Background

I am not a blockchain expert, crypto purist, or self-made millionaire, and this opinion piece is not financial advice. I have a vested interest in the success of NEX platform.

What is NEX

NEX is a platform for high performance decentralized exchange and payment. Per their official twitter account:

NEX’s mission is to empower more than one billion users to invest, trade and manage digital assets by 2030. We aim to be the premier platform for decentralized financial tools and services.NEX is a security token approved by the Financial Market Authority (FMA) of Liechtenstein. Per one of their co-founders, Ethan Fast:

The NEX security token allows us to deliver strong token economics for investors in our exchange. It also sets precedent for many other projects that are seeking to issue tokenized securities in the European markets, and lays the groundwork for our future plans to legally interact with governments and regulators

What is the value of 1 NEX token

As of this writing, the token is $1/token.

What is the speculative value of 1 NEX token

Before I present a speculative value I offer NEX’s description of their staking model:

Users can stake their NEX tokens in a smart contract that pays out a proportion of exchange and payment service fees. To stake their tokens, users send their NEX tokens to the smart contract via a staking method that records the starting block and the amount sent by the user. The user can then make periodic claims on the contract to retrieve their share of NEX profits since staking began. Users can commit to staking their tokens for longer periods of time to receive a larger proportion of fees. The base rate of fee share will be 25%, if the user stakes their NEX tokens for one month, increasing linearly up to 75% if a user is willing to stake for two years.

See claim example below.

A user owns 1,000 NEX, and NEX has generated fees in tokens equivalent to 100 million dollars at market value since they last made a claim. Assuming the user has staked NEX at the two-year staking rate of 75%, they would be eligible for a claim worth:

$100,000,000 ∗ 1,000 / 50,000,000 ∗ 0.75 = $1,500.

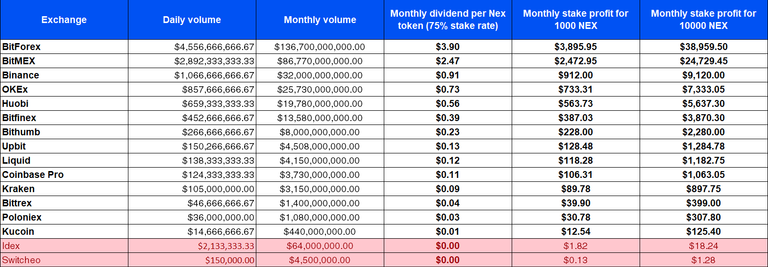

- Volume + utility will drive the base price. The chart below provides the estimated dividend you would receive for each NEX token if it’s volume matches any of the available trading platforms today.

Formula per NEX token (75% stake rate): (monthly volume0.00190.75)/(5*1⁰⁷)(NEX staked). Decentralized exchanges highlighted in red.

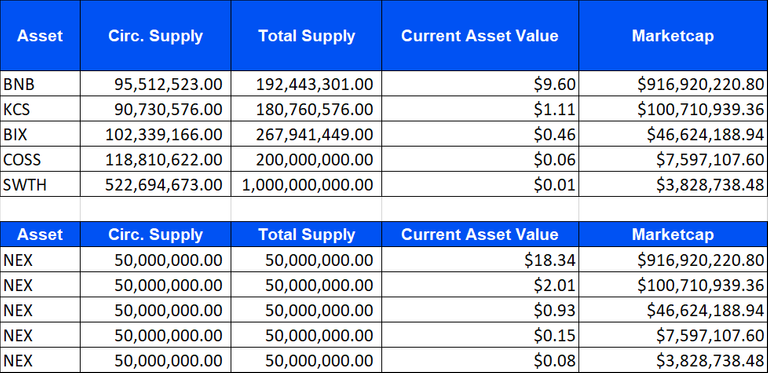

- Comparative values can provide a projection.

Below you’ll see comparable exchange assets with their market values. The second chart shows the price of one NEX token assuming marketcap is the same as its competitors.

Note: There is inflation with competitor tokens; none with NEX.

- NEX’s roadmap shows they really want “empower more than one billion users to invest, trade and manage digital assets by 2030.” The volume on this exchange has the potential to surpass the $4.5B daily volume of BitForex.

2018 Exchange launched with fiat integrators, cross-chain trading with support for NEO, ETH, NEP-5, and ERC20 tokens (BTC, LTC, and RPX trading to follow shortly)

2019 Crypto securities trading, institutional investment tools (OTC + block trading)

2020+ Inter-exchange with other platforms worldwide

- The biggest question everyone has for the team is how they intend to drive volume to the exchange. The team’s main two responses: best in-class UI and mutually beneficial partnerships with FIAT integrators, remittance groups, etc. In the next few weeks, a number of these partners will be revealed and that will provide new insight into the scale of this entire endeavor.

All things considered I see the following token prices for NEX as they launch and meet their goals:

Q4 2018 $4.50 > based on speculation and quick adoption

Q2 2019 $10.25 > The platform will be hitting volume equal to or greater than $105M/daily. Assuming the owner is staking the maximum allowed, the dividend payout is close to 10.8%

Q4 2019 $75 > The platform will be hitting volume equal to or greater than $1B/daily. Assuming the owner is staking the maximum allowed, the dividend payout is close to 14.6%

Q2 2020 $150 > The platform will be hitting volume equal to or greater than $2.8B/daily. Assuming the owner is staking the maximum allowed, the dividend payout is close to 19.8%

2023 $1,000 > In five years, blockchain platforms will be fully integrated into the real world. The volume will be at least $12.6B/daily (only 1/10 of NASDAQ’s daily vol. today). Assuming the owner is staking the maximum allowed, the dividend payout is close to 12.9%

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://blog.goodaudience.com/why-you-should-have-nex-in-your-portfolio-ea8f3b3c02be