The much hyped and extremely popular Initial Coin Offering (ICO) market is growing in billions. Hence, we are presenting you the review of one of the hottest ICOs: NEX ICO Review. With an innovative and exciting idea of a decentralized exchange, NEX promises smart contract based payment and funds management services. But is this idea worth investing? To make an informed investment decision, read on to our NEX ICO Review!

Important dates:

Lottery Registration open for token sale: March 12

Lottery Registration closes on: March 30

1st Round Lottery Winners announced: March 31

2nd Round Lottery Winners announced: April 8

NEX Token Sale Begins: April

ICO sale amount: 25 million

Max supply: 50 million

Price for both rounds: 1 Nex = $1.00 USD

Sold on presale: No Presale

Accepts: NEO, GAS

NEX: A hybrid cryptocurrency exchange

A decentralized exchange on NEO platform, it boasts of being “a platform for complex decentralized cryptographic trade and payment service creation.”

In the growing and ever-evolving cryptocurrency world, there are numerous decentralized exchanges but NEX sets itself apart by introducing an off-chain matching and trusted engine based platform. Like off-chain relay exchanges, NEX’s “orders are matched off-chain and fulfilled on-chain”, however, its automatic matching engine allows more complex orders while reducing the chances of arbitrage.

A decentralized exchange that provides a centralized exchange comparable performance.

The evaluation time!!

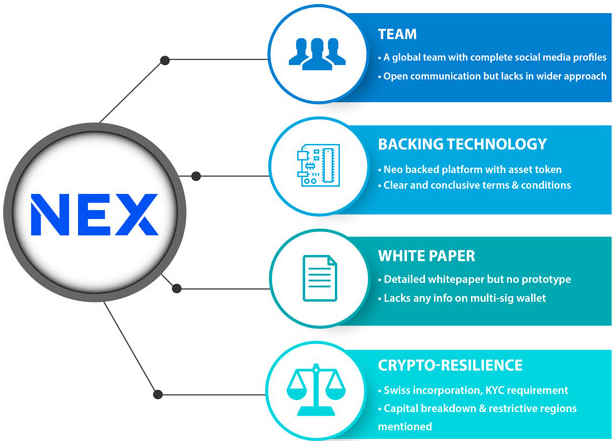

A detailed whitepaper

NEX provides a detailed and clear information through its explanatory whitepaper. With a professional and technical feel to this document, it’s easy to capture the dynamics and facets, the company is trying to convey.

The company has no prototype of its product for its investors to look at and understand the projects’ feasibility and viability, which certainly doesn’t work in the project’s favor. Additionally, the whitepaper doesn’t mention anything pertaining to where exactly the crowdsale funds will go.

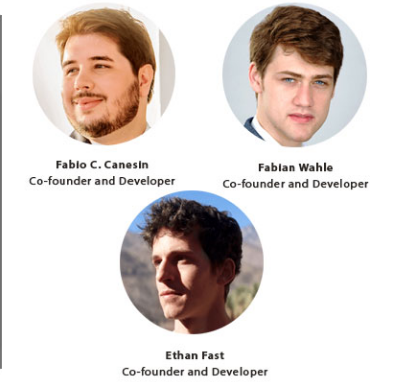

Global team profile

The NEX’s team of 14 members is a collaboration from all over the globe with 5 of its members being the co-founder and developer of the project.

Fabio C. Canesin- Co-founder and Developer: The co-founder of CoZ, he is an MSc from Universidade Federal do Rio de Janeiro and a Research Engineer at Schlumberger-Doll who has the expertise in numerical methods applications in geomechanics, petrophysics, inversion and optimization techniques.

Fabian Wahle- Co-founder and Developer: The co-founder of CoZ, Fabian, has done his Ph.D., from ETH Zurich and worked as a CTO at Altoida.

Ethan Fast- Co-founder and Developer: The co-founder of CoZ, he is the creator of NEON Wallet who received his Ph.D. degree from the Stanford University.

Luciano Engel and Thomas Saunders are also the co-founders and developers of this project that have created NEOScan and Neo-python respectively. The remaining nine members comprise of the designer, developers, marketing and communications, public relations, and advisors.

The team members of this project have their LinkedIn profiles attached that provides all the information from their educational background to the professional experience.

The founders of NEX are active participants in the social community via numerous channels like Quora, Twitter, and Medium among others.

Business model: An asset token

The NEX token of the project provides a straightforward vision of a decentralized exchange with a smart contract based management service. The platform allows users to buy assets from traditional channels and interact with those assets on the NEO blockchain via NEX Smart Contract. Its business model also enables cross-chain exchange by allowing the trading of assets on NEX.

