A lot of people follow stock markets and wish to invest in the shares offered by various companies, but they fear that they don’t have enough knowledge or don’t have sufficient time to keep track on and follow the latest buzz about the dynamic market.

A lot of people follow stock markets and wish to invest in the shares offered by various companies, but they fear that they don’t have enough knowledge or don’t have sufficient time to keep track on and follow the latest buzz about the dynamic market.

A mutual fund is a perfect solution for them as investing directly in the equity market is a risk, not everyone willing to take.

The biggest advantage of investing through a mutual fund is that it gives small investors access to professionally-managed, diversified portfolios of equities, bonds and other securities, which would be quite difficult to create with a small amount of capital.

Let’s look onto the 10 mutual funds that would have doubled your money in 5 years.

10 Mutual Funds That Doubled Wealth in 5 Years

Returns have always been the basic benchmarks for investor while going for any investments. These indicate how much the fund has lost or gained during particular investment duration.

Here’s the list of 10 Mutual Funds that would have doubled your money in just 5 years :

- Reliance Small Cap Fund

This is a Small Cap Equity Oriented Mutual Fund launched on September 16, 2010. It is a fund with high risk and has given a return of 22.74 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 41.17 %

3 years 22.64 %

5 years 35.57 %

Invest in Reliance Small Cap Fund Now

This fund has been rated as a 5-star fund by Groww.

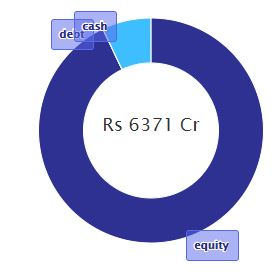

AUM of close to ₹ 6371 Cr.

Age is nearly 7 years. So its performance can be easily judged.

Has consistently outperformed its benchmark S&P BSE Small Cap since its launch.

The top portfolio holdings of the fund include Navin Fluorine International Ltd., Deepak Nitrite Ltd., Aditya Birla Finance Ltd. ( 91D ), V I P Industries Ltd., RBL Bank Ltd., Cyient Ltd., CBLO ( CCIL ) etc.

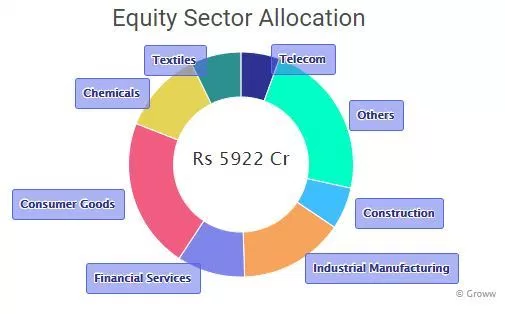

The holdings are balanced across various sectors with maximum weightage given to Consumer Goods ( 21.7 % ) followed by Industrial Manufacturing ( 15.1 % )

Minimum SIP = ₹ 100

Equity share = 93 % , Debt share = 0 % and Cash = 7 %

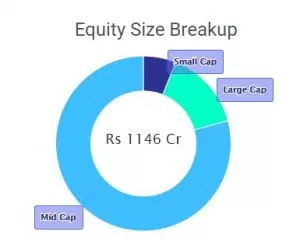

Large Cap share = 5.4 % , Mid Cap share = 46.4 % and Small Cap share = 48%

This funds have exponential growth potential and give high returns on investment and is best suited for investors with high risk appetite or for seasoned investors.

Also, this best for investors who have very good ideas of mutual funds and the risks associates with them. Associated with this fund for some good numbers of years for getting benefit of its high return on investment.

- UTI Transportation and Logistics Fund

This is a Sector Equity Oriented Mutual Fund launched in March 9, 2004. It is a fund with high risk and have given a return of 19.77 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 24.07 %

3 years 12.38 %

5 years 32.11 %

Invest in UTI Transportation and Logistics Fund Now

This fund has been rated as a 5 star fund by Groww.

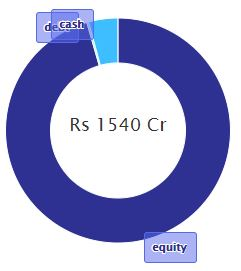

AUM of close to ₹ 1540 Cr.

Age is nearly 13 years. So its performance can be easily judged.

Has consistently outperformed its benchmark UTI Transportation & Logistics Index since its launch.

