- Apple Patent Application indicates Blockchain Usage

- Japan: GMO Internet Group plans Salary Payments in Bitcoin

- Litecoin is replacing Bitcoin on Steam and its Price is rising

- Germany: Crypto Assets Conference in Frankfurt

- The ICO Governance Foundation, Waves, and the Idea of Self-Regulation by ICOs

- Government of Bulgaria owns over 200,000 Bitcoins

- Bitwise Investments launches Crypto Index Fund and receives $ 4 Million

- Bitcoin Course Challenge Week 10

Apple recently filed a new patent claiming to use blockchain technology in a future system to create and verify timestamps.

Based on the public patent application on Thursday, Blockchain technology will be used to certify timestamps using a Public Key Infrastructure (PKI) tool.

Apple's application describes three potential uses for timestamping, with one of these scenarios focusing on blockchain technology. In this case, information is attached to the transactions in order to be able to store them in the blockchain, making the state of data at exact times more comprehensible.

The program will generate a block with a timestamp, which will be verified with the next block, since miners will verify the transactions that are executed on the chain. The system is part of what Apple calls a "multi-check architecture," which means another system will validate the timestamp before it hits the blockchain.

Like other established institutions, Apple believes in blockchain technology and its impact.

Apple has recognized the benefits of having transactions recognized by a consensus within a network, being aware that scams are thereby recognized in some form to be made much more difficult. The technology operates on a distributed platform rather than a centralized one, giving each participant access to exactly the same blockchain data, which in turn provides a large barrier to possible attacks.

The largest Internet service provider in Japan, the GMO Internet Group, will offer its 4,700 employees from March 2018 to pay up to $ 900 of their monthly salary in Bitcoin. The group has been generating revenues for several months with its own blockchain and mining services.

Truly groundbreaking news from Japan. Bloomberg editor Yuji Nakamura announced yesterday on Twitter that one of Japan's biggest employers in the online sector wants to change its payout arrangements.

For the moment, the new conditions apply only to the employees of GMO Internet Co. Ltd., but this should change soon. If all the companies in the group have followed suit, over 4,710 full-time employees can be paid at least up to $ 900 in Bitcoin. Among other things, the GMO Internet Group operates as an Internet service provider, arranges online advertising and offers products from the areas of Internet security and mobile entertainment. Since July of this year, a separate blockchain development service is offered. Bitcoin mining services have been available to GMO customers since September.

Japan shows it: cryptocurrencies overcome national borders

According to media reports, management said that it is anticipated that cryptocurrencies will sooner or later become universal currencies. Because anyone can carry out transfers almost at zero cost from anywhere, one day a new global economic zone will emerge, which will be able to do without any limits. That sounds like a vision of the future, which should find much support in the crypto community.

Apart from any prophecies, Japan could soon be the first nation ever to demonstrate the mass suitability of cryptocurrencies. Since April 2017, Bitcoin has been a state-approved means of payment in Japan. Rough estimates suggest that there will be up to 300,000 Bitcoin acceptance points by the end of the year. In the Japanese television channels even TV spots run by Bitcoin dealers.

After Litecoin (LTC) reached the $ 168 mark, Charlie Lee announced that Steam vouchers can now be purchased with Litecoins instead of Bitcoins. The reason for abandoning Bitcoin was the increase in fees and volatility. Many Litecoin fans find that unlike Bitcoin, Litecoin is better in terms of payment and has improved.

By creating the Litecoin as a kind of diversion from Bitcoin implementing a few changes such as the reduced block generation waiting time - a Litecoin transaction can be handled 4x faster than the average Bitcoin transaction.

The icing on the cake, however, is that the Litecoin has created a blockchain that has more tokens in circulation than Bitcoin. This allows greater scalability as most exchanges do not allow trading below the 0.01 BTC mark. The same usually applies to Litecoin, which allows users to make it much easier to use for transactions.

Litecoin has not just implemented these changes. The average cost of a transaction is around $ 0.15. The cost of a Bitcoin transaction, by contrast, is around $ 6.00. Therefore, it is no surprise that Steam now waives the Bitcoin as a means of payment.

