Compound interest is one of the basic tenants of fiance. It is also the single most powerful force in the world of finance.

Unfortunately many people's first introduction to the power of compound interest comes in the form of credit card bills that have snowballed out of control. Don't let such negative experiences keep you from enjoying the benefits of compound interest when you are the one earning the interest instead of paying it out.

Compound interest is simply "interest on interest." This means reinvesting any interest/dividends earned on an investment instead of spending that interest. Let's look at what compound interest can do below.

Here are the results of a $10,000 deposit, earning 8% interest per year with no additional deposits:

As you can see, the main feature of compounding interest is that becomes more powerful the longer it goes on. The only way to achieve this is by simply NOT TOUCHING the money. Just like an avalanche that starts small and becomes huge, it must be given time to work. At least ten years is the ideal minimum, but you can clearly see the advantages of allowing compounding to go to work for several decades.

Ways To Compound

Many people actually think that compound interest can only happen with a traditional savings account, but nothing could be further from the truth. In today's low interest rates environment, traditional savings accounts are a guaranteed loss in real terms(inflation adjusted), because the meager interest rate doesn't even come close to the rate of inflation. So here are some of my favorite ways of achieving compounded returns.

-Dividend paying, blue-chip stocks

Lots of people will tell you that the stock market is nothing more than a casino, but the truth is that it is only risky if you behave in a risky way. The best way to achieve compounding returns in the stock market is to invest long-term in blue chip companies, which are the biggest and most established companies that are publicly traded. Think companies such as Coca Cola, Proctor & Gamble, or Johnson & Johnson. Chances are you have products from all three of these companies in your home right now. These are companies that have been around for many years, have big market share, usually are household names, and will likely be around for many more years.

Companies of this size pay a quarterly dividend to their shareholders, and every dividend payment is a chance to reinvest. More shares are bought with every dividend that is paid, and those new shares pay dividends which are reinvested in more shares and so on. The advantage of compounding with stocks is the capital appreciation in share price that comes with investing in these kinds of companies for the long run. This is just and added bonus though, as many studies have been done on dividends which have shown that the dividend payment and dividend growth contribute anywhere from 30%-90% of the total returns, depending on which markets and time periods were looked at.

-Dividend Paying Whole Life Insurance

This is a very controversial thing to say, because life insurance is generally viewed as a very bad product for investing. The truth is that dividend paying whole life insurance policies can become very effective investment vehicles, but only when they are structured properly.

Dividend paying whole life insurance, also known as permanent or participating whole life insurance, provides a cash value component. They also pay a yearly dividend, which is technically a 'return of premium.' What this means is that the insurance companies greatly overestimate the amount of death benefits that will have to be payed out, and every year the difference is returned to policy holders in the form of a dividend. The ideal companies for these types of policies are those that are mutually owned versus publicly owned. While these dividends are not contractually guaranteed, the best companies have very long track records of consistent dividend payment. MassMutual, for example, has paid out dividends every single year since 1869. The dividend rate is far superior to savings account rates as well, with MassMutual never paying below 6.7% over the past twenty years.

So of course, these dividends can be used to purchase additional insurance, which increases the cash value and therefore increases the dividend amount paid the next year. This means that you can absolutely compound with these types of policies and they can be a core part of your portfolio if they are structured the proper way. One specific strategy can be used called 'dividend offset', which refers to the point where the yearly dividends cover your premiums, meaning you no longer have to fund the policy with premiums out of pocket. Dividend offset can be achieved in 5-10 years depending on how the policy is set up and the particular dividend rates.

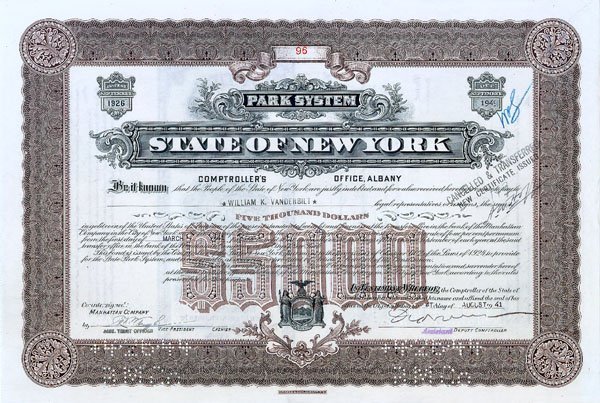

-Tax-Free Municipal Bonds

Municipal bonds are loans made to local, state, and federal municipalities. These bonds are tax-free, as the money is being used for public projects or generally paid back with tax revenue. Muni bonds actually have a lower rate of default than government or corporate bonds, and they are considered a very conservative investment. A muni bond fund invests in hundreds or even thousands of bonds which spreads the risk out. There are many muni bond mutual funds what are riddled with high fees, so it is important to only go with funds that are no-load and very low in fees. Vanguard is one of the leaders in this category.

Conclusion

The younger you are, the more important it is to start compounding today. If you aren't young anymore, is still isn't too late, but be sure to drill this concept into the head of any youngsters you know and help them get a head start with their finances.

*This post is not intended to be financial advice and is for informational purposes only.

References:

https://tackletrading.com/tag/compound-interest/

https://fieldnet.massmutual.com/public/life/pdfs/li7954.pdf

http://www.fastgraphs.com/research_articles/2016-03-24-carnevale-dividends-true-contribution-may-suprise

https://www.pinterest.com/danduyser/logos-worth-recognizing/

https://www.linkedin.com/pulse/what-exactly-you-insuring-old-life-insurance-policy-guerin-cfp-

https://www.creditwritedowns.com/2011/02/kyle-bass-at-municipal-level-its-open-season-for-defaults.html

I love that you're reinforcing the importance of compounding, but have to add that we shouldn't restrict the investment universe of good compounding wealth assets to those you listed. There are a ton more, and even these listed need to be in the context of risk adjustment.

for instance, you're spot on with long horizon thinking, but saying "The best way to achieve compounding returns in the stock market is to invest long-term in blue chip companies" isn't true. That's one way of investing in stocks, but a long horizon investor should probably be looking towards small value stocks for higher risk-adjusted returns.

Investing these days is more about factor exposure than selecting a single asset class, or even segment of an asset class, like blue chip stocks.

If the long term goal to is create a compounding dividend machine with stocks, I just think the established companies will do the job better since many of them have been increasing their dividends for many years. There are about 20 companies in the S&P that have increased their dividend for at least 50 consecutive years.

Small caps are definitely the place to be if you're looking for growth, but I honestly think the average person should at least have the core of their equities portfolio in dividend paying blue chips. Thanks for the comment and for reading!

My pleasure and thanks for writing...the overall message is very important. And yes, if you're goal is to get dividend income, then i agree that blue chips are the way to go. i just think the message of compounding ought to extend to all value compounding, not just income; e.g. earnings compounding instead of just the dividend distribution component.