The top portfolio holdings of the fund include Maruti Suzuki India Ltd., Tata Motors Ltd., Mahindra & Mahindra Ltd., Hero MotoCorp Ltd., Adani Ports and Special Economic Zone Ltd. etc.

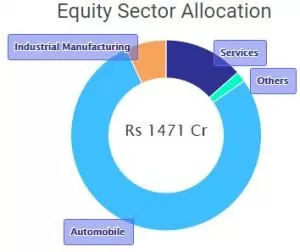

Being a sector mutual fund, the holding is confined to transportation sector only with maximum weightage Automobile ( 77.8 % ) followed by Services ( 13.6 % ) and Industrial Manufacturing ( 6.9 % ).

Minimum SIP = ₹ 500

Equity share = 95.5 % , Debt share = 0.3 % and Cash = 4.2 %

Large Cap share= 68.4 % , Mid Cap share = 25.9 % and Small Cap share = 5.7%

The performance of this fund is dependent on the performance of the whole Transportation and Logistics industry in India. Associated with this fund for some good numbers of years for getting the benefit of its high return on investment.

- Mirae Asset Emerging Bluechip Fund

This is a Multi Cap Equity Oriented Mutual Fund launched in July 9, 2010. It is a fund with moderately high risk and has given a return of 23.40 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 23.72 %

3 years 19.47 %

5 years 30.77 %

Invest in Mirae Asset Emerging Bluechip Fund Now

This fund has been rated as a 5-star fund by Groww.

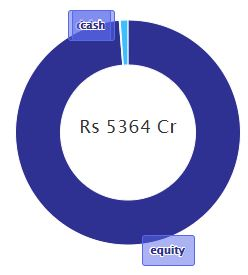

AUM of close to ₹ 5364 Cr.

Age is nearly 7 years. So its performance can be easily judged.

Has consistently outperformed its benchmark Nifty Free Float Midcap 100 since its launch.

The top portfolio holdings of the fund include Tata Global Beverages Ltd., ICICI Bank Ltd., Kotak Mahindra Bank Ltd., Raymond Ltd., HDFC Bank Ltd., Federal Bank Ltd., Info Edge Ltd., IndusInd Bank Ltd., Ceat Ltd. etc.

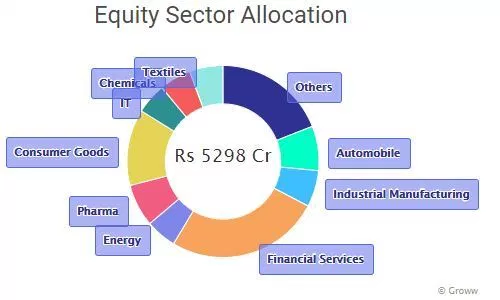

The holdings are balanced across various sectors with maximum weightage given to Financial Services ( 25.9 % ) followed by Consumer Goods ( 12.8 % )

Minimum SIP = ₹ 1000

Equity share = 98.8 % , Debt share = 0.1 % and Cash = 1.1 %

Large Cap share = 36.8 % , Mid Cap share = 57.6 % and Small Cap share = 5.6%.

This is one of the best performing Multi cap fund available in market right now. This is a diversified fund with holding in companies of different market capitalization.

Multi-cap funds are risky as compared to large cap funds and depend a lot on the ability of fund manager. Associated with this fund for some good numbers of years for getting benefit of its high return on investment.

- Canara Robeco Emerging Equities

This is a Mid Cap Equity Oriented Mutual Fund launched in March 11, 2005. It is a fund with high risk and have given a return of 18.85 % since its launch. Returns per annum over the years from this fund are:

Duration Returns

1 year 28.67 %

3 years 17.26 %

5 years 35.57 %

Invest in Canara Robeco Emerging Equities Now

This fund has been rated as a 4 star fund by Groww.

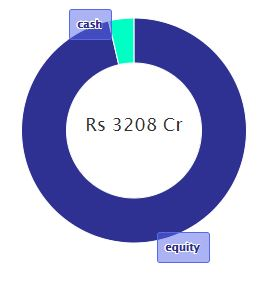

AUM of close to ₹ 3208 Cr.

Age is nearly 12 years. So its performance can be easily judged.

Has consistently outperformed its benchmark Nifty Free Float Midcap 100 since its launch.