Why Litecoin overtakes Bitcoin in terms of payment methods

Bitcoin was created as an electronic peer-to-peer cash system. And although many people still use it as such, most Bitcoin advocates use it as a great way to accumulate value - but no longer as an electronic cash system.

This should not be a form of Bitcoin-Shaming now. After all, it is still one of the most impressive technologies. But still thinking that he is one of many means of payment is unrealistic. The price is far too high for that - and it continues to rise. So Satoshi's vision would be gone. Litecoin's "father" Charlie Lee saw the limits of Bitcoin not as a technology, but as a form of money.

That's not necessarily bad, because like any other project, Bitcoin is subject to interpretation. Due to the constant increase in prices, Public Opinion believes Bitcoin is an excellent investment opportunity - and they are right. Due to the limited number of coins, the token suffers from deflation and not inflation - unlike Fiat currencies.

Due to the implemented changes described above, the Litecoin could possibly take over the Payment Department. The number of WordPress plugins is increasing, as well as the general adaptation. Charlie Lee makes himself heard on social media, which of course increases the awareness.

Market analysis:

The December forecasts seem to be true. After the Bitcoin surge, every Altcoin has risen - and today the Litecoin (LTC) has broken its previous record of 162 USD and now has a new all time high of 344 USD. Some people think Litecoin might one day grow that big that he encounters the same problems that the Bitcoin is struggling with, the key differences in its core protocol making it much easier to achieve this potential.

Just look at the last month: Then we see that Litecoin has seen organic growth and is celebrating its breakthrough today. The Litecoin community was very excited to break the three-digit mark for the first time. But she had no idea what was coming.

There are many speculations about the potential value of the Litecoin in 2018. Although growth is always uncertain, everyone seems to expect that both the market and Litecoin will have a great year ahead. After all, the growth of Litecoin this year was a good 3000%, but he started at only 4.20 USD.

If there is not a big market shift in January after the Christmas nestpots spill over the market, we can expect a big increase in February. Once the big fish with a discount set everything on their favorite coins, and if everyone turns into a Holder after the purchase, then the market situation will thrust again in the trillions direction - and maybe even reach the Billion this time.

After Steam made payments with Litecoins, I can safely say that the Coin could reach a four-figure sum in February or March.

The Crypto Assets Conference will take place in Frankfurt on February 26 and 27, 2018. The event will be held in cooperation with the KI Group on the campus of the Frankfurt School. Among the speakers are numerous experts and innovative disrupters.

Topics of the conference:

The conference will provide answers to the following questions: What influence do cryptocurrencies have on international trade? How can innovators adapt so-called crypto-commodities? How can they reinvent their business models and compete against today's monopolies? What happens when crypto tokens, crowdfunding and venture capital reach unprecedented heights? And which industry will benefit next? The focus is on the topics listed below.

Crypto Assets: Importance of cryptocurrencies, tokens, ICOs and other digital assets

Investment: Valuation of crypto assets

Asset Management: New business models for asset managers and brokers

Assessment: Value determination of decentralized networks

Tokens and their regulation: Types of tokens and possible regulatory approaches

Venture capital: Disruption potential of ICOs and tokens for traditional venture capital

Startups: Presentation of start-ups with future potential

The conference will provide a platform to discuss future opportunities and provide answers together with the support of technology experts, industry innovators, crypto investors and blockchain entrepreneurs. The goal is to bring together experts from the crypto-specific scene with experts from the traditional financial industry. There will be speakers from the following areas:

Start-up & Innovation: Andrei Martchouk (KI decentralized), Rouven Heck (ConsenSys), Sven Läpple (Astratum)

Economics & Governance: Dr. Martin Diehl (Deutsche Bundesbank), Dirk Bullmann (European Central Bank), Shermin Voshmgir (Blockchain Hub)

Banking & Finance: Dr. Stefan Teis (Deutsche Börse), Jan Westerhues (Robert Bosch Venture Capital), Felix Holtermann (Handelsblatt)

If you are interested you can get tickets here!

The Waves blockchain platform is currently working with other companies in the blockchain industry, such as the ICO Governance Foundation, on a design for a self-regulated ICO market. What shows through is how old structures meet new technologies.

