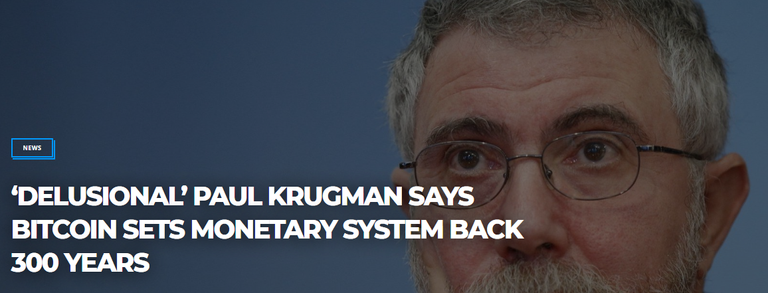

Cryptographic money industry figures are responding with despise after US financial expert Paul Krugman compared Bitcoin to "setting the fiscal framework back 300 years."

BITCOIN IS NO EVOLUTION, SUGGESTS KRUGMAN

In a sentiment piece for the New York Times July 31, Krugman focused on the surprising expense of Bitcoin mining and the "speculatory" idea of its clients, asserting it undermined soundness contrasted with fiat cash.

"… You should make certain that a Bitcoin is genuine without knowing who issued it, so you require what might as well be called gnawing a gold coin to make certain it's the genuine article, and the expenses of delivering something that fulfills that test must be sufficiently high to dishearten extortion," he contended.

At the end of the day, digital money aficionados are viably praising the utilization of bleeding edge innovation to set the financial framework back 300 years.

Krugman is the most recent surely understood financial analyst to approach cryptographic money with doubt, with others, for example, Robert Shiller making rehashed endeavors to dishonor Bitcoin specifically.

Most as of late, Shiller gauge that Bitcoin would last just a single hundred years because of the capacity to hard fork, its extremely presence will be a "matter of debate."

Conspicuous instructor Andreas Antonopoulos had beforehand tended to the hard fork hypothesis, saying any Bitcoin subsidiary would need to surmount scaling challenges, which Bitcoin is as of now doing keeping in mind the end goal to succeed.