The top portfolio holdings of the fund include CBLO ( CCIL ), Reliance Industries Ltd., Bajaj Finserv Ltd., Minda Industries Ltd., Container Corporation Of India Ltd., Piramal Enterprises Ltd., ITC, Atul Ltd. etc.

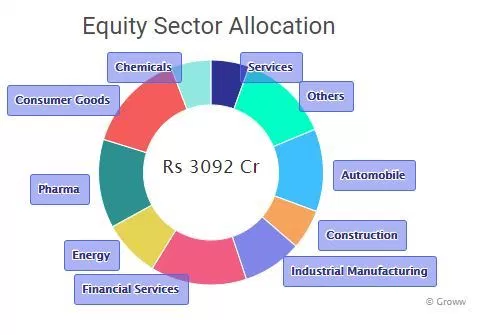

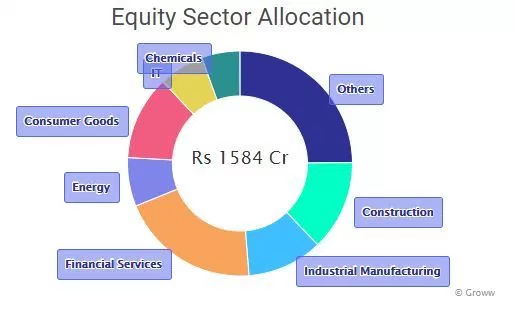

The holdings are balanced across various sectors with maximum weightage given to Consumer Goods ( 14.5 % ) followed by Financial Services ( 13.8 % ) and Automobile ( 11.9 % )

Minimum SIP = ₹ 1000

Equity share = 96.4 % , Debt share = 0 % and Cash = 3.6 %

Large Cap share = 46.1 % , Mid Cap share = 47.2 % and Small Cap share = 6.7%.

This is a well performing mid cap fund available in market, but there better option available in this category with lower minimum SIP amount.

So, associated with this fund if you want to invest in funds with high return possibilities, without the volatility of small caps and index-related returns like those of large cap funds.

- Aditya Birla Sun Life Small & Midcap Fund

This is a Mid Cap Equity Oriented Mutual Fund launched in May 31, 2007. It is a fund with high risk and have given a return of 14.24 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 28.93 %

3 years 19.77 %

5 years 28.30 %

Invest in Aditya Birla Sun Life Small & Midcap Fund Now

This fund has been rated as a 5 star fund by Groww.

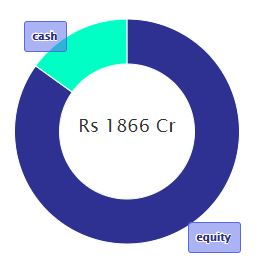

AUM of close to ₹ 1866 Cr.

Age is nearly 10 years. So its performance can be easily judged.

Has consistently outperformed its benchmark Nifty Free Float Midcap 100 since its launch.

The top portfolio holdings of the fund include Cyient Ltd., CBLO ( CCIL ), Chennai Petroleum Corporation Ltd.etc., DCB Bank Ltd., Gujarat State Petronet Ltd., KEC International Ltd., PNC Infratech Ltd. etc.

The holdings are balanced across various sectors with maximum weightage given to Financial Services ( 20.1 % ) followed by Construction ( 13 % ) and Consumer Goods ( 12.1 % )

Minimum SIP = ₹ 1000

Equity share = 84.9 % , Debt share = 0 % and Cash = 15.1%

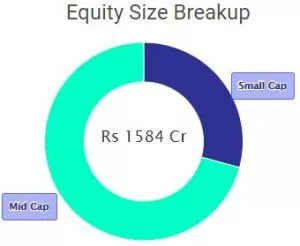

Large Cap share= 0 % , Mid Cap share = 70.8 % and Small Cap share = 29.2 %

This is one the best performing mid cap fund available in market for 2018. Mid cap fund are in high demand, because the share price of large caps has increased substantially. That results in the prices of the mid-caps, climbing upwards steadily and made them an attractive investment category with high growth potential.

Associated with this fund if you want to invest in funds with high return possibilities, without the volatility of small caps and index-related returns like those of large cap funds.

