The decentralized economy has been establishing itself slowly with the growing crypto ecosystem. The blockchain is the foundation to realize a decentralized economy, where the role of a traditional centralized bank is nullified. The monopoly of loan processing fees and other hidden costs are challenged. Now the peers can set up their own terms to reach an agreement of loan in decentralized finance empowered with blockchain technology. Bitcoin to become a giant dominant coin in the crypto ecosystem took 10 years of time and it was all part of the evolution process. Bitcoin is the poster boy of the crypto ecosystem.

In the crypto ecosystem, along with Bitcoin many other coins have also gone through the evolution process. For any coin to have long term economic value, the use-cases and token sinks are fundamental to its economy. One of the significant and most profound use-case for most of the coins is "loan" which is a part of the decentralized finance. When Bitcoin was a baby, it was the use case of "loan" which establishes the emergence of decentralized finance to full-proof the real applicability and utility of Bitcoin. Decentralized finance later got organized in the crypto ecosystem. Decentralized finance is a wider term but "loan" is a major use-case of it.

Surprisingly even though there are various lending platforms available such as SALT, ETHLend, NEXO, MakerDAO, etc; the lending use-case is still short of supply. Just imagine the market size of lending & borrowing!!

With that being said, today's focus is on "Neoxian Bank"why Neoxian Bank is important to Steem blockchain and also why Neoxian Bank is far better than a Smart contract loan. which has a presence in Steem blockchain. It extends lending facility and also offers deposit facility. It is the first-ever lending service offered by @neoxian in Steem blockchain. As on date, Neoxian.city is a tribe in Steem-engine. Neoxian Bank is a branch of Neoxian.city. This article is a comprehensive review of Neoxian Bank and it will establish

Neoxian.city is a well-known tribe in Steem-engine with its token called NEOXAG. It is a general tribe and any general post can use the tag #neoxian, to earn NEOXAG. Neoxian Bank is an important branch of Neoxian city. Neoxian Bank is very well existent since long in Steem blockchain. @neoxian is a witness in Steem blockchain with high reputation. He is well known for his commitment to Steem blockchain.

So Neoxian Bank has also gone through the process of evolution. With the passage, of time, the customer base also grew and the popularity also grew. It is provably the only lending facility in Steem blockchain. It is also the most popular bank in Steem blockchain. With the passage of time and with growing popularity, @neoxian finally establishes its city named as Neoxian.city and it has a coin known as NEOXAG which is a part of second layer economy in Steem blockchain.

Neoxian Bank offers an interest rate of 6.25% APR for deposit and the interest rate in case of lending varies from 5-20%.

At this point in the article, you might ask, Why this is the only bank in Steem blockchain? Why no other parallel competitors are being able to establish themselves just like in other decentralized systems? I am going to elaborate on every detail, so take some time to read this article, you will get the answer, by the time you reach the bottom of it.

Accepted Collaterals (All major coins+Steem)

All major crypto coins are accepted as collateral. But the coins must be a listed one in major exchanges. Steem is also accepted as collateral. Some of the tribes of Steem-engine are also considered for granting a loan by the Neoxian Bank.

Loan-to-value(LTV)

Loan-to-Value in Neoxian Bank is 80%.

If you are an active blogger in Steem blockchain, have a good history of repayment with Neoxian Bank, then the Bank may even consider giving you a loan up to 85% LTV.

Waiting period

- For loans 100 usd or less, none.

- 250 usd to 100 usd: 24 hours

- 500 usd to 250 usd: 3 days

- above 500 usd: at least 5 days and probably 30 for huge amounts.

Working Hours

- Mon to Thursday- 5 pm to 6 pm UTC & 11 pm to 4 am UTC

- Friday: Off

- Sat and Sun- 1 pm to 1 am UTC

Note- In case of emergency, if you want Neoxian Bank to process a new loan off hours, then it is going to charge an upfront fee of 2 SBD or 5 steem.

LTV

80% of the SP value. Steem-engine account's worth may also be considered while calculating the worth of the collateral. The same LTV applies in Steem-engine also. However, the Bank reserves the right to choose which tribe it will accept as collateral out of the so many in Steem-engine.

