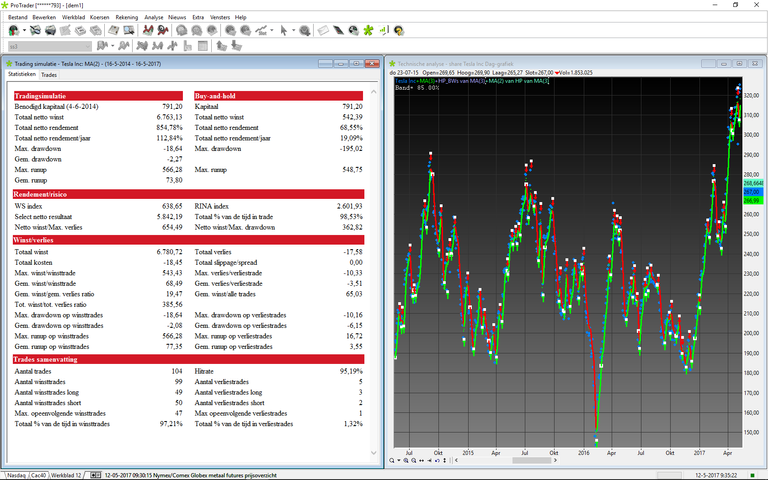

First indicator is a 3 day moving average on the opening price of Tesla.

attached to that is the Hodrick Prescott indicator with a lamba of 1

attached to that is a 2 day moving average to do the backtesting with:)

Starting amount in example = 1000 dollar

End result = 6500 dollar

Impressive and thanks for sharing. How are the results with companies that have completely different profiles? For example - oil companies between 2013 - 2017 would have seen some interesting swings. Banks as well.

Ty:)

Ok,

Give me the company names you want to see results from, and i will post them in a blog:)

Thanks, looking forward to it. How about Exxon 2013 - 2017, Seadrill 2013 - 2017, Citi 2006 - 2010, GE 2006 - 2010? I think they would show the boom and the bust and how well the indicators perform :)

It's ready, enjoy:)

Thanks for the good article

Ty:)