The “Gypsum Lady” Theresa May has no intention of staying strong on Brexit negotiations. Her job was always to deliver a Brexit deal that was, in effect, no deal.

She was to thread the needle that kept the U.K. in the European Union for everything that matters, the customs and trade unions, while selling the illusion of an independent Britain that has no voting rights on the floor of the EU Parliament.

And that would be the ultimate win for the Soros Gang in Brussels. All the control over Britain they want with none of the pesky Nigel Farage farragoes of scathing rhetoric along with it.

But, after the breakdown of talks this week in Salzburg it may be dawning on her that these Brexit negotiations are a Gordian knot designed to crush the U.K. under the boot heel of growing autocracy in Brussels.

And she is rapidly coming to the end of her rope.

Because, let’s seriously step back for a moment and look at the complete irrelevancy of the Northern Ireland border which is the issue of the day holding up a deal. And it’s complete nonsense.

There is a way to come to terms with this but Brussels is having none of it. They don’t have to because they don’t want the U.K. to leave the EU.

Furthermore, does anyone really think Remainer May is doing anything other than virtue signaling about the border issue to keep her fragile coalition with the Democratic Unionist Party (DUP) together long enough to stave off a revolt and deliver a Brexit no one can be proud of, except the technocrats in Brussels?

I, for one, certainly don’t. And every time she shows the barest amount of spine, the currency markets throw up a little in their mouths.

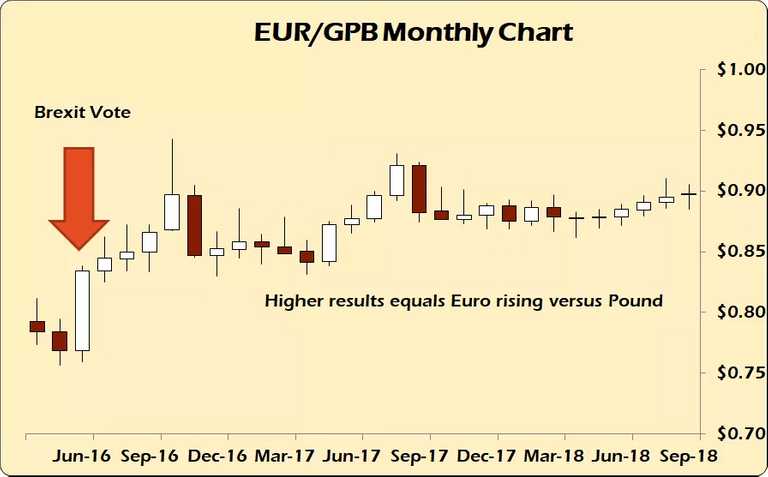

On Friday after talks broke down in supposed acrimony the British Pound went south versus the dollar and the euro rose as offshore dollar markets positioned themselves for the quarter end coming up on Friday.

Failed Melt-Up of the British Pound on Brexit Fears

)

)Here’s the gig.

The technocrats in the EU want a higher British Pound versus the Euro since it means suppressing the good effects of leaving the European Union.

So, when anything pro-Brexit happens the Pound is sold versus the euro creating stronger export markets for British goods.

This is why since Brexit the EU has been trying to push the Pound up by throwing ‘spanner’ after ‘spanner’ into the negotiating process. The EU leadership knows that on Brexit, the Pound will fall to reflect British global competitiveness more accurately.

This gives them the opportunity to sell goods into Europe at better prices than EU members can internally given how overvalued the Euro is which benefits Germany and the northern banking centers and no one else.

But, no matter how much they try to put the genie back in the bottle, the Pound keeps sliding versus the euro. And it has been since May, quietly pushing down as we get closer to Brexit without a deal.

For this reason, the EU is failing. The euro is a flawed currency that will not survive this political upheaval in its current form. Either Germany will leave or everyone else will.

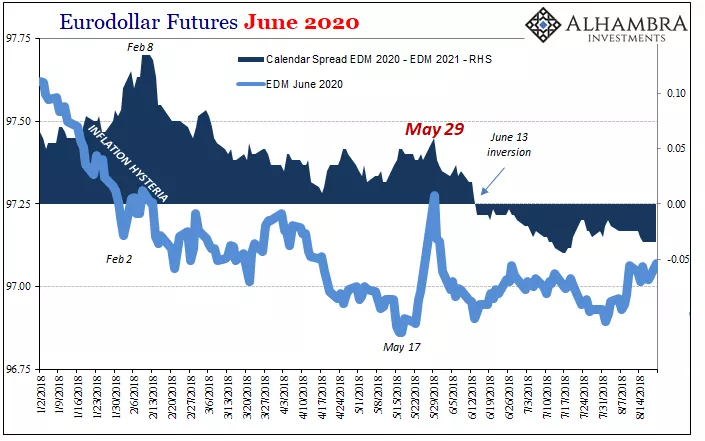

Since the Eurodollar event on May 29th that Jeffrey Snider at Alhambra Partners is convinced is shaping the current tight dollar liquidity situation, there is little politicians like Tusk and May can do to change what’s happening.

Hell, pros don’t understand this stuff. Do you really expect feckless jerks like Donald Tusk do?

The Eurodollar future spread between 2020 and 2021 has been negative for three months and beginning again to widen. Simply put, this means the real money movers are handicapping a recession by then as dollars are in higher demand than a year later.

It’s no different really than any other yield curve inversion. When short-term money is in higher demand than longer-term money there is a funding crisis brewing.

So, all of this theatre surrounding Brexit by these silly little politicians is truly a ‘deck chairs and Titanic’ moment with the notable exception that their incompetence in running the institutions which undergird these so-called markets is having a feedback effect of our confidence in them.

Thereby setting the stage for a debt-fueled asset value catastrophe.

People like EU Commission President Donald Tusk and French President Emmanuel Macron are the past. German Chancellor Angela Merkel is on her last legs politically.

When I look around and see an open coup against Donald Trump in the U.S. having the effect on propping up failing markets like the EU where its Central bank is trapped at the negative bound on interest rates I have to wonder what happens after Trump survives the mid-term elections.

At that point the hard-line stance about the EU’s common market and importance of its inviolability becomes so much virtue-signaling as eurodollars begin to rushing out of Europe to simply become dollars again while levered-up bond prices begin falling at rates that will drain what little color Theresa May has left in her cheeks.

I read this very fast, but good explanation.

I wondered the day after Brexit, how long it would take for people to realize there was not intention of letting the UK leave the union.

They can't stop the disintegration of the EU (woohoo!), but the psychos are hanging on for dear life..oh well.

A 70 year commie project, reduced to tatters within 3yrs.

What an absolute mess for the UK. An absolute disgrace that the government refuses to deliver the decision chosen by the PEOPLE.