- Motilal Oswal MOSt Focused Multicap 35 Fund

This is a Multi Cap Equity Oriented Mutual Fund launched in April 28, 2014. It is a fund with moderately high risk and have given a return of 28.83 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 23.72 %

3 years 19.47 %

5 years 30.77 %

Investt in Motilal Oswal MOSt Focused Multicap 35 Fund Now

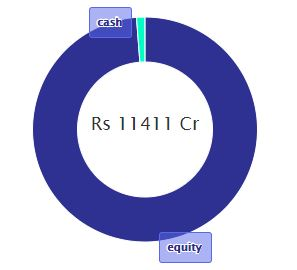

This fund has been rated as a 5 star fund by Groww and ranked 1 in Diversified equity category by Crisil.

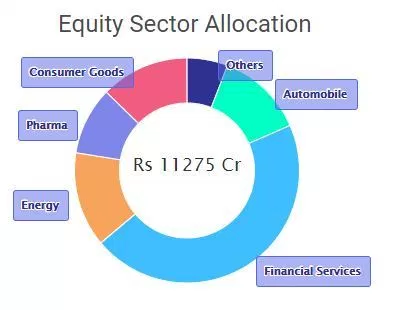

AUM of close to ₹ 11411 Cr.

Launched just 3 years back, so performance cannot be easy to judge. Though its a relatively new fund, it has made its mark with high return on investment.

Has consistently outperformed its benchmark Nifty 500 since its launch.

The top portfolio holdings of the fund include United Spirits Ltd.,BPCL, HDFC Bank Ltd., Maruti Suzuki India Ltd., HPCL, Jubilant Life Sciences Ltd., Interglobe Aviation Ltd. etc.

The holdings are balanced across various sectors with maximum weightage given to Financial Services (45.5%) followed by Energy ( 13.6 % ) and Consumer Goods ( 12.7 % ).

Minimum SIP = ₹ 1000.

Equity share = 98.8 % , Debt share = 0 % and Cash = 1.2 %

Large Cap share= 76.4 % , Mid Cap share = 23.6 % and Small Cap share = 5.6%.

This is one of the best performing multi-cap fund available in the market right now, even though it launched just 3 years back. This is a diversified fund withholding in companies of different market capitalization.

Multi-cap funds are risky as compared to large-cap funds and depend a lot on the ability of fund manager. Associated with this fund for some good numbers of years for getting the benefit of its high return on investment.

- L&T Midcap Fund

This is a Mid Cap Equity Oriented Mutual Fund launched in August 09, 2004. It is a fund with high risk and have given a return of 21.75 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 29.3 %

3 years 18.76 %

5 years 29.36 %

Invest in L&T Midcap Fund Now

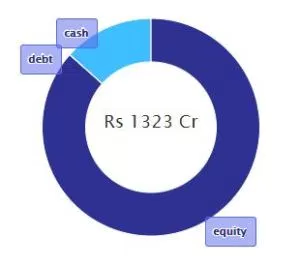

This fund has been rated as a 5-star fund by Groww.

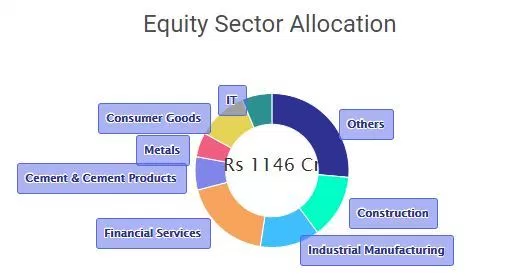

AUM of close to ₹ 1323 Cr.

Age is nearly 13 years. So its performance can be easily judged.

Has consistently outperformed its benchmark Nifty Free Float Midcap 100 since its launch.

The top portfolio holdings of the fund include Mphasis Ltd., CBLO ( CCIL ), The Ramco Cements Ltd., Emami Ltd., Mindtree Ltd., Engineers India Ltd., Jindal Steel and Power Ltd., Sundaram Finance Ltd. etc.

The holdings are balanced across various sectors with maximum weightage given to Financial Services ( 18.5 % ) followed by Construction ( 13.5 % ) and Industrial Manufacturing ( 12.5 % )

Minimum SIP = ₹ 500

Equity share = 86.6 % , Debt share = 0 % and Cash = 13.4 %

Large Cap share= 14.8 % , Mid Cap share = 79.2 % and Small Cap share = 6 %

This is one the best performing mid cap fund available in market for 2018. Mid cap fund are in high demand, because the share price of large caps has increased substantially. That results in the prices of the mid-caps, climbing upwards steadily and made them an attractive investment category with high growth potential.

