Hi Steemians,

this is my first lesson into options trading.

We had some pretty wild swings lately in the stock markets, which is great.

Option traders love high volatility.

So let’s get this trading course started.

Why trade options instead of stocks?

Buying shares of stock or selling them short is basically always a 50/50 shot. In the long term the stock markets have a slightly upward drift, but in the short term buying or selling shares of stock is pretty much the same as flipping a coin. The same is true for buying cryptos.

Trading options is a strategic investment. It’s a numbers game. You trade probabilities. By trading options instead of stocks, you can decide for yourself how much risk you are willing to take and how big your chances of winning will be. There are strategies which can make you unlimited profits and come with defined risk, but have a lower probability of profit. There are strategies which come with a defined max profit, a very high probability of profit and theoretical unlimited risk. There are strategies which come with defined risk and a defined max profit. There are strategies which make you money if the price of the underlying stock goes down, there are strategies which make you money if the price of the underlying stock goes up, there are strategies which make you money if the price of the underlying stock stays in a certain range or closes at a certain price, there are strategies which make you money if the implied volatility goes up and there are strategies which make you money the implied volatility goes down.

As you can see, with options you have nearly unlimited options.

But now let’s start from the beginning.

What are options?

Stock options are contracts between two parties, which give the buyer of the option the right (but not the obligation) to buy (call option) or sell (put option) a stock at a certain agreed on price ,within a certain time period. For this right, the buyer has to pay the option premium.

The other side of the trade (seller of an option) always has the obligation to buy or sell shares of stock, if het gets exercised/assigned. One contract of a stock option represents 100 shares of the underlying stock. Stock options are American style options, which can be exercised anytime until the expiration day. Index options (e.g. SPX, NDX, RUT) are European style options. European style options can only be exercised on the expiration day and are cash settled. The seller of an option always has the obligation to sell/buy 100 shares of stock per contract, if the option is exercised/assigned.

Call Options:

A call option gives the buyer the right (but not the obligation) to buy 100 shares of the underlying stock at the strike price.

If the buyer of a call option exercises his right to buy 100 shares of the underlying stock, he calls away the 100 shares from the other party. Therefore the name call option.

Put Options:

A put option gives the buyer the right (but not the obligation) to sell 100 shares of the underlying stock at the strike price. If the buyer of the put option exercises his right to sell 100 shares of the underlying stock, he puts 100 shares of the underlying stock into the account of the other party. Therefore the name put option.

Let’s look at an example:

Let’s assume somebody wants to buy a call in Apple in the March expiration cycle, because he thinks the price of Apple will go up sharply until expiration on March 16.

Currently Apple (ticker symbol AAPL) is trading at 158.91.

So let’s have a look at the option chain to see, which strikes are available and at which price they are trading.

There are much more strike prices, than the option chain is showing, but let’s concentrate at the options which are near the money.

We have put options on the right side and call options on the left side. If you never traded anything before, you might notice, that there are two different prices. The bid price and the ask price. This might look a bit odd to people who have never traded before, since when you buy stuff in a shop, you always just see one price, the ask price. The financial markets are the greatest and fairest markets in the world, since you always can take both sides. You can sell or buy. When we buy shares of stock or an option, we are long the option or stock. When we sell short shares of stock or sell an option to open, we are short the stock or option. So why the two different prices?

Well, in the financial markets, there are market makers. In the old days these where the people standing at the trading floor and shouting at each other like crazy. Today most of the times, the market maker is just a computer program constantly selling and buying. The market maker offers you to buy a stock or an option at the bid price and he is willing to sell to you the underlying financial instrument at the ask price. Kinda like a grocery store owner, who buys potatoes from the potato farmer at the wholesale price and sells them to you at the retail price. But the financial markets are much better than buying groceries. At a grocery store you can only buy. At the financial markets you can buy or sell.

I added the terms in the money and out of the money puts and calls to the option chain.

An out of the money (otm) put has a lower strike price, than the actual stock price and an in the money (itm) put has a higher price, than the actual stock price.

An otm call has a higher strike price, than the actual stock price and an itm call has a lower strike price than the actual stock price.

When we go long an option, we buy to open and sell to close.

When we go short an option, we sell to open and buy to close.

We are not limited to single options or strike prices, we can combine up to four different strike prices in one single trade.

Now let's get back to our example:

At the time of this writing AAPL is trading at 158.91.

Somebody thinks that the price of AAPL might go up sharply until March expiration and wants wo buy a slightly itm call option at the 155 strike price.

The bid/ask spread for the 155 call is 7.80/7.95.

So the market maker is offering to sell the 155 call to us at $7.95 (times 100, since 1 contract consists of 100 shares of stock) and he is also willing to buy the 155 call for $7.80.

