A Decentralized exchange or DEX is a type of a pair matching that allows users to trade cryptocurrencies and place orders. It’s without an intermediary institution controlling their funds or managing the ledger. Crypto excites people because it is a way to trade value directly. Blockchain allows strangers to trust each other without the need for a central institution.

It is an amazing technology with the potential to change the way we think about trade and structure our economy. Ironically, you have to use a real currency i.e. euros, dollars, yens or any other to enter the crypto ecosystem. This entry is usually done through a number of centralized exchanges like Coinbase or Kraken. To enter a decentralized ecosystem, you have to trust a centralized institution. It manages your accounts, takes your information and is vulnerable to hacks and slowdowns.

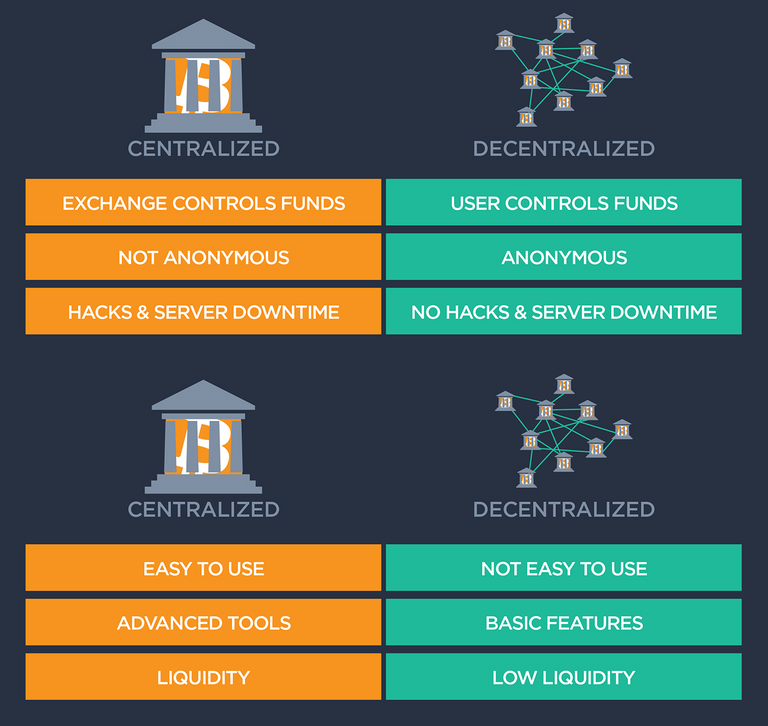

Image source: altcoin.io and https://www.cryptocompare.com/exchanges/guides/what-is-a-decentralized-exchange/

Basic Components

There are two basic components when talking about DEXs – centralization, and custody.

Centralization alludes to where is the order routing, matching, and execution. As the term alleges, all action takes place on a specific server using exchange software. DEXs operate on a computer network. Either directly on the chain through the use of smart contracts, or through second layer networks or trusted nodes. Around 98% of transactions take place on centralized networks. This allows some to judge this aspect as one of the most negative concerning crypto infrastructure.

Custody means that the exchange holds the ownership of the accounts keys. If you have coins in a custodial exchange, you do not own them until you have transferred them to an external wallet. In an instance of a hack, slowdown or any technical malfunction there can be serious problems of securing your assets. A non-custodial exchange acts as a service provider. It allows users to keep their coins in private wallets. Also, it helps them do transactions using verified open source smart contracts. The vulnerable point of this system is the time when assets are not in users’ wallets.

Benefits of a DEX

DEXs offer a number of benefits to crypto users. The main one is free and direct trades, generally representing the main idea and mission of crypto. Centralized exchanges usually gather quite an amount of user data, including name, address and even bank account number. In theory, DEXs use only blockchain information, requiring only a public address. In order to comply with government regulations, even anonymous exchanges have to gather user location data. Some DEXs have tried to pose as open source software providers not liable for their users’ actions. Most of DEXs are non-custodial, giving users the responsibility for the safety of their assets. Existing on a network of separate computers, DEXs are exponentially more secure against hacking. This also means less chance for them to go down.

Top ERC20 DEXs

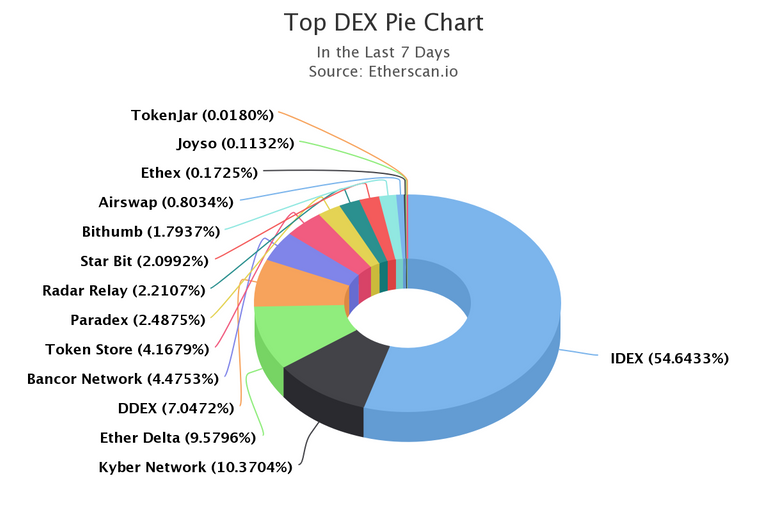

As you can see in the chart below, IDEX currently is the most popular exchange. However, this chart only represents the exchanges that operate with ERC20 tokens. DEXs like Stellar, Binance, Tron, and Waves native ones aren’t in this chart.

Source: https://etherscan.io/stat/dextracker

The current situation of DEXs

At present DEXs still face a number of drawbacks, being intrinsically more complex than centralized. Even the first steps are not user-friendly and can demand technical knowledge like software installation and configuration. Users typically can only buy and sell their assets, lacking advanced tools like options and margin trading. Only small volume deals with popular coins can be done, meaning low liquidity. High latency time on order processing and cancellation can lead to price changes and price slipping. This allows malevolent users with fast connections to jump ahead and make transactions before anybody else with the same intent.

Major technical problems

There are still some major technical problems that need solving before a move to complete decentralization can happen. It seems that a hybrid model could emerge. It would be with benefits from both – centralized (speed, liquidity, advanced tools) and decentralized (security, anonymity) features. Solutions like 0x protocol, Atomic swaps and Lightning could make the transition even smoother. The role of regulation is still unclear and perhaps governments will still collect KYC information, making true anonymity unreachable. The technologies being developed for DEXs will undoubtedly create a trend of innovations in the crypto world. It will help us to get closer to the dream of fast, anonymous, secure and cheap coin trading.

Source:

https://en.wikipedia.org/wiki/Decentralized_exchange

https://blockgeeks.com/guides/decentralized-exchanges/

https://medium.com/trivial-co/thoughts-on-decentralized-exchanges-and-real-world-usage-of-their-own-tokens-d0a6a16f5d3d

https://www.coindesk.com/why-a-decentralized-crypto-exchange-is-seeking-a-securities-license

https://blog.coinmarketcap.com/2018/09/06/decentralized-exchanges-101-all-you-need-to-know/

https://hackernoon.com/the-state-of-decentralized-exchanges-235064446ab0

https://blog.0xproject.com/a-beginners-guide-to-0x-81d30298a5e0

https://www.investopedia.com/terms/a/atomic-swaps.asp

https://www.investopedia.com/news/understanding-smart-contracts/

Photo by: pixabay.com