The Bitmex exchange is a trading platform for the sale and purchase of futures for crypto-currencies owned by HDR Global Trading Limited. The company was founded in 2014 by three financial analysts, who in time were able to consider the prospects of the crypto-direction. CEO Arthur Hayes in 2008 graduated from the Wharton Business School, one of the most prestigious educational institutions of the United States of America.Shortly after graduation, he moved to Hong Kong to work in the banking sector, but quickly realized that he did not have a place there, and in 2013 finally left this field to fully and fully focus his attention on the development of the crypto-currency market. In his opinion, bitcoin in just a decade will become the world's leading currency, when all countries will finally understand the futility of the existing financial system. Together with him working financial experts Samuel Reed, acting technical director of the company, and Ben Delo, who performs the functions of an operational director.

The main office of BitMEX is in Hong Kong, but the company is focused on the international market.

Verification in BitMEXhttp://www.bitmex.com/

The process of checking for new users is simple enough, it consists only in checking the e-mail address. Once an email is confirmed, the new user of the site receives unlimited access to the trading platform. This process takes only a few minutes.

Supported futures for crypto-currencies:

Bitcoin (XBT)

Zcash (Zec)

Ethereum (ETH)

Ethereum Classic (ETC)

Monero (XMR)

Ripple (XRP)

Augur (REP)

Litecoin (LTC)

Factom (FCT)

Fees

Like many other trading platforms, Bitmex takes charge for the services provided, commissions are levied for different types of trading operations with futures:

For Zcash (ZEC):

The fee for opening an order is 0%

The fee for order purchase is 0,25%

The fee for closing the order is 0.25%

For all other coins:

The fee for opening an order is 0.025% REBATE

The tariff for the order is 0,075%

The fee for closing the order is 0.050%

As for margin margin on futures, the exchange offers the following conditions:

5x - on futures Zcash (ZEC)

10x - for Augur futures (REP)

20x - for futures Ethereum Classic (ETC), Factom (FCT), Ripple (XRP)

25x - for Monero futures (XMR)

33x - for futures Ethereum (ETH), Litecoin (LTC)

100x - for Bitcoin (XBT), Bitcoin / Yen (XBJ), Bitcoin / Yuan (XBC) futu

For Bitcoin Swaps, we also offer a shoulder 100x with a commission for the purchase of a warrant of 0.075% and a warrant opening of 0.025%. Long-term and short-term commission for financing is 0.0245%, the financing interval is 8 hours.

BitMEX does not impose a commission for depositing funds into accounts. For withdrawal of funds from the exchange, the minimum commission is taken.

In addition, the BitMEX exchange provides an option of so-called "iceberg" orders for purchase or sale, or, more simply, "hidden." Basically, similar type of applications are used by the major players of the financial market, who do not want to show the full number of offers submitted for sale or purchase. In simple terms, if a large player wants to sell 100,000 shares of his company, he uses only an "iceberg" to sell only 10,000 shares on the sales page, after which the system will automatically place another 10,000 shares, and so on. Such a tool, as a rule, is used to restrain other market participants and reduce the cost differentials.

The value of the "iceberg" on BitMEX is 0,075% of the cost and is paid until the "hidden" part of the offer is fully implemented. After that, the commission percentage will return to the figure that corresponds to the usual application without a hidden part

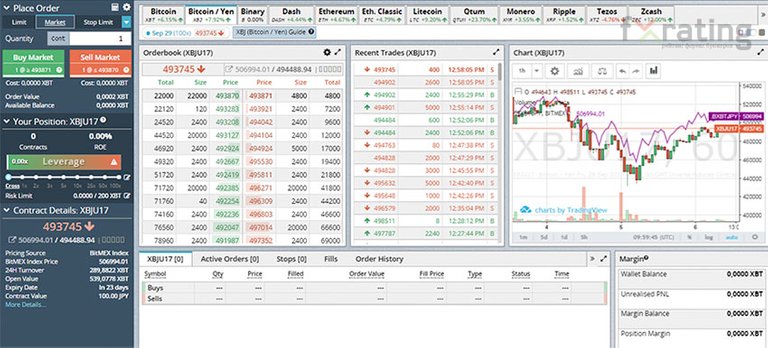

Trading analysis on BitMEX.com

BitMEX provides one of the widest range of services offered to users:

Market order - a market order indicating the purchase and sale of crypto currency at an affordable price.

Limit order - this order sets the maximum price for which the user of the exchange is ready to purchase coins, as well as the minimum cost of selling already existing coins.

Stop order - this type of order is used mainly to close pending orders, which are closed when the market reaches the prices indicated in them.

Take Profit order - an order that determines the exact number of orders, where you need to close the current position for profit by the current price at that time.

Iceberg orders - the sale of assets in parts and hiding their total number.

Hidden orders - an iceberg-like system designed for customers. Used in case the user intends to purchase a large number of assets, but does not want to inform the other bidders of this.

Close On Trigger Orders is an optional option that can be used for any of the services described above. It is used, as a rule, when the trend is reversed.

Post Only orders - limit orders, calculated for a long-term perspective. Available for Limit order, Stop order and Take Profit order.

The exchange offers margin trading in all digital currencies used on the site. Since recently, BitMEX has also launched futures trading on EOS and Tezos. Many financial analysts are of the opinion that next year the sale of EOS and Tezos tokens will beat all profitability records.

User interface and support

In general, the interface looks good, but it is quite difficult for beginners. For advanced users, the interface does not cause complications. The site engine is fast, which allows customers to conduct their business in comfortable conditions. Also there is an application for smartphones based on android, but it is not official.

The trading platform has a round-the-clock multi-channel support service, not the most ideal, but employees always try to help users with a problem. The standard response time for an application is about 1 hour - not every service can boast of this speed.

Most of the complaints are mostly of a technical nature: mostly users complain about the complexity of the interface. Over the years BitMEX has not received a single error message on the site.

Security

The security of the exchange is at the highest level. BitMEX uses two-factor authentication to secure servers using hardware tokens (known as a cryptographic token or USB key). Notifications of logging in come via both SMS and e-mail, while PGP encryption is used for communication.

In addition, the trading platform has a unique system of risk checks. In the event that the system suspect suspicious activity, all user operations stop.

The main thing that testifies to perfect protection of a site - absence of precedents. For the entire existence of BitMEX, none of the users have ever been hacked.

I found your post and decided to help you get noticed.

I will pay a resteeming service to resteem your post,

and I'll give you my stamp of automatic approval!

Curious?

introduction post

Check out the great posts I already resteemed.Resteemed by @resteembot! Good Luck! The resteem was payed by @greetbot The @resteembot's Get more from @resteembot with the #resteembotsentme initiative