According to the FINMA guidelines, NEX is an asset token that allows its holders get a particular percentage of fees that are generated by the exchange and the payment service. These fees entitled 50 million tokens to get to claim their profits through a staking process. This process is similar to the NEO network’s GAS claim calculations.

The more the exchange is used, the more fees are generated and the more rewards a NEX holder gets.

Backing technology: NEO-based blockchain

The company has about 3 advisors viz. Muzzammil Zaveri, who is a Y Combinator alum, Da Hongfei, Onchain CEO and NEO Council member and Erik Zhang, Onchain CTO and also a NEO Council member.

Based on the 2015 launched Chinese NEO blockchain, the Project provides a clear number specification for a potential investor to dive in. With $1,000 as the maximum contribution in the first round and $9,000 in the second round, it also intimates the minimum contribution of 1 NEO per person.

Crypto-sale resiliency

The project will be incorporated in Zug, Switzerland where it is working closely with the authorities to ensure compliance, for investor protection. The company has no legal advisors listed per se but provides the investors with the maximum limit for the 2 round ICO sale. Moreover, participants need to submit their KYC documents to fulfill its legality measures.

Token distribution

The website of the company provides a clear picture of the distribution of tokens as out of the total 50 million NEX tokens, 1% will go to E.S.O.P, 4% to company fund, 10% to partnership, 15% to NEO council, 20% to founders and the remaining 50% would go to public ICO.

A number of countries are excluded from entering the lottery viz: Algeria, Bolivia, Vietnam, Indonesia, Kyrgyzstan, Lebanon, Morocco, Namibia, Nepal, Pakistan, Ecuador, Myanmar, Ivory Coast, Cuba, Iran, North Korea and Syria.

With the aim to resolve the security problem of the centralized exchanges while maintaining its speed feature, NEX provides a hybrid system that combines both with a fully off-chain matching engine. Furthermore, users’ security is achieved through smart contract based trade method.

Community acceptance

The project team is quite active and enthusiastic about their project as it provides constant development information to its investors.Though the company is not on the telegram, slack and mailing list, citing scam vulnerability and development focus the reasons, it offers a good reach to its potential investors via LinkedIn, Twitter, Medium and Youtube.

Roadmap

Stage of project

The project presents a working and feasible roadmap with constant development additions to the platform in every quarter. Right now the project is planning to make its token sale live that the project will be able to achieve in the starting of quarter 2 of 2018 in comparison to its scheduled first quarter.

Red flags:

As NEO has yet to reach mass adoption within the market, there is a risk that it could be replaced or made redundant by the Chinese government’s regulations around cryptocurrency, removing the need for NEX in the first place.

Major hurdles:

Due to the token being NEP-5 (NEO blockchain), the token may not be immediately available to trade. A similar instance is of Red Pulse, the first NEO blockchain based ICO token that has yet to be listed on a tier one exchange. This can certainly put off the very short-term investors.

For the project to be successful, there needs to be a substantial amount of NEP-5 tokens available on the market to exchange. Although cross-chain support is being developed, first off it won’t be an easy feat and secondly, it will be significantly behind other Ethereum DEXs (Decentralized Exchanges) once launched.

A note to investors

The idea of a hybrid decentralized exchange infused with security, speed and trust features is credible. With a good global team and an asset NEX token certainly demands attention. However, the absence of a prototype, crowdsale fund location and legal advisors dials down the value of a well-thought-out project. Furthermore, the company has no user base and lacks a wider social interaction. Having said that, the KYC procedure, min-max limit and compliance with Swiss authorities make it a valid project that given the appropriate time, resources and tact can turn out really profitable.

Are we investing?

Yes, we are investing in this project. The idea of a hybrid exchange is a new and daring concept that can help in transforming the world of cryptocurrency exchange notwithstanding a few glitches the project is having.

Our ICO review methodology

To rate an ICO, we follow a list of KPIs (Key Performance Indicators) of a project viz:

Whitepaper – Availability of code or prototype, the breakdown of funds, wallet for crowd sale.

Team profile – Team’s strength and reputation.

Business model – Problem solved, purpose & utility of the token and the economic model.

Backing technology – Blockchain infrastructure, clarity of terms & conditions and token software.

Crypto-sale resilience – Incorporation, token distribution, legal risks and security aspect.

Community acceptance – Clarity & frequency of communication and social media presence.

By asking the right questions, we maintain the integrity and viability of our ICO review while following a rating method that is based on the criticality of a particular factor. For instance, elements like token utility and funds breakdown have been given the highest importance while the team members’ reputation and plan to attract a user base are of medium criticality.

We have a team of robust professionals who rate the ICO projects in completely unbiased manner.

Caution: Coingape publishes the ICO project reviews only for the information purpose. It is not an invitation for investment. When making investment decisions, conduct your individual assessment and consult with an advisor.