The emergence of the Blockchain technology has been a very innovative prospect in our lives as its integration in many of our daily activities has made a lot of things easier and faster with the use of its decentralized nature. This technology has been successfully applied in numerous use cases such as finance, payments , marketing, and many more.

In the world of business, entrepreneurs who are under the umbrella of Micro, small and medium business (MSMEs) has been facing a lot of challenges and problems in relation to acquiring funds and business partners for business expansion. They find it hard and exhausting securing loans from financial institutions such as banks due to an incomplete or no credit history thereby pushing them to get involved with other lending platforms that charge an outrageous Annual Percentage Rate (APR) and it hampers their growth and development leading ultimately to debt and bankruptcy.

In view to solving and tackling most of the issues associated with lending, a group of individuals led by Brandon come up with a solution in the form of Pngme, and this will forever change the face of lending marketplace forever.

Introducing the PNGME: An Innovative Global Lending Platform

Pngme is a blockchain integrated marketplace lending that was specifically designed to tackle most of the current challenges faced when using the current lending marketplace. It features the blockchain technology as well as a decentralized rate setting algorithm as well as issuing digital credit scoring so as to offer a transparent system that borrowers can have quick access to loans and investors can also invest in the platform.

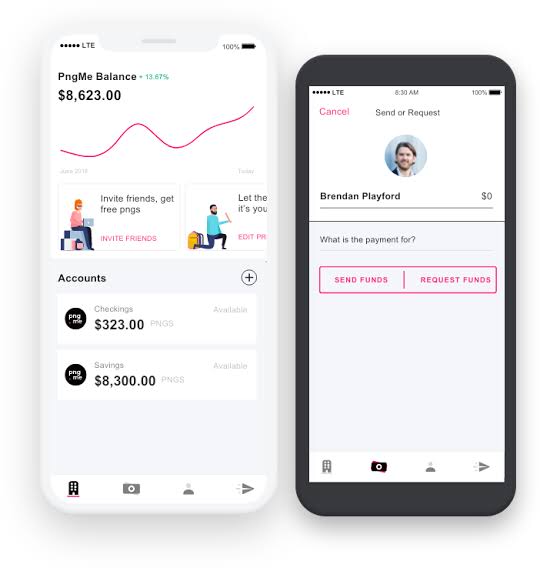

Pngme also offers a mobile banking application that will allow to business owners and consumers and it features mobile payment, personal savings, as well as a digital credit score.

This was specifically created for MSMES who have limited access to loans and other partner financial institutions that offer the loan services via the platform.

What Makes Pngme different from other Similar Lending Marketplace?

Pngme offers a variety of features that allows it to triumph over other similar competing lending marketplace (e.g. Lending Club, Lending Tree, Upstart, e.t.c) and these features include:

PNGME makes use of the decentralized nature of the blockchain technology to offer a transparent and open lending platform.

It also offers an affordable lending rates that are being set with efficient credit models.

It has a credit scoring model that enables users with no formal credit score to have access to loans

It offers a mobile banking application that allows users in any part of the world to have access to loans, perform mobile payments and savings.

It reduces the risks of borrowing as it entails the use of digital bonds as collateral and the mobile phone locking technology when there is a default in payment.

Conclusion: Will the Emergence of PNGME will favor the emerging markets?

The emerging markets consisting mainly of MSMEs will be favored by the entry of the Pngme that makes use of the blockchain technology to provide a platfrom that allows for the easy access to loans and other financial services such as savings, mobile payments and others. With the hybrid credit scoring system, it will allow users that have no credit history at all to have access to loans. Unlike banks that uses most of its customers deposits as finance loans, this platform serve as a brokerage system that connects both lenders and borrowers and take a fee as operation costs. It reduces the default of loan payment with the use of digital bonds as well as the mobile phone locking technology thereby reducing risks associated with borrowing.

So if you are a business owner and are looking for business funds, PNGME is here to serve all your needs.

For more information on Pngme and it’s details, visit any of the following links below

Website

Whitepaper

BitcoinTalk ANN

Telegram Chat

Twitter

Facebook

Medium

Instagram

Reddit

LinkedIn

YouTube

AUTHOR'S DETAILS

Bitcointalk Username: hamzeto

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1189991