Minimum reputation of the borrower in Steem blockchain

The primary Steem account holder must have reputation of at least 58.

Age of the Steem account

The minimum age of the primary Steem account must be at least 4 months old.

Activity

The primary Steem account holder must be an active blogger(must have a record of posting at least three times per week). At the same time, the borrower must not have a history of being blacklisted by Steemcleaner or other reputed agencies in the past.

Introduce yourself post(the Bank may also ask for a Govt ID Proof)

The introduce yourself post is an obligation in Neoxian Bank. The introduce ourself post must include a picture of visible face of the account holder. the Bank may even ask for Govt approved ID, if required.

Owner key & Recovery account

The Neoxian Bank shall ask for the owner keys to be handed over to the bank prior to disbursal of the loan if an agreement is reached between either party. The Bank will also change the recovery account to neoxian. The borrower should be comfortable with these criteria before asking for a loan.

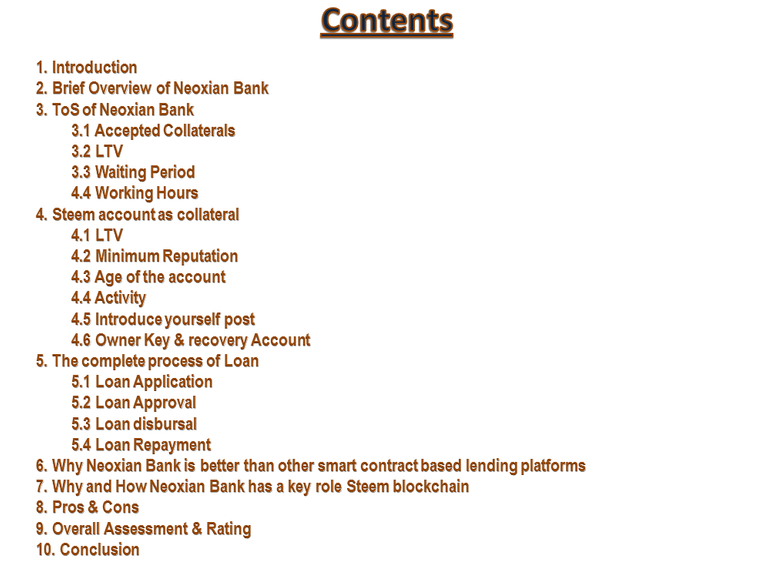

Any borrower after going through the ToS of the Neoxian Bank can apply for a loan. The Bank gives loan both in crypto as well as USD term. In USD term, the borrower can select any major crypto including Steem as the mode of payment. The complete process of the loan goes through the following steps:-

Loan Application

The borrower can apply for a loan in Discord server of Neoxian.city. Alternatively, he can also talk to @neoxian(#3936) in Discord. Neoxian Bank is a little flexible in terms of its offer. The borrower can submit a proposal with Neoxian Bank. It must contain all the details:

- Amount of Loan

- Collateral offered

- Tenure of loan

- Plan of repayment

- Interest rate

- Purpose of loan

The interest rate of the Bank varies from 5 to 20%. However, Neoxian would like to know from you about the interest rate and then the Bank will then decide on it. Please note that the interest rate is a part of the negotiation process before being finalized.

Loan Approval

The Bank verifies all the collateral details. The reputation, past history and the good behavior of the applicant are checked & verified(in case of Stem account as collateral). The Steem account must have enough SP to consider a loan. The loan application must be in line with the ToS of Neoxian Bank. Once everything is verified, the final interest rate and the term of repayment & mode of repayment is finalized.

Loan Disbursal

Once the loan is approved by the bank, then it proceeds with "loan contract". The "loan contract" is immutably recorded on Steem blockchain. In the "loan contract", the Bank publishes a post with all the relevant details of the mutually agreed "loan contract" on Steem blockchain. The borrower has to sign the "loan contract" there and then the Bank disburses the loan to the borrower.

Loan Repayment

The borrower must take utmost care to pay it as per the schedule of repayment as mentioned and agreed in the "loan contract". Good behavior of "loan repayment" really helps to secure a high credit rating which may further help the borrower in taking a future loan from the bank easily. Once the loan is paid by you in full, your collateral is released immediately. In case of Steem account as collateral, you will get your keys back.

