If you're in financial media or tech media, you've definitely heard of crypto currencies like Bitcoins or Ether (Ethereum). Perhaps you have heard that this is the form of the future? Or, you have read stories that some investors have either earned or lost large amounts of speculation in one of these currencies.

But what is the crypto currency really and what can you expect from that type of payment in the future?

Most payments on the internet today take place via credit card. When you wants to buy a blouse via an online store, yes, you usually pays via your Master card or Visa card. This can be done either via a plastic card or over the phone. In this way, you and the store actually use an intermediary to account for the transfer of money. This intermediary is among other things a bank that stands for both parties' identity and controls their accounts, money holdings etc.

The system is smart because it allows relatively fast transaction of value instead of you going to go to the store and put her cash on the table and then take on the blouse.

But is the method really smart enough?

In the internet age, a system of computers can exchange information over a split second, almost without cost. So why should you find that you must first be approved by her bank to create a Visa card? And why should you then live with high fees and often also relatively slow transfer of money when you purchase goods online?

It is exactly the conditions that virtual currencies such as Bitcoins and Ethereum (Ether) try to solve.

Instead, if you uses a virtual currency transfer, you simply runs the bank as an intermediary, thus saving the fees, approval procedures and waiting time associated with a bank.

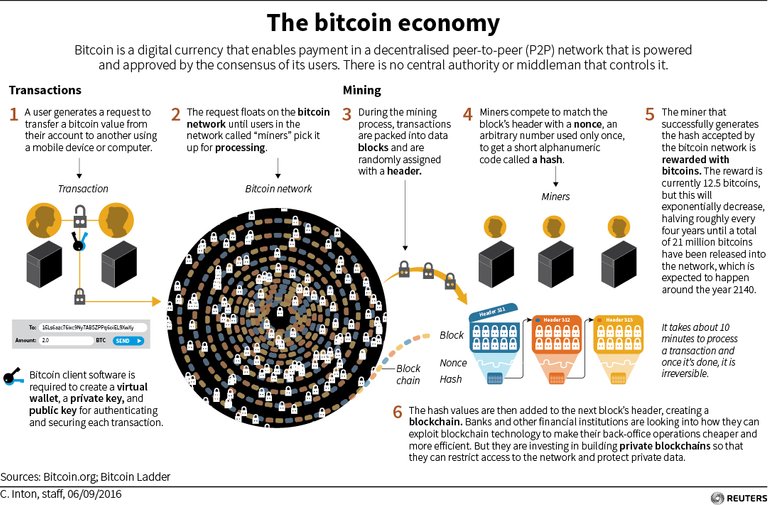

But if the bank is out of the picture, who then stands for the soundness of the value and the actual transfer? The answer to that question also provides insight into the genius of kryptocurrencies. In reality, authenticity is endorsed by all "others" in a sensible system of computers and algorithms, collectively called "blockchain" technology.

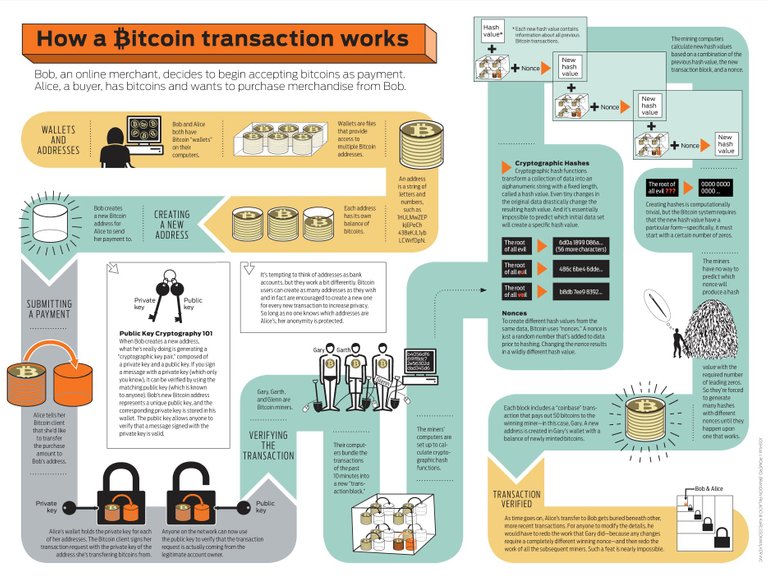

Let's say you will pay her shirt via a transfer in Bitcoins instead of using her credit card. Initially, it is obvious that the internet store accepts payment at Bitcoins. (More about this later). If you are using a virtual currency, you must first create a wallet called "wallet" in which you holds her virtual money. This wallet can be located on your own computer or at an internet company that stores her wallet. One can easily have many wallets.

