With the rise of cross-border e-commerce, online payment methods have become more advanced. A convenient and easy-to-use payment gateway is like a hand that helps you collect money and is closely related to the income of merchants. The following will help you easily choose the most suitable gateway for your current mainstream three gateways: Epay, PayPal, and Stripe through horizontal evaluation based on different dimensions.

Today, we are going to review 3 mainstream payment gateways, which are Epay, Paypal and Stripe, to help you easily choose the most suitable gateway for your website.

PayPal:

Rate ⭐⭐⭐

PayPal has 3 rates: 1. Gateway collection rate → 2. Currency exchange fee → 3. Currency withdrawal fee

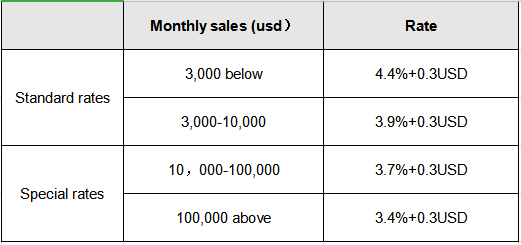

1)In terms of gateway collection fees, PayPal uses charging based on the merchant’s monthly sales volume

2)Currency exchange fees. PayPal China supports withdraw the US dollar and Hong Kong dollar, and you will be charged the currency exchange fee if you need to withdraw other currencies PayPal’s currency exchange fee is based on PayPal’s wholesale exchange rate price plus 2.5%.

3)Withdraw fee

Receiving methods¤cy support:⭐⭐⭐⭐⭐

1)Bank account:Accept payments from more than 200 countries or regions in 25 currencies

2)Credit cards: Supports almost all major credit cards

Pros and Cons: ⭐⭐⭐

Pros:

- Flat, predictable rates

- Set up your account easily

- Easy to use

- Customers are familiar with and trust PayPal

- Funds are instantly available in your PayPal account

- Non-profit discount

- No contract needed

- Refundable flat fee

- Multiple support options (help center, phone, live chat and email)

- Compliant with PCI standards

- Available in more than 200 countries

- Free online invoice

Cons:

- Unable to move all your customer data to another payment processor

- No double billing

- Redirect customers to your website during checkout

- Higher refund fee ($ 25)

- Inconsistent support quality

Epay:

Rate: ⭐⭐⭐⭐⭐

Merchant withdrawal fee 1%

Payment methods & supported currencies: ⭐⭐⭐

1)Local bank transfer: support bank account transfer in 15 currencies in 60 countries and regions around the world

2)E-curremcy:Support Perfect Money,Fasapay,Payeer,Advcash. No Epay account is required.

3)Cryptocurrency: USDT, PAX and EUSD.

Pros and Cons: ⭐⭐⭐

Pros:

- Transparent, ultra-low rates, multi-currency support for merchant settlement

- Easy to use for customers

- Customized interface solutions such as buttons, typography, etc.

- Customers never leave your website during the purchase process

- No contract needed

- No worry about the malicious refund

- 7 * 24 customer service

- Compliant with PCI standards

- Supports cryptocurrency, and E-currency and bank transfer.

Cons:

Credit card payments are not supported

Stripe:

Cost: ⭐⭐⭐

In terms of fees, Stripe charges 2.9% of merchants transaction + 0.3 USD per transaction

Payment methods & supported currencies: ⭐⭐⭐⭐

1) Payment method: Stripe accepts more payment methods. They accept all major debit and credit cards as well as the following wallets: Alipay, American Express Checkout, Apple Pay, Google Pay, Microsoft Pay, MasterCard Masterpass, Visa Checkout, and WeChat.

2) Support currency: Stripe supports different currencies in 26 countries.

Pros and Cons: ⭐⭐⭐

Pros:

Flat, predictable rates

- Non-profit discount

- No contract needed

- Lower refund costs ($ 15)

- 24/7 support

- Multiple support options (help center, phone, live chat, and email)

- Compliant with PCI standards

Cons:

1.Setup is not user-friendly

- Not as well known as PayPal

- It takes longer to get funding (2 days on average)

- No fees will be returned for refunds

- Available in fewer countries than PayPal

- Online invoices are only free until sales reach $ 1 million