Associated with this fund if you want to invest in funds with high return possibilities, without the volatility of small caps and index-related returns like those of large cap funds.

- Sundaram SMILE Fund

This is a Small Cap Equity Oriented Mutual Fund launched in February 15, 2005. It is a fund with high risk and have given a return of 19.68 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 28 %

3 years 14.17 %

5 years 28.54 %

Invest in Sundaram SMILE Fund Now

This fund has been rated as a 4-star fund by Groww.

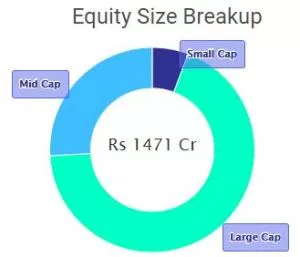

AUM of close to ₹ 1481 Cr.

Age is nearly 7 years. So its performance can be easily judged.

Has consistently outperformed its benchmark S&P BSE Small Cap since its launch.

The top portfolio holdings of the fund include Navin Fluorine International Ltd.,Rane Holdings Ltd., J K Cement Ltd., V-Guard Industries Ltd., Heritage Foods Ltd., ITD Cementation India Ltd., NRB Bearings Ltd. etc.

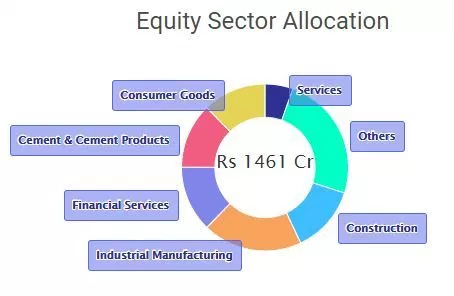

The holdings are balanced across various sectors with maximum weightage given to Industrial Manufacturing ( 19.3 % ) followed by Construction ( 13 % ) and Financial Services ( 12.8 % ).

Minimum SIP = ₹ 1000

Equity share = 98.7 % , Debt share = 0 % and Cash = 1.3 %

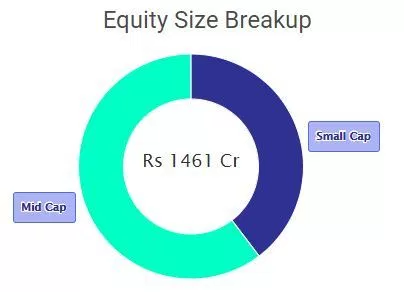

Large Cap share= 0 % , Mid Cap share = 60.3 % and Small Cap share = 39.7 %

This fund has shown good growth in last 5 years but is not performing in last 3 years as per its potential and is best suited for investors with high-risk appetite or for seasoned investors. The fund manager is changing portfolio from riskier small-cap to mid-cap companies to bring stability to this fund.

Also, this is best for investors who have very good ideas of mutual funds and the risks associated with them. Associated with this fund for some good numbers of years for getting the benefit of its high return on investment.

- HDFC Small Cap Fund

This is a Small Cap Equity Oriented Mutual Fund launched in April 03, 2008. It is a fund with high risk and have given a return of 16.60 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 44.19 %

3 years 21.21 %

5 years 25.14 %

Invest in HDFC Small Cap Fund Now

This fund has been rated as a 5 star fund by Groww.

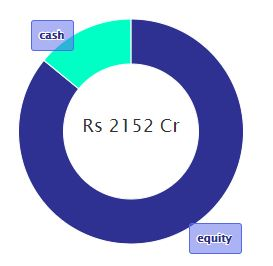

AUM of close to ₹ 2152 Cr.

Age is nearly 10 years. So its performance can be easily judged.

Has consistently outperformed its benchmark Nifty Free Float Small cap 100 since its launch.

The top portfolio holdings of the fund include Sonata Software Ltd., CBLO ( CCIL ), Redington India Ltd., Aarti Industries Ltd., KEC International Ltd., Dilip Buildcon Ltd., Balkrishna Industries Ltd. etc.

