Back in December 2023, six weeks after the "relaunch" in October, I managed to organize a second event under the banner of our budding "OffChain Luxembourg" organization. All we had back then, @wgomes26 and myself, were a brand ("OffChain Global / Luxembourg chapter") and the remote support of Jonathan and the OffChain Global, Guangzhou-based team who helped us create the event announcement.

However at about the same time I had started posting my Master's Thesis on MiCA in installments and this work absorbed me till April 2024 - the December 2023 OffChain event had been forgotten.

However, the content I presented then is as relevant as it ever was, so I decided to not let it "gather dust" on my hard drive, but rather to publish it here for discussion.

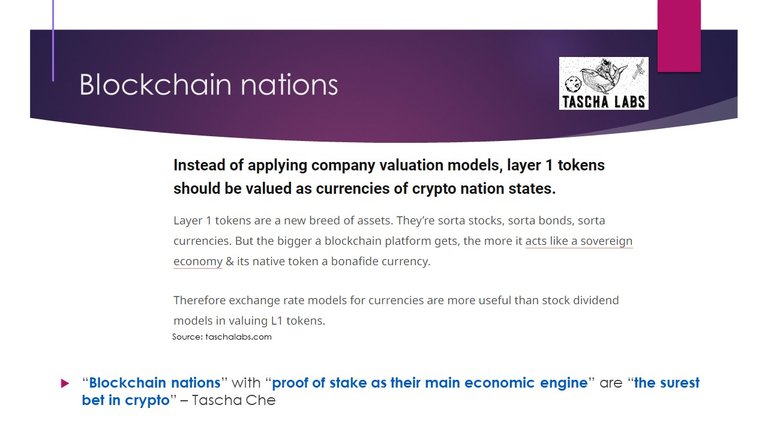

I presented a thesis that is close to my heart: layer 1 blockchains are best seen as "central bank systems" for their communities, that can in turn acquire the characteristics of "virtual countries". I have argued in favor of this thesis six years ago in the context of steem, when I was talking about "Steemland". Later, I revisited the concept regularly, talking about "Hiveland" in 2021 and later.

To avoid a purely theoretical presentation that might have been boring for a crypto audience, I have taken the angle of "crypto-asset valuation".

The first thing when tackling "crypto valuation" is of course to distinguish between "price" and "value".

The second thing is to distinguish between "investing", "speculating", and "gambling". I brought up here the very important concept of "risk adjusted return on capital" (RAROC).

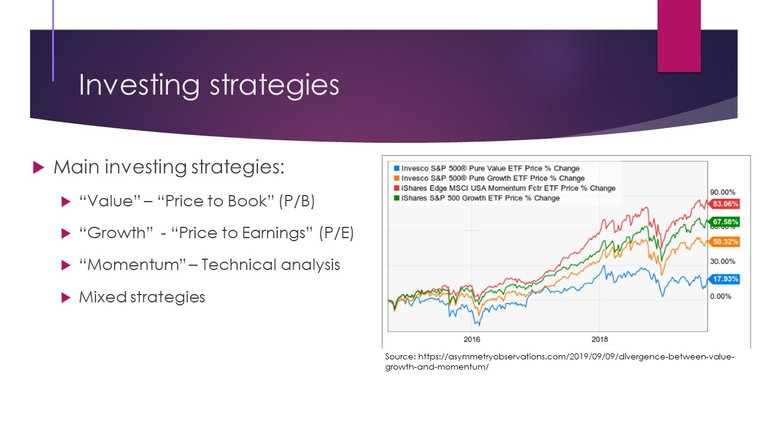

Focusing on investing, I have then introduced the various investment strategies from the world of traditional finance:

- value,

- growth,

- momentum,

- mixed.