You should never buy at the ask price or sell at the bid price. It is always best to do a little bargaining, so we put in a limit order at the mid price (7.80 + 7.95 = 7.88).

There are hundreds of market makers and liquidity providers, who are competing for your trade, so in a liquid underlying like AAPL, you will most likely get filled at the mid price.

So let’s assume the order gets filled at $7.88.

We buy to open one contract of the AAPL March 155 call and have to pay $788 plus commission. At the broker I would recommend, which is tastyworks, the commission we have to pay is $1 for the opening of the trade and zero dollars for the closing of the trade.

From now on until March 16, we have the right, but not the obligation to buy 100 shares of AAPL at the strike price, which is 155.

But usually it makes no sense to exercise the option. When we have a profit on our trade, we just sell to close our option and take our profit.

The great thing with trading options is, that you have to put up much less money, than trading the stock. If we had bought 100 shares of AAPL we would have to come up with 158.91*100 = $15,891 in a cash account and $7,945,50 in a margin account.

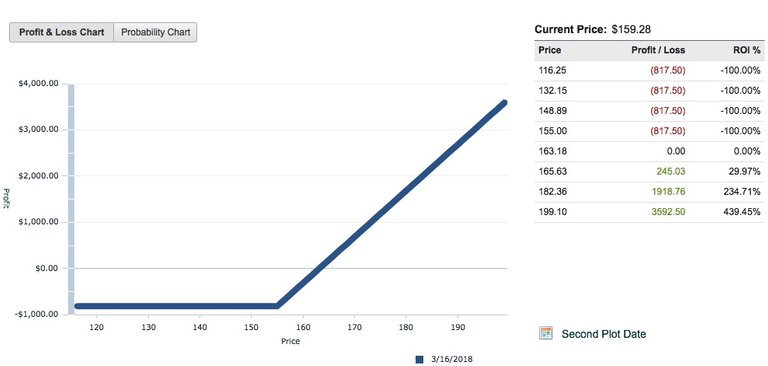

Now let’s have a look at the profit/loss graph for our long AAPL call:

The most we can lose on a long option, is the price we paid plus commission.

So $788 plus the $1 in commission per contract ($789)

Since our strike price is 155 and we paid $7.88, our break even price at expiration is $162.88. That’s why long options have a probability of profit below 50%. If the price of AAPL doesn’t move up quickly, we lose money. Our risk is defined, since we can’t lose more than we paid and our profit can be unlimited, since in theory the price of AAPL can go up unlimited.

The chance to unlimited profit comes with a lower probability of profit.

Kinda like a lottery ticket.

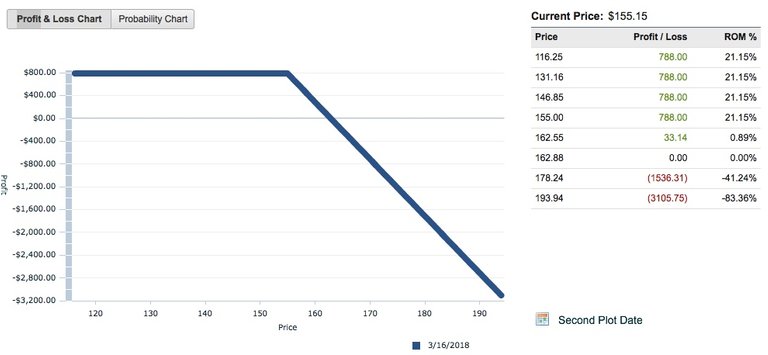

Let’s have a look at the profit/loss graph of the same trade, but we take the other side of the trade.

How would my profit/loss scenario would look, if I sell to open the 155 call:

If we sell to open the AAPL March 155 call, we get paid the $788.

Since we get paid $788, our break even price is $162.88.

So we make money, until the price of AAPL doesn’t close above $162.88 on the expiration day.

Therefore we have a much higher probability of profit than 50%.

Selling naked options comes with a margin requirement.

At the moment your broker would reduce your buying power by $2,959.26, if you would sell this 155 call. But your buying power reduction can go up, if the price of AAPL moves against you, or if the implied volatility of AAPL goes way up (we will talk about implied volatility in a later article).

When you sell to open naked options, your profits are limited, but your losses can be unlimited.

As an options seller, or in traders slang, as a premium seller, you are like a casino. From a probability standpoint, you have an edge, but if a gambler hits the jackpot, you can blow up. That’s why we always trade small.

Wow, we covered a lot in this first lesson.

I hope you learned a lot and did understand everything.

If you enjoyed this lesson, please upvote/resteem and if you have any questions, feel free to ask in the comment section.

In the next lesson we’ll look at selling and buying put options (and a lot more) and I also will tell you, why you never should buy naked long options.

Have a great day,

Stephan Haller

There is an error in the first picture:

Out of the money and in the money must be interchanged.