Remember the opening of trading bitcoin futures on the Chicago exchange last year? The air was saturated with naive euphoria from the fact that institutional investors will come to the market, which is very good for bitcoin.

But what actually happened? The Chicago Stock Exchange played into the hands of the bears and they first held back the market, and when the fixing periods came, the bitcoin course inevitably fell.

In the universe called bitcoin, there are two opposing camps - enthusiasts and skeptics. Enthusiasts see in bitkoin a revolution that will change our interaction not only with money, but with each other and with the world as a whole.

The manifesto of the cryptoanarchist usually says: "Crypto-currencies and blocking will radically change the nature of corporate behavior, the state policy of interference in business and personal space of citizens. Crypto-currencies (read crypto-anarchy) in combination with the emerging information markets will create a liquid market for any product that can be described in words or expressed graphically.

Skeptics, on the other hand, consider bitcoin to be essentially useless. Tulip economic bubbles and financial pyramids are the most frequently used epithets to reject Bitcoin's potential. For the sake of justice, it is worth noting that speculative bubbles exist for technologies that change the world. They are often a provocative spark that brings technology to the level of the product, and raises public scrutiny.

What does this have to do with the future?

Until now, the only way skeptics could influence the market was the dissemination of negative information. But with the arrival of futures, skeptics can now take their money there and actively bet against bitcoin. One camp sees the future in bitcoin, the other is a useless and dangerous surrogate of money.

But now a completely new group with interests comes to the market - these are institutional investors, differing in that they have huge capital and like to dictate their rules. And, of course, to enter the asset, they usually know how to squeeze a profitable price for themselves, and it always was. Large institutional investors have repeatedly been suspected of manipulating the price of assets.

There are three groups in the battle for the future of bitcoin:

Believers in bitcoin - their motto HODL

Skeptics and cheaters (owners of money) - their motto "Bubble, pyramid, tulips, surrogates ..."

Institutional investors are their motto "We want to buy cheaper, and then sell you more and fix profits"

Which of them will win? Any person who says that he knows the winner is not right. It's only true that all three groups have equal chances to win and we are now entering an era when, in the open markets, which, according to liberal economists, regulate themselves, in fact, they manipulate it very well. The most dangerous of this group are skeptics (that is, bankers) because they have long learned to bet against everyone without buying the underlying asset, in this case bitcoin.

If there was only one asset in the world that could protect people from inflation and unreliability of fiat money, then only gold could be such an asset. But a clever tool was invented against him, allowing him to keep his prices down, despite the fact that all gold produced ever in the world costs at the current price not more than $ 3 trillion, and the money supply of this most important currency grows by 100% every year over the past 50 years. If you calculate the fair price of gold, then after 1972, when the dollar ceased to be supported by assets in this precious metal, gold grew in price only 8 times, and dollars became 50 times more. The fair price of gold should be 6 times higher than now.

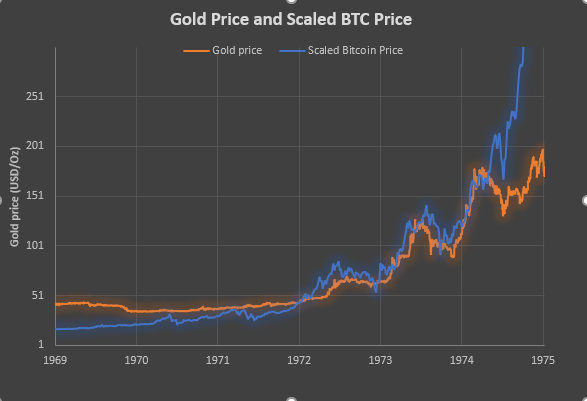

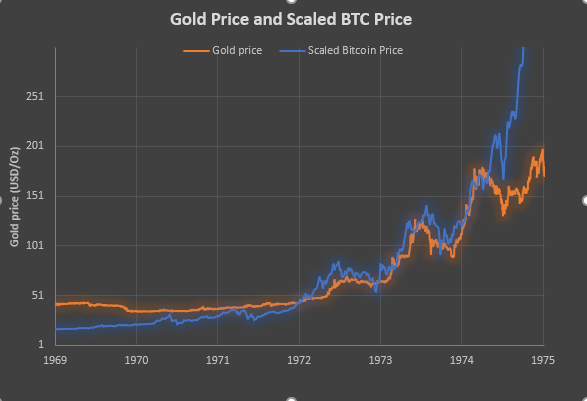

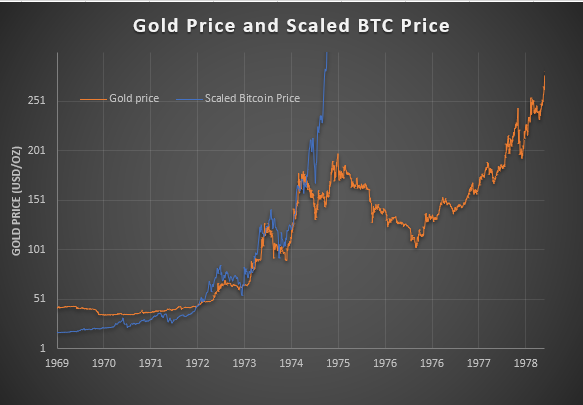

There are striking similarities, graphs of historical prices for gold and bitcoin. Not only are the basic oscillations identical, but several deep dips are repeated in the same place. And here you involuntarily think about it, or the universe really is one big fractal, or someone is using the gold price chart as a guide to managing the prices of crypto currency.