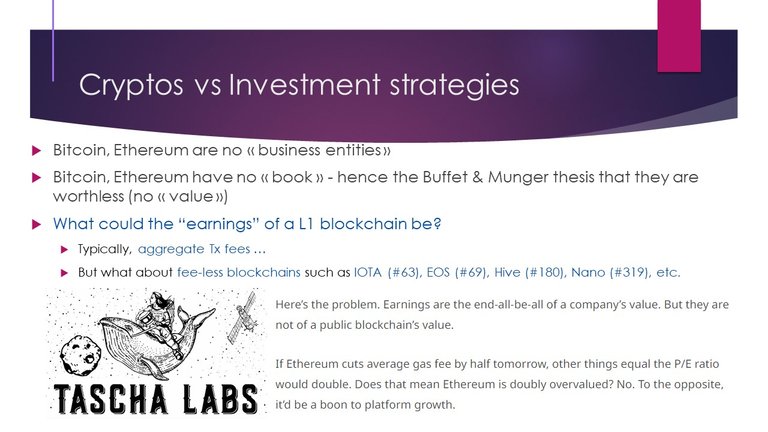

Crypto-asset investing is seldom based on fundamental value because there is very rarely an underlying economic activity. "Value investing" can barely apply since its main indicator is the "book value", which is either zero or nearly impossible to assess in crypto. "Growth investing" principles are sometimes applicable. But most of the time, and this is even more true in the latests cycle and concerns especially the "memecoins", we are seeing "momentum investing".

source

source

The "growth" approach typically looks at "transaction fees" levied by the blockchain networks. But these are a treacherous indicator and the analysis chokes on feeless blockchains such as IOTA, EOS, Hive, Nano.

I felt vindicated that my analysis was echoed by Natascha Che ("Tascha Labs"), a pretty well-known crypto influencer.

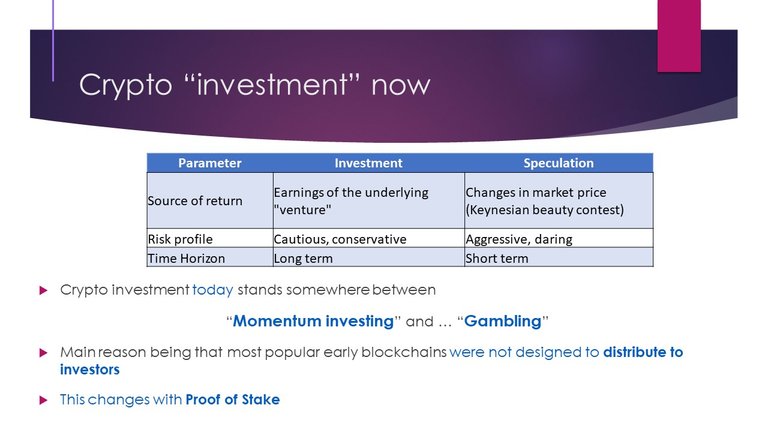

In the slide above, I underlined the difference between "investment" and "speculation"... and then I proceeded to point out that with Proof of Stake blockchains, especially with DPoS ones tobe more precise, we should actually step back from the investment rationales of the traditional finance.

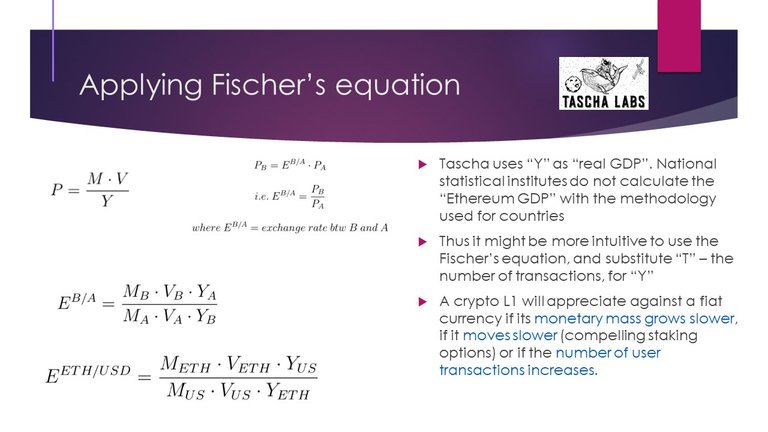

As Tascha says, blockchain platforms such as Hive act like sovereign economies, their native tokens like bona fide currencies. Therefore, exchange rate models for currencies are more useful than stock dividend models in valuing such tokens.

One year later, I want to point out that this is the economic reasoning that underpins the OffChain Luxembourg Token: the aim is to create a "sovereign" economy with OCLT as its currency.