A Wallet consists of a collection of encryption keys that allow you to transfer and receive payment. One key is called "private" and it allows you to send virtual currency and the other is called "public" and it allows to receive currency. The latter can be perceived as an email address or a phone number that puts the transfer together with the associated wallet.

When you are ready to send her Bitcoins to the store, you clicks up to your wallet, and now enters the online store's "public key".

Now that you have entered the amount and the shop's "public key", you press "send", thus putting her into the sensible blockchain that forms the very heart of the crypto currency.

A network of thousands of computers is now ready to receive your transaction and approve it in each version of the common "bankbook" that is part of the overall blockchain. Your transfer may be associated with a number of codes, such as a signature, a time stamp, and more keys that put it in connection with ALL other previous transfers.

It takes between 0 and 2 seconds before the entire network of computers is familiar with your transfer and only when most of the network has registered your transaction and found that it is codically and mathematically fit into the entire chain of prior payments, the payment will be Stamped correctly.

It is not the bank that ultimately approves of your payment, but rather the entire network of computers, each of which gets your payment to vote, while writing the transaction into Bitcoin's major historical "bankbook" so that your modest transaction also comes To play a role when all future transactions with Bitcoins must be approved as either genuine or false.

That's why Bitcoins - and all other related virtual currencies - are very difficult to cheat on. To influence the power of Bitcoins for one's own benefit, you must change the entire historical code in the bankbook to at least 51% of all the computers that make up the network. Only in that way will false payments in principle be approved. However, such a change requires computing power that is 100 times more powerful than all Google's computers combined. In reality, it's almost impossible. No country or company has so much data power.

In Bitcoin's case, all computers are called in the authentication network for "mining computers", and the owners of these computers are called "miners", ie miners. Anyone with internet access and a powerful computer can in principle be "mines". Thus, one's computer becomes a small part of Bitcoin's network, helping to approve new Bitcoins transfers from around the world. Thanks to the help, the owner of the computer earns new Bitcoins, which can of course be used to pay with. It may sound like being "mines", but if you're going to work with a good financial surplus, it's typically like living in a country where electricity is cheap because it requires a lot of energy for A computer to approve Bitcoin transactions and reward the "miners" with new Bitcoins.

The Bitcoin system only allows 21 million Bitcoins, and there are no more. Thus, Bitcoins distinguishes itself from traditional currency, where it is typically possible for central banks to simply print more money. This means that Bitcoin does not at the same time create the same risk of inflation as normal currency. As a consequence, the value of Bitcoin will increase in line with demand, and that particular element has made Bitcoin particularly interesting for investors.

It is precisely as an investment opportunity that Bitcoin and other cryptos such as. Ethereum (Ether), for the time being, has drawn the most headlines. This is due, among other things, to the fact that the stock exchanges' stock exchanges have been chopped or have been exposed to so-called flash crashes, where the value is shrinking at the moment. But the issues basically have nothing to do with the virtual currency. Also, the usefulness of a gold clump as a jewel does not fall away simply because the local gold exchange has been subjected to robbery. Thus, the technology behind the virtual currency is even if the stock market is cracking.

This is so helpful for underatanding specially for people new into this like me ☺ Thank you for taking the time posting this and explaining. 🖒

My pleassure!

Let the economic revolution begin! Great knowledge to people!

Hello @tradewonk. Welcome to Steemit. I am David. I wish you have a happy journey here.

Thanks, but this is not an introduction :-)

Welcome to Steemit @tradewonk :)

Make sure to participate in this weeks giveaway to get known in the community!

Here are some helpful tips to get you started:

@reggaemuffin, the creator of this bot is a witness. See what a witness is and consider voting for the ones you feel are good for steem.

Very well written

Thank you!

Usefull info. Thanks

Glad that you like it!

Thats some bunch of information that is well managed

Welcome mi friend good post i am @djnoel :)

Welcome mi friend good post i am @djnoel :)

Thank you!

Welcome to Steemit! Please consider checking out minnowsupportproject.com and @minnowsupport. It is a great community of individuals that will help you get started and can answer all of your questions.

this is what i needed. Thanks!

Those are damn good graphics!

Thank you, i appreciate it!