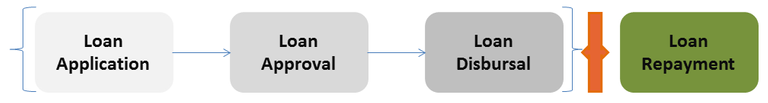

Now we have arrived at the most valuable part of this article. I have enough reasons and facts which can establish that "Neoxian loan is not just better rather far better option than other Smart contract loans". So let's dig into it.

In all smart contract-based lending platforms, the basic process is to deposit a crypto asset such as BTC, ETH or any other acceptable crypto asset into a smart contract as collateral for the loan. The smart contract loan runs with a certain logic and that logic is governed by a set of parameter relevant to the loan contract such as interest rate, repayment, keeping a track of the LTV dynamically(as crypto is a volatile asset) and if the value of the collateralized crypto asset falls below the LTV, the smart contract triggers to either ask the borrower to add additional collateral or will liquidate the collateral.

A smart contract loan definitely makes the business of lending & borrowing trustless, but it is emotionless as well. So while the business achieves the highest goal through a smart contract, at times, it can be ruthless to the critical and genuine situations of a borrower.

For crypto assets which are generally pegged as collateral are highly volatile in nature. So crypto can shoot to moon and one can gain tremendous value, but in a bear market, we have also seen crypto assets losing even to the extent of 90 to 95% of the value. Most of the Smart contract loans offer with 55% LTV on an average. So in a bear market, a borrower may not be able to save the collateral, as the smart contract will automatically trigger to liquidate the collateral in the event of the value of crypto asset falling below the LTV.

Across the same domain of "lending", Neoxian Bank also offers loan. The LTV is far better( up to 80%). But it is not emotionless. It is not ruthless. Even though the ToS is strictly followed, Neoxian Bank does consider the critical & genuine situations of the borrower, if the borrower has a good history, good conduct from past. The Bank does not liquidate the collateral in a haste. The Bank does give a second chance to the borrower if the repayment schedule fails.

Let's go with the facts by analyzing the other features of Neoxian Bank with other Smart contract-based lending platforms.

The notable smart contract-based lending platforms are:- SALT, ETHLend, Nexo, etc

SALT

- LTV- Up to 70%

- Interest Rate- 12-22%

- Accepted Collateral- BTC, ETH, LTC, BCH, DASH, TUSD, USDC, etc

ETHLend

- LTV- Up to 55%.

- Interest Rate- Average MPR is 2.7%, so in APR it is 37%.

- Accepted Collateral- BTC, ETH, LEND, ERC20 tokens, etc

Nexo

- LTV- Up to 50% on average for major coins.

- Interest Rate- 24.9%

- Accepted Collateral- BTC, ETH, NEXO, LTC, XRP, BNB, XLR etc

Neoxian Bank

- LTV- Up to 85%.

- Interest Rate- 5 to 20%

- Accepted Collateral- All major crypto assets(listed in major exchanges) including STEEM. Steem-engine tribes are also acceptable.

The above are just briefing of the features of lending platforms. SALT has a lengthy process. NEXO is relatively better as no processing fees and it has a better balance in its framework. ETHLend is a perfect decentralized p2p lending platform. But one can not receive money in fiat and the APR is high if we consider its MPR at 2.7%. Neoxian Bank not only offers crypto loan but also in fiat term. Its interest rate is reasonable. The acceptable crypto assets are wider in comparison to the other smart contract-based lending platforms. Most importantly it is very flexible in its framework as loan can be tailored made specific to a borrower capability & requirement. Nonetheless Neoxian Bank accepts SP value and the Steem account as collateral which no other person or lending platform accepts.

Further, in less popular crypto assets, people don't even give a loan with 50% LTV, If at all they give, they give with very less value of LTV, although that is secure but eventually that does not fulfill the need of a borrower.

I am not saying that everything should be tilted towards a borrower. There should be a proper balance from either side.