In order to value such "economic platform tokens", the most elegant framework is the "quantitative theory of money", originally formulated by Copernicus in 1517 and dubbed "the oldest surviving theory in economics":

M * V = P * T

Tascha uses a slightly different variant, substituting "Y" - the GDP of the economic zone instead of the "P * T" product on the right side of the equation. This make her calculations a bit hard to follow as the "P" symbol here is overloaded. However, the main message is that the change in the dollar-price of a crypto asset will be impacted by the change in the ratio between (M * V / Y)token - for that blockchain economic area and the (M * V / Y)USD

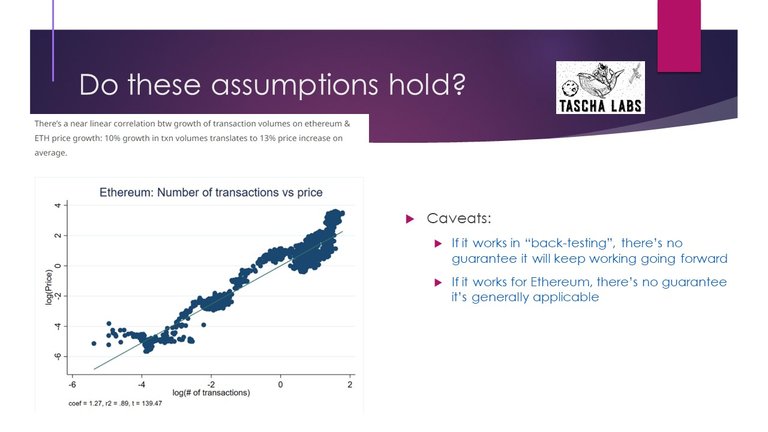

She back-tests her theory against Ethereum, by plotting the log(price ETH/USD) against the log(nb of Ethereum transactions) - the regression is remarkably good.

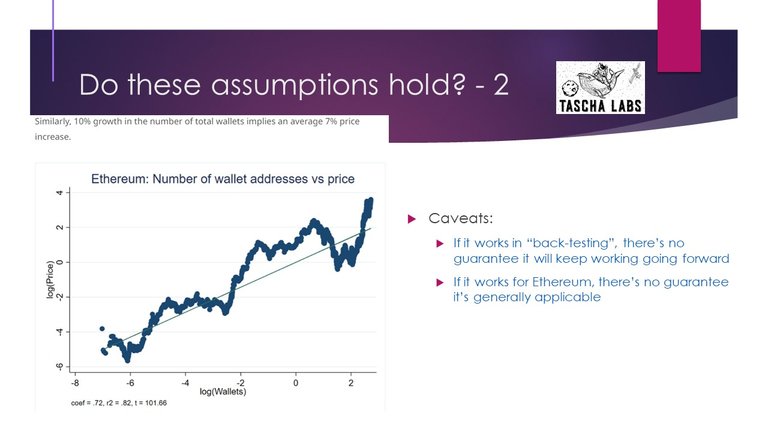

She also back-tests agains the number of wallet addresses and her assumptions hold well too.

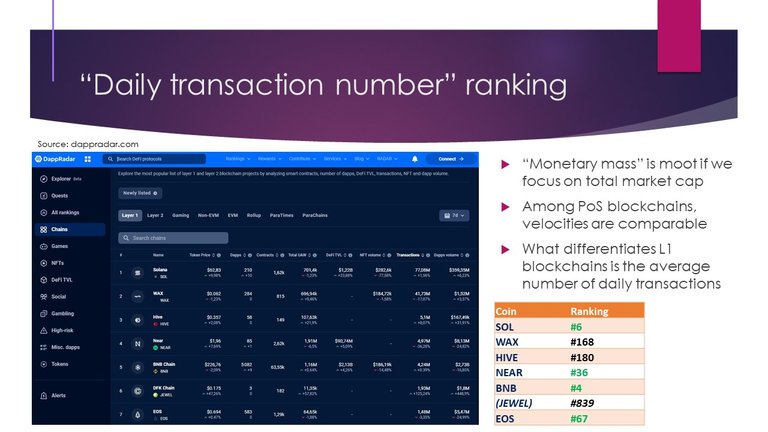

I tried to tentatively extend that type of analysis to a ranking of different blockchains by number of transactions. "Jewel" was an obvious outlier that has to be eliminated. With the exception of WAX and HIVE, which seem undervalued compared to the number of transaction they sustain, the correlation was not too bad.

The main conclusions of my presentation were:

- When looking at a blockchain or crypto project, it's appropriate to imagine a "blockchain nation" with the token as its currency and with a "GDP"

- What matters most for the token price in another currency (fiat or otherwise) is the GDP growth of the "crypto nation" it powers.

"GDP of the crypto nation" - fully agree! This is a more correct view, and not the one analyzing chains by market cap.

Thanks for the insights