Last week, in Amsterdam, the Bitcoin world "king"

was met in Amsterdam for the annual conference on the evolution of this technology (see our report). The atmosphere that breathed was a movement that began to become mass, opening itself increasingly to the business world and to the institutional finance. Bitcoin's future has been discussed both in terms of regulation and business, but also in terms of technology.

Among the participants in the conference were those who think that Bitcoin is just the beginning of a process, and that other innovation waves are about to fall into the world of finance. According to some, Bitcoin is the first step in a long way towards a completely decentralized new finance.

One of these is David Schwartz, chief cryptographer at Ripple Labs. Ripple is, like Bitcoin, a protocol designed to make online payments in a distributed way without having to resort to the traditional financial network. It is one of the innovations in the field of mathematical coins, and according to some it may be the next important phenomenon after Bitcoin. Unlike the latter, in Ripple, the network is less decentralized, though it allows faster transactions (in the order of magnitude than seconds instead of minutes).

Beat a little nerd and is available to tell what goes on in the scenes, Schwartz immediately makes it clear that Ripple does not compete with Bitcoin. Bitcoin is in fact both a payment system and a currency, and - according to Schwartz - a potentially more liquid payment system would allow Bitcoin to emerge as the best value reserve, competing with fiat currencies, and those of central banks. Although not entirely convincing, the argument revolves around the idea that the market now dominated by the incumbent is so great that there will be room for everyone. To demonstrate this, Schwartz updates us on the focus that Ripple Labs has recently made: spread the Ripple protocol where Bitcoin would have more difficulty penetrating.

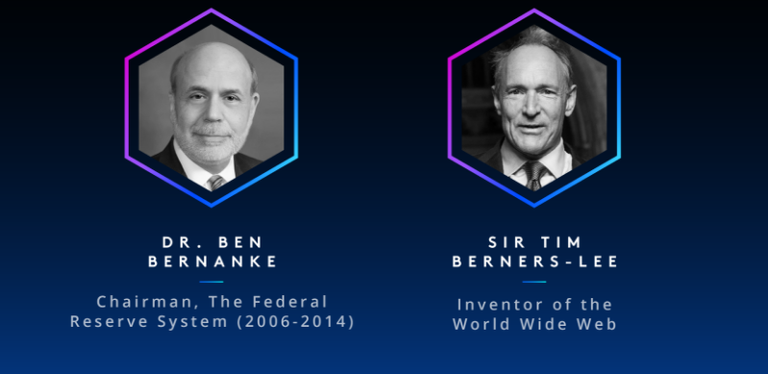

The sector is that of intra-bank payments, where a single financial institution moves resources from one department to another, often using the same interbank payment networks, which are therefore expensive and charge significant commissions on transfers. The German bank Fidor was the first to believe in this opportunity, and will integrate Ripple for its internal moves (we have talked about it here). Schwartz admits that a network like Ripple will need years to get in the way, and for this reason the focus of the company is for now limited to financial institutions, rather than to other companies or individuals. In the near future, one can also imagine a use of the credit management Ripple network, but - says Schwartz - it's still too early to talk about it. At the moment there is so much work to do, even considering that they are also working on distributed identity management systems to allow the network to remain distributed but be more "compliance-friendly" than the older Bitcoin brother, and thus limit the weeds legal for those who decided to use it. See the major speakers of the conference, you will not believe it!!

Finally, on the theme of the XRP, the coin underlying the Ripple network, of which the company holds 20% of the total turnover, Schwartz confidently satisfied that the sale of XRP is the source of revenue with which the business is currently arguing, though having raised $ 9 million from investors and venture capitalists. On the future business model, Schwartz refers to value-added services for companies that want to delegate aspects of the Ripple network connection instead of handling them in-house. But in this case it is too early to talk about it: today's job is to grow the network and reach the critical mass needed to start managing large volumes of payments. The goal, at least in words, is not only to make money but to first issue good open-source code. If the XRP coin should not take off, or if Ripple itself fails to succeed, Schwartz has been important to have taken a single step with a protocol that can then be resumed and improved by others.

In this Schwartz is not just: other bright minds are working on interesting innovations in the Bitcoin protocol.

Adam Back, an English encrypator, is the creator of Hashcash, a digital currency that contained some of the essential features later years after Bitcoin. He is currently driving a startup called Blockstream. Established in Canada with the support of the Austin Hill investor, Blockstream aims to provide a better link between Bitcoin's backbone, blockchain, and any parallel networks that Back calls "side-chains."

There is an undercoat of altcoin, alternative coins to Bitcoin, starting from zero trying to imitate its functionality. The innovation that Back wants to bring is to allow these experimental coins to lean on Bitcoin as a fundamental underlying, to make them more liquid and favor Bitcoin's growth by avoiding useless competitions. Blockstream can boast in its own team Jorge Timon and Mark Friedenbach, the two Freicoin co-creators and authors of the proposed "Freimarkets", a distributed securities issue system that would allow any economic operator to access credit without going through the traditional banking system . A kind of peer-to-peer trust in short. The proposal, which was unsuccessful at the time of its publication, was rather appealing to Back, who invited the two developers to join the Blockstream team in Canada and make their vision reality under its protective wing. One of Back's goals is to create a "smart credit" system where businesses and individuals can do complex operations far more than they can in Bitcoin or Ripple, and may issue representative securities of any underlying asset using Bitcoin as a currency reference. While most of the Bitcoin community seems to focus on disintermediation of traditional payment systems, these proposals point to another market now dominated by large financial institutions: credit. Just as today Bitcoin makes it possible to make payments with unprecedented freedom, is it possible for a company to access the credit needed to grow without having to go from a bank? Friedenbach and Timon think so. The two, like Schwartz, are more interested in advancing technology than business. Blockstream could do it or not, but what's up to them is pushing the boundary of what we now think is possible with cryptocurrencies.

Schwartz, Back, Friedenbach and Timon are just some of the minds involved in the evolution of Bitcoin. From a certain point of view the most interesting aspect of Bitcoin is the community of highly-regarded intellectuals who are devoting time and energy to "reprogram" the coin. Satoshi Nakamoto opened a pot of Pandora, and it is unlikely that this process of evolution will stop. The Bitcoin protocol, which for the mass is still science fiction, is outdated for these guys: apparently they are simple hackers, but in fact they are world-builders. A line of code at a time is building the future of finance, laying the foundations of the economic world where we will probably all live in a few decades.

Let me know your thinking! Do you believe the news from this conference will be positive?

Best

Francesco

Sources of images and text can be found here