It must be noted that the above comparison is not the basis of whether it has all regulatory framework or not, it has a dapp or not, etc. The basic objective of this comparison is how well suited a loan offer to a borrower is and how easy it is on the part of either side. Whether during critical & genuine situations, the contract can also behave with emotions. There may be many dishonest actors who can try to exploit this "emotion" factor citing critical situations. But Neoxian Bank comes harder on such people and very strict with its ToS. So it is better not to take it for granted.

For any lending platform, the basic objective is to facilitate the lending services and making a business out of it. The business principle ideally should be low to average interest rate of the market standard, it should not be like sucking the blood of a needy borrower. A proper repayment schedule and all other relevant points in regard to the loan contract should be defined, so the business looks fair and devoid of any dispute. However, the crypto asset is highly volatile in nature and due to that very often the smart contract triggers when it falls below the LTV and this the reason why the smart contract based platform may not suit a borrower. Keeping that in mind, I see Neoxian Bank is a far better option not just for people of Steem blockchain, outsiders too.

If you are a member of bitcointalk.org and if you have taken a loan from any lender then you can understand how hard they are when the crypto asset value falls below the LTV or when you miss a payment. They may give you a chance, but their time frame is very rigid and in that comparison, Neoxian Bank is far better.

In Steem blockchain there are many people who survive through the earning from their engagement in this community. There are many users who are in the category of the minnow to dolphin level. Rather it is better to call them the middle-class community. For such category who work hard to generate a living from Steem blockchain, "loan" is a valuable use-case. They really need a loan from time to time.

Therefore it is essential to have a lending facility or such a platform in this community. Sadly, no one gives a loan here except Neoxian Bank. It is the Neoxian Bank which not only gives a loan with a reasonable interest rate but also allows users to tailor-made their own loan proposal which is suitable for them which is then mutually agreed upon and approved.

I have talked to many people even outside Steem blockchain. No one recognizes Steem account as collateral; when I ask them "why"? They simply say the user can initiate a "stolen account recovery procedure" after taking the loan. That means Neoxian Bank is literally taking a risk here by accepting Steem account as collateral. That is also probably the reason why there is no parallel competitor to Neoxian Bank across this domain of lending who can accept Steem account as collateral and give a loan.

Pros

It is the only bank which gives a loan based on SP as collateral, so it is most valuable to Steem blockchain to serve the needs of users, especially middle-class users in Steem blockchain.

The LTV is quite high to the extent of 80%( in special cases to the extent of 85%).

It is better than other existing Smart contract loan as Neoxian is kinder to critical & genuine situations of the borrower and relaxes a bit based on the genuinity of the case, whereas Smart contracts are emotionless and it does not regard those critical situations of a borrower.

Neoxian Bank follows the ToS, however depending upon the effort of the borrower, the Bank may consider giving some extra period to the repayment schedule, if the borrower fails to stick to the original schedule. But a borrower should not take it for granted.

The facility of both USD terms and Crypto terms accommodates a wide variety of borrowers.

The interest rate is very reasonable(5-20%).

The accepted collateral list is wider.

Cons

- Being the only Bank which gives loan in Steem blockchain, at times it witnesses heavy traffic. During those times, it does not scale and does not process the loan at a faster rate(even though in a general sense the loan gets processed faster than the waiting period). Therefore further development should be made by the Bank to scale it higher and take it to the next level.

Neoxian Bank is definitely a better option when it comes to taking a loan either in fiat or in crypto and I am saying this in a general sense, not just for Steem users. However, for Steem users, it is really a blessing in my honest assessment. I have taken loan from this Bank many times in past. To be honest, this bank is also one kind of inspiration to stay active, because with every day's activity you keep on adding steem power and at a time when you need some money, you can take a loan from Neoxian Bank. I have always got a loan very quickly and always before the defined wait period. It hardly takes 15 to 20 mins to get a loan from this Bank.

In case you miss the due date or during a critical time, you must communicate properly with the Bank and I am sure in most of the cases Neoxian Bank does consider and give you a second chance. But the Bank does at its own discretion. So never take such things for granted. Stick to the ToS always.

