Authored By John Mauldin from Mauldin economics

According to a 2014 Pew study, only 15 states follow policies that have funded at least 100% of their pension needs. And that estimate is based on the aggressive assumptions of pension funds that they will get their predicted rate of returns (the “discount rate”).

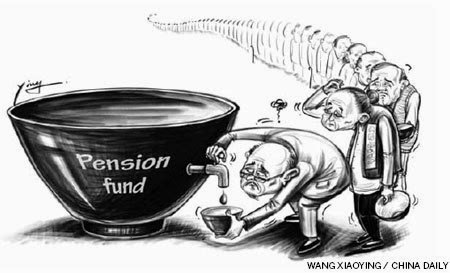

We throw the words a trillion dollars around, not realizing how much that actually is. Combined state and local revenues for the US total around $2.6 trillion. Following the next recession (whenever that is), the unfunded pension liabilities for state and local governments will be roughly three times the revenue they are collecting today, and that’s before a recession reduces their revenues. Can you see the taxpayer stuck between a rock and a hard place? Two immovable objects meeting? The math just doesn’t work.

Pension trustees don’t face personal liability. They’re literally playing with someone else’s money. Some try very hard to be realistic and cautious. Others don’t. But even the most diligent can’t control when the next recession comes, or when the stock market will crash, leaving a gaping hole in their assets while liabilities keep right on rising.

I have had meetings with trustees of various government pensions. Many of them want to assume a more realistic discount rate, but the politicians in their state literally refuse to allow them to assume a reasonable discount rate, because owning up to reality would require them to increase their current pension funding dramatically. So they kick the can down the road.

Intentionally or not, state and local officials all over the US made pension promises that future officials can’t possibly keep. Many will be out of office when the bill comes due, protected from liability by sovereign immunity.

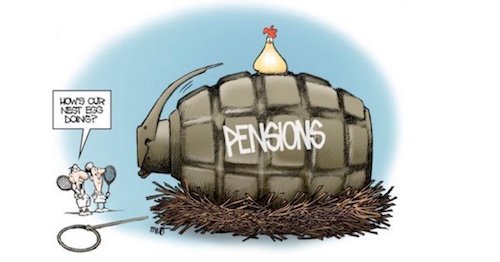

We are starting to see cities filing for bankruptcy. That small ripple will be a tsunami within 7–10 years.

But wait, it gets still worse. (Do you see a trend here?) Many state and local governments have actually 100% funded their pension plans. Some states and local governments have even overfunded them – assuming they get their projected returns. What that really means is that the unfunded liabilities are more concentrated, and they show up in unlikely places. You think Texas is doing well? Look at some of our cities and weep. Look, too, at other seemingly semi-prosperous cities all over the country. Do you think the suburbs of Dallas will want to see their taxes increased to help out the city? If you do, I may have a bridge to sell you – unless you would rather have oceanfront properties in Arizona.

This issue is going to set neighbor against neighbor and retirees against taxpayers.

It will become one of the most heated battles of my lifetime. It will make the Trump-Clinton campaigns look like a school kids’ tiddlywinks smackdown.

I was heavily involved in politics at both the national and local levels in the 80s and 90s and much of the 2000s. Trust me, local politics is far nastier and more vicious. And there is nothing more local than police and firefighters and teachers seeing their pensions cut because the money isn’t there. Tax increases of up to 100% are going to become commonplace. But even these new revenues won’t be enough… because we will be acting with too little, too late.

This is the core problem. Our political system gives some people incentives to make unrealistic promises while also absolving them of liability for doing so. It also places the costs of those must-break promises on innocent parties, i.e. the retirees who did their jobs and rightly expect the compensation they were told they would receive.

So at its heart the pension crisis is really not a financial problem. It’s a moral and ethical problem of making and breaking promises that profoundly impact people’s lives. Our culture puts a high value on integrity: doing what you said you would do.

We take a job because the compensation package includes x, y and z. Then someone says no, we can’t give you z, so quit and go elsewhere.

The pension problem is going to get worse as more and more retirees get stuck with broken promises, and as taxpayers get handed higher and higher bills. These are irreconcilable demands in many cases. It’s not possible to keep contradictory promises.

What’s the endgame? I think much of the US will end up like Puerto Rico. But the hardship map will be more random than you can possibly imagine. Some sort of authority – whether bankruptcy courts or something else – will have to seize pension assets and figure out who gets hurt and how much. Some courts in some states will require taxes to go up. But courts don’t have taxing authority, so they can only require cities to pay, but with what money and from whom?

In many states we literally don’t have the laws and courts in place with authority to deal with this. And just try passing a law that allows for states or cities to file bankruptcy in order to get out of their pension obligations.

The struggle will get ugly, and innocent people on both sides will be hurt.

We hear stories about retired police chiefs and teachers with lifetime six-digit pensions and so on. Those aberrations (if you look at the national salary picture) are a problem, but the more distressing cases are the firefighters, teachers, police officers, or humble civil servants who served the public for decades, never making much money but looking forward to a somewhat comfortable retirement. How do you tell these people that they can’t have a livable pension? We will see many human tragedies.

On the other side will be homeowners and small business owners, already struggling in a changing economy and then being told their taxes will double. This may actually happen in Dallas; and if it does, we won’t be alone for long.

The website Pension Tsunami posts scores of articles, written all across America, about pension problems. We find out today that in places like New York and Chicago and Cook County, pension funds have more retirees collecting than workers paying into the fund. There are more retired cops in New York and Chicago than there are working cops. And the numbers of retirees just keep growing. On an individual basis, it is smart for the Chicago police officer to retire as early possible, locking in benefits, go on to another job that offers more retirement benefits, and round out a career by working at least three years at a private job that qualifies the officer for Social Security. Many police and fire pensions are based on the last three years of income; so in the last three years before they retire, these diligent public servants work enormous amounts of overtime, increasing their annual pay and thus their final pension payouts.

As I’ve said, this is the crisis we can’t muddle through. While the federal government (and I realize this is economic heresy) can print money if it has to, state and local governments can’t print. They actually have to tax to pay their bills. It’s the law. It’s also an arrangement with real potential to cause political and social upheaval that Americans have not seen in decades. The storm is only beginning. Think Hurricane Harvey on steroids, but all over America. Of all the intractable economic problems I see in the future (and I have a vivid imagination), this is the most daunting.

Sources:

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.prisonplanet.com/pension-storm-coming-this-will-become-one-of-the-most-heated-battles-of-my-lifetime.html

I never think of the future - it comes soon enough.

- Albert Einstein

why do I always get einstein quots! old man I want some new quote!!!

What do you think about bubble-up bail-outs as a "fix"? That is, city bailed out by State, State bailed out by Fed? I see it likely to happen.

Possibly but that would very likely hyperinflate the dollar in just a few years, which could ultimately lead the end of the states. Death by printing machine. https://steemit.com/money/@christophzak/the-real-story-behind-america-s-new-usd20-trillion-debt

Work until you can't than put a gun to your head. That's the retirement plan of many.

I'm in a union and that's the reality

Workers never get to retire the money is always stolen from them. Its Happened in every generation before me and it's going to happen to every generation after me.

Work and die that's the only option.

Social security and retirement plans was one of the worst things that happened to society. It was yet again a great socialist idea with horrible implications that nobody cared or thought off in the beginning. Before the pension system, the deal had kids spend a lot of time an money on them. BUT when you be old they will take care of you. Socialism destroyed all of this, which is a big reason for the low birth rates and those low birth rates are the reason for the failed retirement plan .