Image Source:

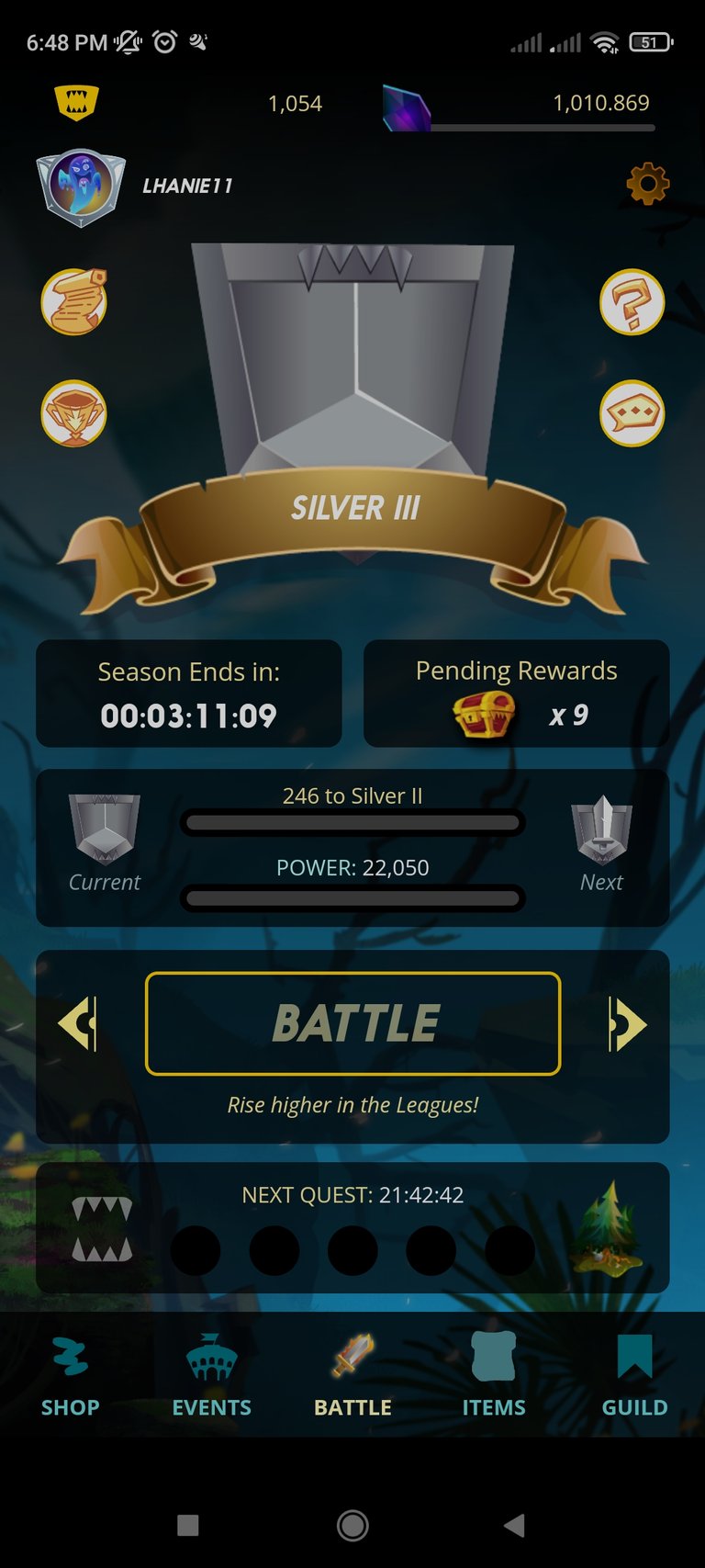

Hello hive users. Hi fellow splinters! I started my day to do a vocal warm-up. Preparing for my vocal lessons. How are you doing today? Just wanna share also to you guys I reached Silver III in splinderlands just on time before the season ends. Temporarily, the struggles are over. I hope the next season I will try to reach higher rating.

Every person does struggle to be a financially stable. The solution is to take loans for housing, business, emergency, shopping and investments. The household income is less than the liabilities. Some got forced to borrow because of the situations they are currently in the family is sick, hospitalized and funeral services. Some individual is business minded. Traders are risk takers they took loans to buy stock markets and cryptocurrency. Everyone dreams to own a house for family or personal. Most of people do loan to buy unnecessary things.

People loan in short terms and long terms. The longest loan is the higher interest rate will be added to it. People are sacrificing their future to pay the outstanding loans, months or years. If you could only save money and planned it before before making decision taking loans. Once you took the loan, you will never get it back and return without interest. Owning a house is not easy you need to pay it for 30 years or 50 years. If you missed the due date more penalties added to it. Possible to lose your house or cars you invested many years because you can't predict what is going to happen in the future. You can also ask your relatives and friends are well off to lend you instead taking it from banks, p2p and credit creditors.

There is a good loan for investment such as real estate, business and trading buy and sell stock and crypto. But, be watchful and manage risk not all of this mode of investments will make you successful. Don't take the loan is not visible for future returns. Your debt will haunt you down until you die. Your family will suffer by paying off their ass on your debt.

