you should too. Information spreads more slowly than you think in bitcoin land.

By the time the rumor is confirmed and hits mainstream publications, the price has already pumped (or dumped), and insiders are ready to exit into rookie and late-to-the-game liquidity — usually within a few days.

The real money is in the higher timeframes

Trading the daily timeframe will net you the biggest return on your time.

Don’t try to manually scalp bitcoin on the 15min timeframe. If you do the math, counting your wins, losses, and fees, you’ll probably end up making less than minimum wage.

In which case, it makes more sense for you to work at a fast food restaurant

Trading bitcoin doesn’t have to take up all your time. And it doesn’t have to be a source of stress and anxiety.

It only takes me 30 minutes a day to check the charts and refine my setup if need be.

Then I let the market do the heavy lifting for me.

It is also crucial to trade through the right platform, and one I strongly recommend is Whaleclub, you get a deposit bonus as well by signing up here.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.whaleclub.co/4-lessons-i-learned-trading-bitcoin-in-2016-1f034827a1f1