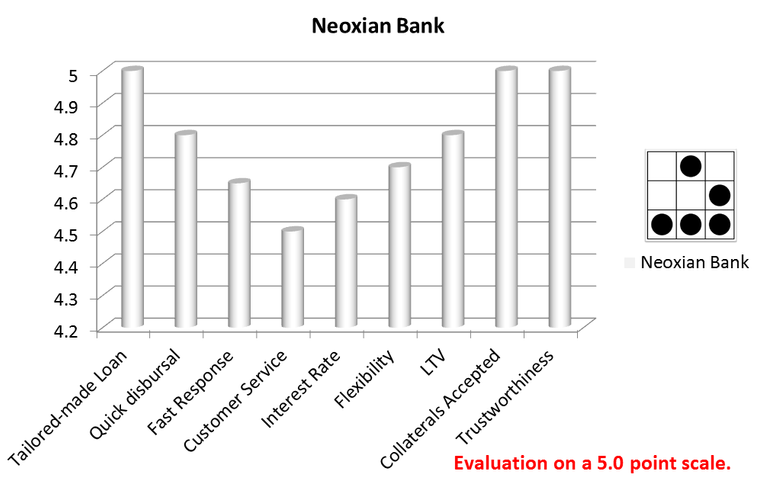

I would like to give a rating of 4.8 star out of 5 stars.

Neoxian Bank is not only fulfilling the purpose of the borrowers but also contributing to the ecosystem of Steem blockchain in particular. A loan is a valuable use case to an ecosystem and that always brings the real utility and applicability of a token and gives an exposure to the people outside of the community as well. The active bloggers(especially the middle-class people) always feel motivated and remain intact with their engagement because of this loan facility in Steem blockchain. Its journey from a lending service to Neoxian city has really been awesome and it has a tribe now in Steem-engine. I am sure, this Bank will further expand its services in the future.

Well explained brother.... The bank of neoxian is the best of the best banks...

Thank you.

Simply amazing. I've been using Neoxian for over 2 years now and it's been a pretty ride always. Your post is well organised, highly detailed and interesting to read.

Thanks for using the realityhubs tag, we look forward to your next posts.

Realityhubs Mod

These words are really inspiring to me. Thank you Sir.

Your posts are always well put together and this one is of no exception. Great read.

Thank you so much for the kind words grandpaa @r2cornell.

This post has been rewarded with an upvote from city trail as part of Neoxian City Curation program

Discord Server for more goodies and giveaways.. We are glad to see you using #neoxian tag in your posts. If you still not in our discord, you can join our

Discord Server for more goodies and giveaways.. We are glad to see you using #neoxian tag in your posts. If you still not in our discord, you can join our

100SP, 250SP, 500SP, 1000SP. Read more about the bot in this post.

WOW that's nicely explained , Thanks for your review .

!neoxag 50

Thank you so much sir.

You are taking so much effort on this review. Well done.

Thanks for your contribution, @milaan

Regards,

[Realityhubs Curator] @anggreklestari

Thank you for recognizing my effort.

You have received

50 NEOXAGgift from @zaku-ag!Please check your neoxian.city wallet.

To know more about our tip bot read Neoxian City Tip Bot Announcement Post

To know more about our tribe read this post

To view or trade NEOXAG go to steem-engine.com

WOW that's nicely explained , Thanks for your review .

!neoxag 50

Very detailed and helpful post. Thank you.

A question, you mentioned that smart contracts liquidate the provided asset for the loan if the cryptocurrency coin market value falls below certain parameters instantly and emotionlessly. Does Neoxian Bank have liquidation parameters tied to the value of the pledged cryptocurrency?

Do we retain use of the SP during the loan?

Thanks

Thank you.

Yes Neoxian Bank has also the right to liquidate the SP which is pledged for a loan. But to the best of my experience and knowledge Neoxian Bank gives enough chance and time to you, if you fail to meet the scheduled payment, but you have to communicate properly with Neoxian Bank, you must elaborate on the reasons in detail to why you defaulted the loan. You have to be polite. You must also tell your future plan, how you will pay.

But if you simply remain silent and/or run away without paying the installment or if any borrower has any malicious intention, then the bank may decide to liquidate the SP which is pledged.