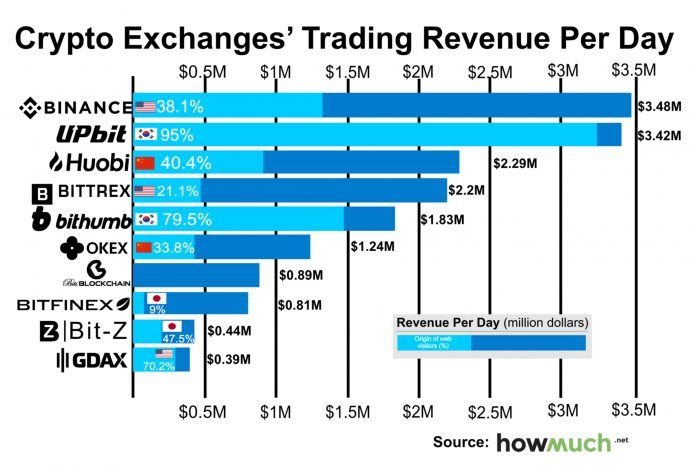

Even as the prices of cryptocurrencies continue to plunge, significantly affecting the overall trade volume of the cryptocurrency market, major cryptocurrency exchanges are still recording as much as $3 million per day in profit.

Listed below are the Top Five Cryptocurrency Exchanges by trade volume and their daily trade revenue;

Binance – The Tokyo-Based cryptocurrency exchange has dominated the market for a long time. Binance currently brings in as much as $3.48 million revenue per day. During the week the platform saw a list of new token listing including WePower (WPR), Qlink (QLC) and SysCoin (SYS). The platform recently launched the Qlink trade competiton in which 3,000,000 QLC would be distributed among winners. Binance currently has a 24-hour trade volume of approximately $1.3 billion.

Huobi – Making about $2.29 million revenue per day the Chinese brokers seek a move to the US following the clampdown of the Chinese government last year. Huobi currently has a 24-hour volume trade of approximately $1.1 billion according to coinmarketcap.

OKEx – This trading platform operated by Chinese cryptocurrency startup OKCoin has notably moved up the table in recent time. OkEx is said to bring in about $1.24 million as revenue per day. It capitalizes on the BTC/USDT trade which makes up about 34.51% of its total trade volume.

Bitfinex – The Hong-Kong based cryptocurrency exchange is one of the few trading platform which offers Fiat-to-Crypto exchanges. On Friday, Bitfinex announced the addition of new fiat pairs including the British pound (GBP) and the Japanese Yen (JPY). The platform currently brings in about $0.81 million as revenue per day.

Upbit – Being the largest crypto exchange in South Korea, Upbit is said to make revenue of about $3.42 million dollars per day, making it the most profitable exchange after Binance. Upbit offers a fiat-to-crypto exchange for its Korean users. Upbit currently has a 24-hour trade volume of approximately $420 million according to Coinmarketcap.

Asian-based cryptocurrency exchange platforms are dominating the global cryptocurrency trading industry. While Asian-based exchanges are estimated to process over 50% daily crypto trading, the recent crackdown on crypto brokers by regulators in the continent could signal the beginning of a shift away from Asia if investors and exchange operators become more wary of the viability of exchanges headquartered there.

This can already be seen in Japan and China, where increased scrutiny by regulators have forced many exchanges to shut down or relocate. Last Month, the Securities and Futures Commission in Hong Kong announced a major crackdown on cryptocurrencies.

Tags: #new #blockchain #crypto-new #trader #analysis #exchanges

Coins mentioned in post: