What does NBFC stand for?

NBFC is an abbreviation used for Non-Banking Financial Company that provides lending and other banking services without even falling under the legal definition of Financial Institutions. NBFCs registered as a company under Companies Act 2013 and its working & operations are governed and regulated by RBI.

NBFCs are registered to carry on the financial services similar to the banks and other activities such as:

- Providing Loans & Advances

- Acquiring shares, securities, bonds, etc.

- Leasing and hire purchase business

- Chit business and Insurance business

Is License mandatory for the operation of NBFCs?

No NBFCs can carry on the business of the Non-Banking Financial Institute without obtaining the proper registration certificate or license from RBI. NBFCs enjoy the advantages of providing banking services along with short term lending, High ROI, no interest cap, etc.

Thus if you are interested in doing the business of NBFCs or going to get the license for NBFC, this article has the information you need concerning the same.

The process to ease NBFCs Registration

Section 45-IA of the RBI Act states that NBFC shall obtain the certificate of the license before commencing the business. It can get such a license by following these simple registration methods:

- The applicant shall be a Company already incorporated either under Companies Act 2013 or 1956 or form the new Company and get the certificate of incorporation.

- Such a Company shall have net owned fund of INR 2 Crore.

- Apply for the license as per the regulations of the RBI Act 1934.

- The applicant shall submit the online application with RBI on its official website.

- On complete submission of application, the reference number is generated, which can be used for future references or inquiry.

- After the generation of the reference number, the applicant shall submit the duplicate hard copies to the regional offices of RBI.

- On receipt of documents, regional officers shall scrutinise the documents for its correctness and accuracy.

- The regional officer shall forward the application to Central Office.

- Central Office of RBI grants the license on receipt of such an application only if it fulfils the requirement as prescribed under section 45-IA.

- NBFC, after getting the license, can commence its business within 6 months from the date of Certificate of Registration.

Documentation

Following is the brief list of documents to be attached with an application:

- COI

- Copy of MOA & AOA

- PAN of the company

- Documents in support of its minimum net owned fund requirement

- Details of directors along with their profile.

- CIBIL score of directors of the company

- Audited balance sheet and P&L Account in case the company is already registered

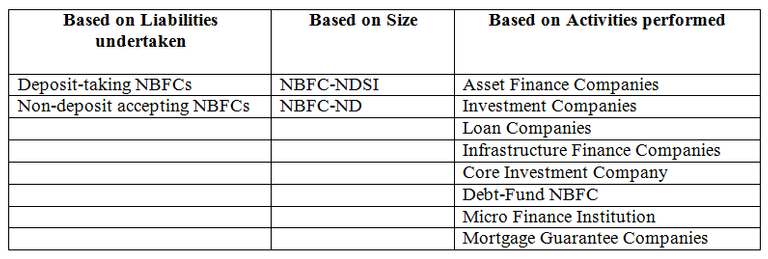

Types of NBFCs

Following are the different categories of NBFCs which can be registered depending upon its activities:

Wrapping up an article

NBFCs are emerging at a fast pace in the financial segment of the rapidly-growing Indian Economy. NBFCs operate as a substitute for banking services, along with providing additional services such as a financial intermediary, provides a loan, accepts deposits, lease and hire purchases, etc. NBFCs can accept the deposit with a minimum tenure of 12 months and a maximum of 60 months. NBFCs are a prevalent mode of finance for start-ups or small retail/wholesale/manufacturers.

For further assistance and guidance on a better understanding of NBFCs, its registration process and compliance, contact @swaritadvisors

Congratulations @swaritadvisors! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!