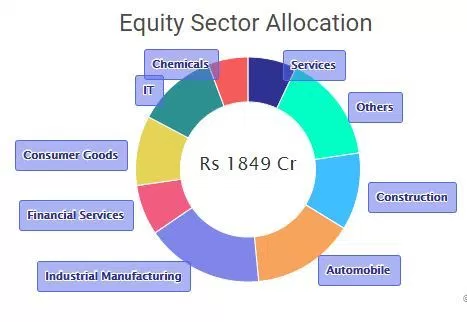

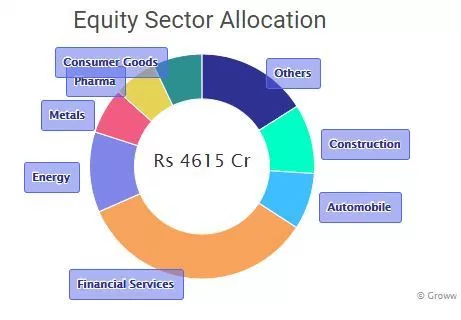

The holdings are balanced across various sectors with maximum weightage given to Industrial Manufacturing ( 15.1 % ) followed by Automobile ( 14.7 % ) and IT ( 11.5 % )

Minimum SIP = ₹ 500

Equity share = 85.9 % , Debt share = 0 % and Cash = 14.1%.

Large Cap share = 1 % , Mid Cap share = 58.5 % and Small Cap share = 40.9%

- DSP BlackRock Opportunities Fund

This is a Multi Cap Equity Oriented Mutual Fund launched in May 16, 2000. It is a fund with moderately high risk and have given a return of 18.91 % since its launch. Returns per annum over the years from this fund are :

Duration Returns

1 year 18.94 %

3 years 13.38 %

5 years 20.79 %

Invest in DSP BlackRock Opportunities Fund Now

DSP BlackRock Opportunities Fund has been rated as a 5-star fund by Groww and ranked 2 in Diversified fund category by Crisil (for the quarter ending December 2017).

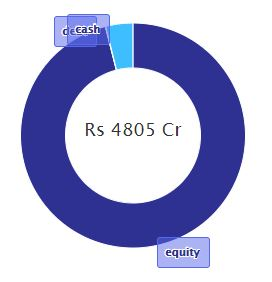

AUM of close to ₹ 4805 Cr.

Past 3 years return is 15.19 % per annum.

Has consistently outperformed its benchmark Nifty 500 since its launch.

The top portfolio holdings of the fund include SBI, HDFC Bank Ltd., ICICI Bank, CBLO ( CCIL ), Gail (India) Ltd., HPCL, BPCL, Larsen & Turbo Ltd., Tata Steel Ltd., Divis Laboratories Ltd., Vedanta Ltd. etc.

The holdings are balanced across various sectors with maximum weightage given to Financial Services ( 34.3 %) followed by Energy ( 11.1 %) and Construction ( 10 % ).

Minimum SIP = ₹ 1000.

Equity share = 98.8 % , Debt share = 0 % and Cash = 1.2 %

Large Cap share= 76.4 % , Mid Cap share = 23.6 % and Small Cap share = 5.6%.

DSP BlackRock Opportunities Fund is one of the best-performing multi-cap funds in the market today. With returns that are competitive with other multi-cap funds and an experienced fund manager.

Things to Remember

Don’t just run for returns from investment for investing in Mutual Funds. There lot of things you should look into before selecting a fund which will match your investment goals. Following the 3 things you should always remember before investing in Mutual Funds :

Higher rates : don’t blindly invest in the fund with the highest returns. Invest based on the duration you want to invest for.

Every person’s financial condition is different. Evaluate the funds you invest in yourself – don’t invest in a fund because of its popularity.

Review your investment from time to time but not too often. Once a few weeks is good enough.

If you a beginner to investment in mutual funds, especially in equity mutual fund, thinking of the small/mid cap mutual funds may not be the best idea for you. These are best for investors who have very good ideas of mutual funds and the risks associates with them.

To ensure that the fund is in good hands, choose a fund house having fund manager with good amount of experience managing small/mid cap funds and associated with these funds for some good numbers of years.

To look at some of the best performing funds from every category of mutual funds, check out Groww 30 best mutual funds to invest in 2018.

Happy Investing!

It's important too remember that even if they gave good returns for the last 5 years, this doesn't mean that they will in the next 5 years. Glad you showcased them still, many well-run funds stay at the top for many years