I may not be a digital native like the Gen Z, but I can definitely relate to them in a big way when it comes to using technology for convenience. In fact, I have become dependent on apps for my everyday needs in life – hailing a ride, ordering food and other items online, playing music, learning a language – you name it, I have apps for all of them and many others in my smartphone.

Now that I’ve made saving as one of my financial resolutions for 2018, I figured I should also install personal finance apps on my mobile. I searched for money-saving tools online, most of which are compatible with both Android and iOS, and found the following to be the most promising ones:

Mint

I realized that if I’m serious about saving, I should stay on top of my spending first and foremost. Since I have several bank and credit card accounts, I could leverage Mint’s ability to link to every single one of them and view all my transactions from those accounts.

That means I can get all the information I need, including a breakdown of my monthly spending, from just one app. Talk about convenience huh?Clarity Money

This app is feature packed, but I especially like the home feed tab. In here, there’s a spending tracker to show me how much I have spent for different expense categories, a tool for monitoring unnecessary subscriptions, and an automated savings feature.

All these work wonderfully—thanks to Clarity Money’s artificial intelligence technology. The app even dishes out a daily quote about finance and money management in an inspiring kind of way.PocketGuard

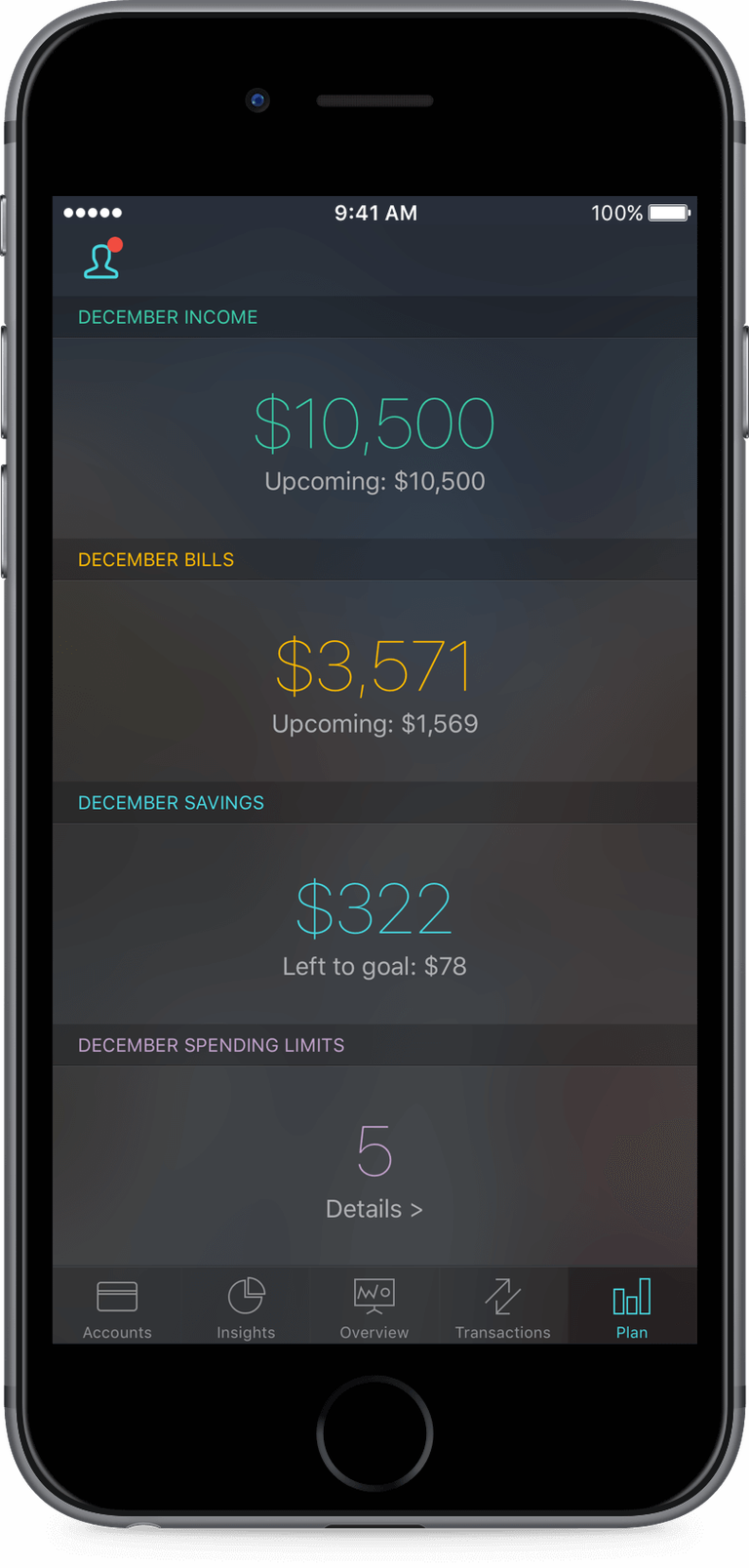

I have a thing for making detailed notes when I’m making a budget, and PocketGuard lets me do the same thing within the app. Once I signed up for the app, I was able to set up my savings target and spending limits for certain categories, as well as add notes to my payment history.

It’s a smart app that helps me analyze how to make the most out of my monthly payments and issues an alert about unwanted charges or fees.GoodBudget

I first heard about this budget app from a number of my freelancer friends. According to them, the app is useful for saving funds that they periodically receive for projects they had worked on through an envelope system – yes, that mode of saving where people stash money in different envelopes neatly labeled for different purposes.

GoodBudget only takes the envelope system on a digital level, both for those with a regular cash flow and work on contractor basis.Qapital