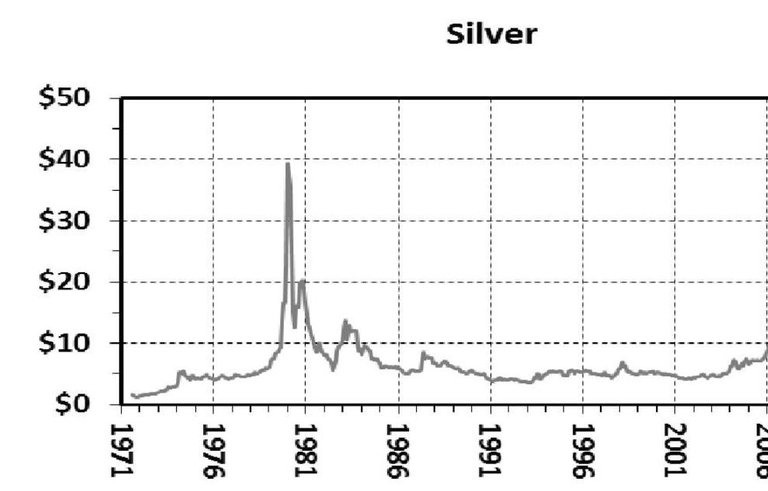

And that's not all, do you want some more interesting information? We completely forgot about silver. So you want to ask opponents of alternative theories the question, is there a centralized, pre-planned manipulation of the market on a global scale? You have to be completely blind or insane, not to answer, yes.

The most famous case in history of futures manipulation in the silver market was the history of the Hunt brothers in the 1980s. It is known that the Hunt brothers made significant investments in silver and silver futures contracts in an attempt to monopolize the formation of prices for this metal. As a result, they managed to consolidate more than ⅔ the global silver market and raise the price by 700%.

To fulfill this plan, the brothers took a huge amount of loans, to buy up silver futures on silver bail. But the world bankers had a law in the US Government changing the terms of silver lending, and the Hunt Brothers could no longer increase their loan portfolio, as a result they reduced purchases of futures, and when they could not meet their margin obligations, causing panic in the market, the price silver collapsed from 48 to 11 dollars in just 5 months.

Does not it look like anything? If you are aware of the historical price charts of crypto currency, you can easily recognize in it the cycles of pampas dumps, which characterize the set of crypto-currencies. Let's take a look at the price chart for Ethereum / Bitcoin

By the way, all operations on the pampoo dump Doge was conducted by a trader under the pseudonym WOLONG, who later wrote the so-called "PDF of God", in which he described in detail his strategy of manipulating the price of Dogecoin.

Well, in the end, let's look at Bitcoin Cash:

Well, what do you say, why all this look? And then, that the markets of the crypto-currencies behave as well as the silver market, when the bankers hustled the Hunt brothers into a corner.

Is it a natural fractal that all assets with limited supply are manipulated by the same simple enough scheme by powerful structures controlling the circulation of money? Probably that yes. And perhaps, human nature itself is fractal and we have long been living in a matrix, which Elon Musk likes to talk about.

Now back to gold, the chart shows the imposition of gold prices and prices

bitcoin. So, in 1974 on the COMEX exchange in New York, the first gold futures contract was concluded, and the auctions began symbolically on December 31. And look what happened next.

The price of gold fell by 50% within two years after the opening of futures. Is there a direct relationship between these two events, definitely yes, because before the opening of futures, gold has always been growing in its history, but here it began to fall, even at a point in 3 and a half years. After that, a new growth began, which was crushed by the coordinated action of G7 central banks. How can this tell us the further behavior of the bitcoin course? First, just before the collapse of the bitcoin course last year, futures trading was opened with bitcoin on the Chicago Stock Exchange, and then both graphics coincided to near full accuracy.

Here two levels are clearly interpolated, to which the price of bitcoin will reach, before it turns down. The first level is $ 60-80, before the big dump, then, the next $ 180K and so on. Time on this scale needs to be accelerated 4.5 times, it is at this scale that the curves coincide.

In order to accept this assumption for the correct forecast, we must take into account the fact that there are several differences between gold in 1974 and bitcoin:

The speed of distribution and availability of information is now much higher than then, in the precomputer era. In 1975, most market participants did not even suspect that there were gold futures.

Buy bitcoin is much easier than in 1975 gold. It is available to everyone and everyone and most have already mastered the rule - to buy on the fall and hold.

You got a micro upvote from me 😎