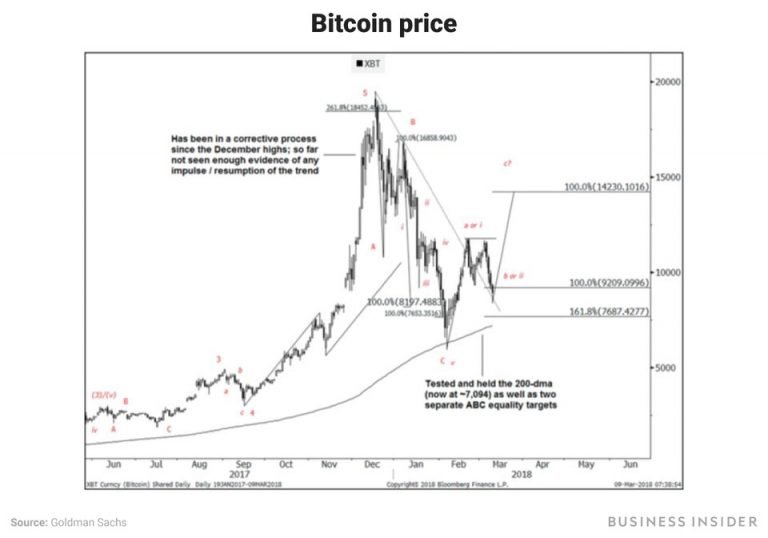

A technical analysis team led by Goldman Sachs' Sheba Jafari has warned the customer about the note Bitcoin. According to Goldman Sachs' technical analysis team led by Sheba Jafari, Bitcoin bulls have not yet emerged from the forest.

On a note sent to customers on Sunday, Sheba Jafari and his team reported that more sales warnings were on the horizon at Bitcoin, broken $9210 short-term support, and the price could fall below $6000. Sheba Jafari said that if the price of bitcoin falls between $ 7000- $ 7500, the technical analysis will show that it may fall below $ 6000 after a while.

If Bitcoin experiences such a decline, as Jafari from Goldman Sachs says, it means that it will fall by about 35 percent from its current price. The team also noted that buying crypto notes such as Ripple, Ethereum, Bitcoin Cash and Litecoin could be very risky now that the majority of crypto money tends to move together.

Who is Goldman Sachs?

Goldman Sachs is an American multinational finance company that engages in global investment banking, investment management, securities, and other financial services including asset management, mergers and acquisitions advice, prime brokerage and securities underwriting services. Goldman Sachs was founded in 1869 and is headquartered at 200 West Street in Lower Manhattan, New York City, with additional offices in other international financial centers. It also sponsors private equity funds, is a market maker, and is a primary dealer in the United States Treasury security market. Goldman Sachs also owns GS Bank USA, a direct bank.