Waves will work with Deloitte CIS, the ICO Governance Foundation and the Ethereum Competencies Center, as announced on December 11, 2017 in a blog post. They want to create legal and fiscal standards as well as guidelines for accounting and other finance at ICOs. They are reacting to the current unregulated flood of ICOs, building on existing proposals from the ICO Governance Foundation.

The regulatory body is said to be headquartered in Switzerland and to offer cooperation for ICO platforms, exchanges and blockchain platforms. One of their partners, the ICO Governance Foundation, is pursuing some interesting approaches, which are briefly presented below.

The ICO Governance Foundation and the anarchic ICO market

In its white paper, the ICO Governance Foundation initially assumes that the ICO community is capable of self-regulation through protocols and blockchain platforms. The current market is already decentralized and yet connected - a property of blockchain that sometimes seems to contradict our reality of life. Decentralization meets states that are separated by national, linguistic and cultural boundaries, to which the technology (in part) grows over the head. The ICO Governance Foundation is aptly proposing self-regulation.

These are by no means anarchist utopias. For example, the ICO Governance Foundation points out that the industry as it currently exists does not offer the most reliable "authorities." Consisting of online forums, chats, stock exchanges and ICO rating agencies, there is a wide unregulated field. If there were certain interest groups that wanted to hide or misrepresent information, it would make the market manipulable, says the association.

Then comes the call for a kind of authority, any authority that controls the whole event. The fact that these can be technological entities is close to the current state of the industry. Consider the possibilities of blockchain technology and smart contracts - decentralized "authorities" that regulate the ICO market itself.

Problems and solution approaches

The main problem at the moment, according to White Paper, is that there is unregulated dispersion through decentralization. ICOs are spreading and no one has it under control, let alone the overview. The fact that it always comes back to scams is just as obvious as the underlying temptation to make quick money. In particular, issues of decentralized trust and transparency are on the initiative's agenda.

What can be clearly recognized by the problem that has been touched on is a rapidly increasing technology that affects old structures. The development of the futures, or futures, which is currently taking place, illustrates this clash. So it is trying to synchronize a new system with old market mechanisms. The fact that long-established big players have their reservations there should not be a surprise.

As a decentralized, unregulated international crypto market territorial, linguistically and legally separated states. To make matters worse, that many do not really know how to deal with the new situation. The idea of creating a self-regulating market seems more appropriate than thinking in the old pattern of absolute prohibition or appropriation. So there is still a lot of work to do on Waves, the ICO Governance Foundation and other market insiders. The states and their governments also have to face the question of appropriate regulation sooner rather than later. Because the development of technology can not be stopped, authorities and companies must not lose the connection. As always, it remains true: it remains exciting.

In May of this year, the Bulgarian police seized 213,519 Bitcoins. Seven months later, the Bitcoins still have not been sold and the Southeastern European government has become perhaps the biggest winner of the Bitcoin Rally of 2017. Congratulations!

On 19 May 2017, the Bulgarian police completed months of cyber crime investigations with the help of SELEC, a center of the Southeast European police authorities. It was about a unit of organized crime that helped to evade taxes by bribing customs officers and installing a virus on customs computers. Participants included Bulgarian citizens with contacts to Macedonia, Greece, Romania and Serbia.

The Bulgarian police searched more than 100 houses and cars. She has arrested 23 suspects, including 5 customs officers, and confiscated a considerable amount of money, including 213,519 Bitcoins. The Bitcoin rate at that time was $ 2,354, so the confiscated Bitcoins were already worth half a billion dollars.

What the Bulgarian government is doing with the Bitcoins is still unclear. A journalistic search went unanswered, the government refuses to publicize Bitcoin's addresses, so speculation is made as to whether the government has actually confiscated the private keys for Bitcoins - or just the addresses.

But if we suspect that the Bulgarian police actually still own the coins and have not yet sold them, then the small country government in southeastern Europe will probably be the biggest winner of the Bitcoin Rally 2017. Let's take a look at the numbers: The price went up from $ 2,500 to $ 17,000, plus the spin-off of Bitcoin Cash (currently about $ 1,500) and Bitcoin Gold (currently about $ 250). The Bulgarian government therefore would have Bitcoins worth 4 billion dollars.