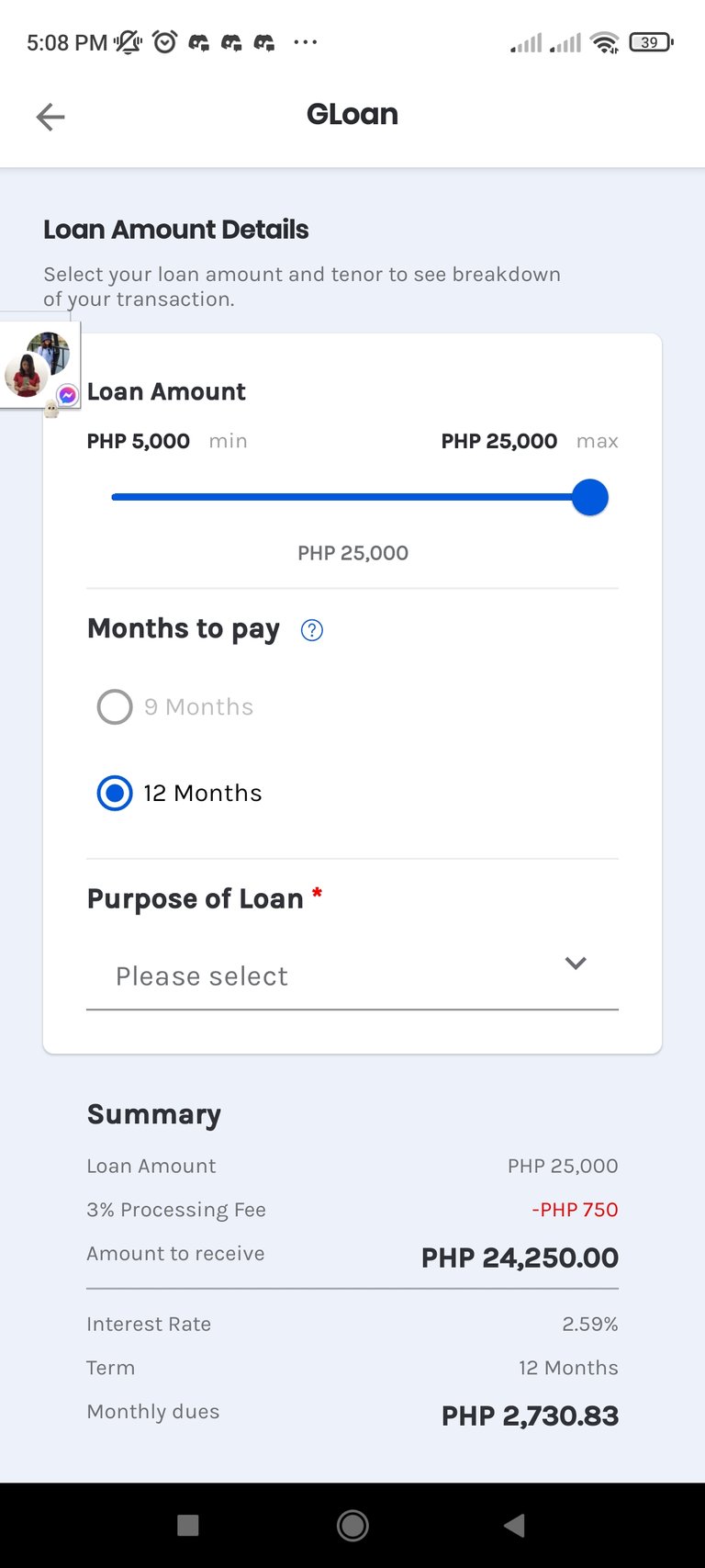

Always compute the interest rate before you take loans. I always got notified with my cash wallet. You can take loan for low interest. When I checked on it. I am paying more interest than on the actual money I loan with. It is a killer we should always avoid taking loans. Making one mistake loan it can turn your life around in hell. I will share a photo as example of loan you will never wish to have. HAHAHHA!

Loan amount is Php25, 000-750. 00 processing fee total you will get is Php24, 250.00 payable for 12 months. Monthly due is PHP 2,730. 83*12= Php32, 770.32, Interest Php8, 520.32. Where's justice here? That's why borrowers are drowning for help.

I remembered some friends message me to lend them money because of installment motorbike. They are crying thinking the years of paying their motorbikes will go to waste because dealers can take it anytime, no mercy if they didn't pay on time.

We can avoid taking loan if we are responsible for our finances. Don't spend the money we don't have. Don't take loan higher than your salary range. At the moment we received our income learn to budget by paying all your household expenses the money left you should put on investment, rain or shine savings, housing, travel, etc.,

Taking a loan is a choice. Don't take a loan you might regret forever. Planning is a good way to avoid this chaos. Contentment is a key to real happiness.

PS: Spread Love & Positivity

Love you all :)

yes taking a loan is really not a good idea indeed. but the loan is for the middle class and lower-middle-class people and we all do have to suffer a lot cause the salary is not enough for us. so taking a loan or an EMI is really helpful sometimes and if the bank or any app gives you a loan then they will surely be going to charge you for that. nothing is free in the world.

thanks for sharing your views.

!giphy great

!PIZZA

Via Tenor

Thanks for you outstanding remarks. Haha. Nothing is free in this world but we can avoid more charges like Indian tax.😂

Discord Server.This post has been manually curated by @bhattg from Indiaunited community. Join us on our

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

PIZZA Holders sent $PIZZA tips in this post's comments:

(2/5) @bhattg tipped @lhanie11 (x1)

Learn more at https://hive.pizza.

A good rule is in regard to what the asset (what was bought with the money) will be worth in the future. For example, a house appreciates or increases in value each year. That means that if you borrow money, the house may be worth more than the purchase price and the interest paid when you go to sell the house. The rule is Only Borrow Money On Appreciable Assets. It's okay to borrow on something that will be worth more in the future. And the opposite is also correct, never borrow if the item that is being purchased will be worth less in the future. Only pay cash for those items.

@hive-140905 thanks for adding more things to what I have said. You insights are highly appreciated. Hehe. Cheers!