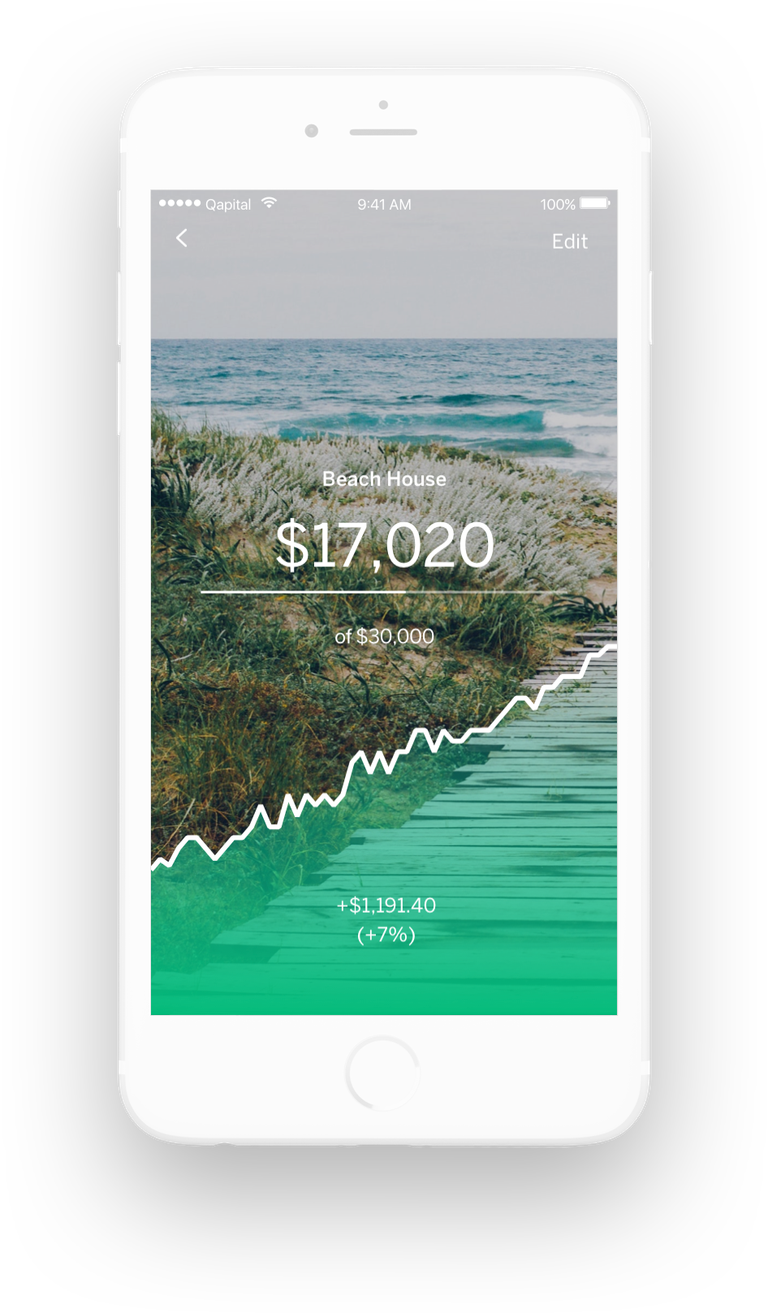

Is it possible to spend and save at the same time? Apparently, that’s the way Qapital works, which quite frankly is not only a brilliant idea but is also suitable for my goal setting.

With Qapital, I can set up a rule that for each expense I incur, Qapital will treat it as a saving trigger, moving a portion of my bank money into my Qapital account.

The result is that through the app, I get to automatically build my savings fund.Spendee

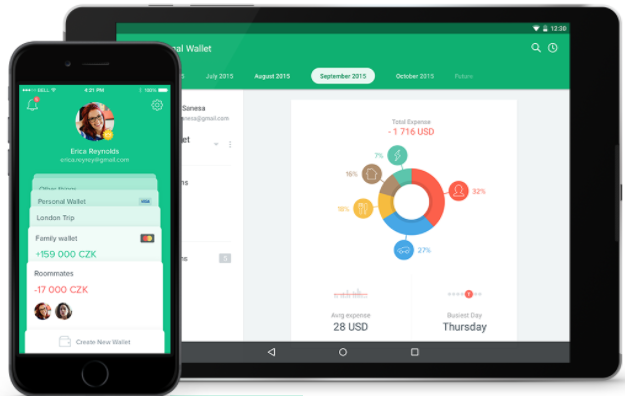

Spendee is a budget and spending-tracking app that gives me the option of linking it to my bank account or otherwise. I find the first option to be convenient and time saving, sure, but I also do not mind manually checking my financial accounts from time to time to give me a more accurate view of my finances.

Spendee also allows syncing of accounts with family members, which I think will help me make sure that we’re all on the same page when it comes to developing positive financial habits. Last but not least, the app is compatible with multiple currencies.The Birdy

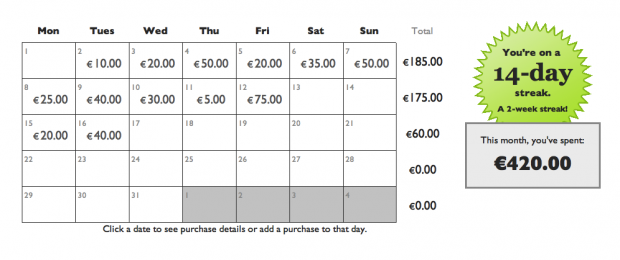

The Birdy is indeed the perfect moniker for this neat app, which could very well be my next saving buddy! Every day, the app is supposed to send me a list of transactions I’ve made on my debit or credit card – presented in a pie chart form – so I could visualize where all of my money goes.

The app also does a comparison of my total spending for any given week compared with the same period from last month to show me how much or how little progress I’m making with my goals.BillGuard

Credit card fraud is on the rise, but it can be avoided with the help of BillGuard. I can use the app to help me account for every single transaction that shows in my bank account’s purchase history. In case I see something that is amiss, I could use the app to contact the merchant to report the issue.

Managing my finances has been an uphill battle for me most of the time, so I definitely think these apps are going to help me change the way I save money, which is why I’m all for it.

Hi. I am a bot that looks for newbies who write good content!

Your post passed all of my tests.

You get:

I also write bots and other code for crypto....

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious? Read @resteembot's introduction post

Check out the great posts I already resteemed.

ResteemBot's Maker is Looking for Work.