Such a number of Bitcoin would be a decent bonus for every state. For a country like Bulgaria, the 213,000 Bitcoins represent a sizeable part of the annual revenue. According to Wikipedia, Bulgaria has a GDP of 52 billion dollars, and according to Factfish, about 20 percent of it goes to the government as tax revenue. Thus, $ 4 billion worth of Bitcoins represents 38 percent of the $ 10.2 billion in taxes that Bulgaria receives each year. Again, to pronounce loud and melt on the tongue: Eighty-eight percent!

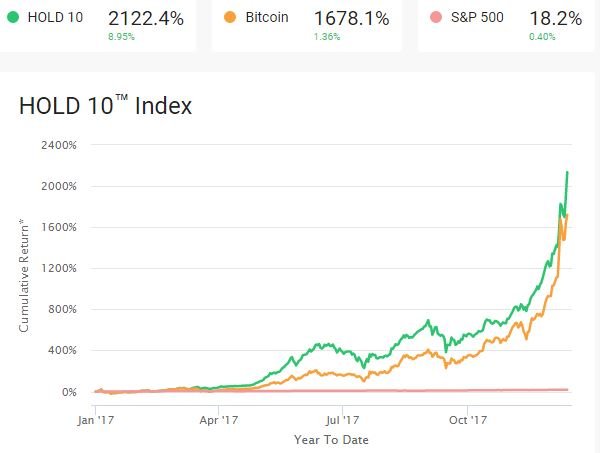

The US company Bitwise announced yesterday that a total of US $ 4 million could be raised to fund the HOLD 10 Private Index Fund. The crypto index fund should comprise the 10 most valuable cryptocurrencies.

The startup from San Francisco is building on various investors, including Khosla Ventures, General Catalyst, Naval Ravikant and Elad Gil. The opportunity to invest is still available to interested investors. With the previously received 4 million US dollars, the team wants to work on the further development of new investment products.

The purpose of the index fund is to enable participants to invest indirectly in the top 10 cryptocurrencies by market capitalization. The money made available will be invested in the trading of cryptocurrencies, whereby the acquired assets will be stored cold. Basically, the investor bypasses the crypto index fund by buying and selling cryptocurrencies directly and choosing or against certain cryptocurrencies.

Image based on data from: bitwiseinvestments.com

Rather, the index fund offers the opportunity to invest in the crypto market as a whole, represented by the top 10 listed cryptocurrencies. Likewise the question of direct acquisition or storage does not arise for a fund investor. In addition, the fund will be adjusted once a month to take account of changes in the Tp 10. Thus, the HOLD 10 Private Index Fund is currently probably the most convenient way to invest in cryptocurrencies.

In addition, other doors open for conventional investors who bring less crypto-affinity than long-time investors in Bitcoin and Co. It seems as if the start of futures trading with Bitcoin had a dam, the cryptocurrencies now the collection into the mainstream.

Disclaimer: The information presented in this post is not a recommendation for purchase or sale. It is only an opinion of me the author. They serve merely to describe the project and are not to be understood as an investment analysis.

Don't miss your CHANCE to Win 💰 20 Whaleshares + 40 Hairshares💰 in the 🏆BITCOIN COURSE CHALLENGE Week 10🏆

How and where to participate? Just click HERE!

I wish you all a lovely Wednesday!!!

ⓁⓄⓥⒺ & ⓁⒾⒼⒽⓉ

Best regards

@danyelk

.gif)

Great read! Did you look into "StreamIn" a project that approaches a pretty unique (disruptive) concept in the live streaming industry. You can actually earn Tokens broadcasting live requests or request a coverage in exchange for Tokens of content you find compelling! Planning to launch the platform in 2018 - keep track on them on Twitter -> @StreamIn_

Thank you no I did not but now I will have a look :)

Amazing this information

Good luck my friend 👍 @danyelk👍👍

Thank you very much :)

The big boys are coming!