Bitcoin broke out in our financial realm, setting the Internet steam with visions of increasing the existing world monetary system. However, by its nature as a cyber race, whose legitimacy exists only in ether, its credibility leaves much room for debate.

The current value of all BTCUSD commodities, with 2.29% in the world, is worth about $ 41 billion, according to the cost estimation site.

This is undoubtedly more money than most Americans will ever see in their lives. But when it comes to defeat, truth is the real bad relationship.

Also see: Bithoin adolescent millionaire can see the cryptocurrency cryptographic value of up to $ 1 million

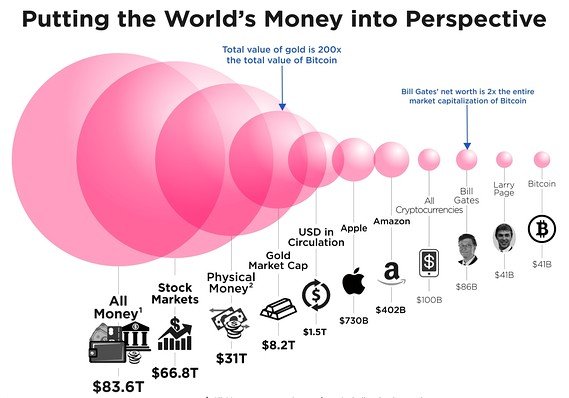

As the HowMuch chart shows, the thickest bubble is for all the money in the world - including bank deposits - amounting to 83.6 trillion dollars.

See the larger chart

The second largest is for all trading shares across the globe, totaling $ 66.8 trillion, and more than double all the physical money in the world.

"A run to or away from stocks would completely destabilize the global economy, and nothing more dramatic than a minus sign in front of that sum would lead to the collapse of global civilization," Raul Amoros told HowMuch.net.

For all its glamor, the total value of gold is the fourth, at only 8.2 trillion dollars, while the US dollar in circulation amounts to 1.5 trillion dollars.

The next bubble is for Apple Inc. LPAA, + 0.45%, estimated at about $ 730 billion, followed by Amazon.com Inc. AMZN, + 0.24% to $ 402 billion.

Meanwhile, the value of all existing cripto-liquidities, such as Litecoin and Monero, checks $ 100 billion, just before Bill Gates MSFT, + 1.35%, claiming a net worth of $ 86 billion Being the richest man in the world.

Larry Page, co-founder of Google GOOGL, + 0.97% and richest 12th on Forbes billionaire list, deserves to be booming in cyberspace with a net worth of $ 41 billion.

Money is tied to trust. Thus, the US dollar DXY, -0.24% as the monetary representation of the largest economy in the world, is also the reserve currency of choice for many foreign governments.

For the time being, bitcoin does not command this level of respect due to his recent wild blows. However, the emergence of cryptocracy itself suggests that people can slowly lose faith in money and other traditional measures of wealth,

This topic is of interest for me. I think it is very useful to present this information in a graph form. I am very visual, so I always look for visual representations of data. Seeing the distribution of the market and Bitcoin´s place in it the way you present it here helps to remind us how new this thing is and how small and pretty much unknown it remains.

I would like for you to site the source of your data points. That makes your writing more credible and gives me the opportunity to look further into it, if I feel like it.