An investment of only $10000 returned $243'526 USD in the last 10 years!

With the rise of the tech, NASDAQ has become one of the most popular index in the recent times. In the last 10 years, it has given a staggering 512.75%. That’s 17.75% CAGR… If you would have invested $10000 in the whole index in 2010 you would have gained $51'275 so far.

What drove NASDAQ?

As we are aware of the current rise of the tech giants, Stocks like Apple, Amazon, Google, Microsoft and Tesla have played the major role in the rise of NASDAQ Composite.

But are you aware that you could have made more returns than NASDAQ if you had simply invested in the top 11 stocks in NASDAQ!

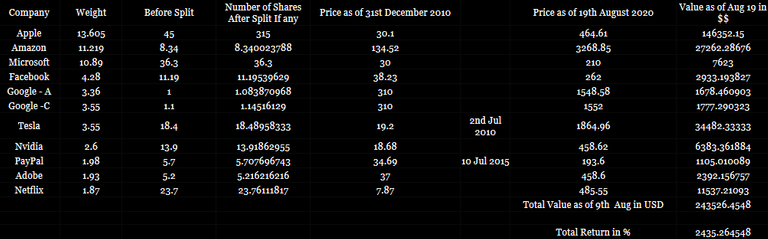

NASDAQ has had to re-balance the weight-age over the years. But we’ll consider that you held the top 10 shares in NASDAQ today since 2010.

So let’s do some Math to determine how much would we make if we held the top 10 NASDAQ stocks today.

For reference, we will consider that we have $10000 as of 2010.

As you can see, an investment of only $10000 would have returned $243'526 USD in the last 10 years (Double that of entire NASDAQ 100 gains). That’s staggering 2435.26% returns which is about 37.61% CAGR thanks to the Apple’s 7:1 Split in 2014.

- On the 31st of August, Apple will split for 4:1. The record date is 21st August.

- Tesla will split 5:1 on the 31st of August. Record date is 21st August.

No Dividends Included in the returns.

Why is there so much of a difference?

As you are aware, there are 103 stocks in N100. And not all of them have an impact on the Index. That is why there is a weight-age given to each stock in the index. No index will ever give equi-weight to the shares.

The reason NASDAQ reached it’s all-time high is due to those selected 10 to 15 shares in the index. Example, Apple, Amazon and Microsoft. The weight given to the share is 13.6%, 11.219% and 10.89%. These 3 shares itself take over 35% of the Index value. If apple crashes, the entire index can crash and vice-versa.

These 15 stocks again benefit from the ETF, Mutual fund etc buying in order to maintain the percentage of the weight given to the shares. (If the ETF is tracking NASDAQ 100, it needs to allocate it’s AUM in proportion to the weightage given to the shares in the index)

What Should You Do?

If you are in your 20s, you should give a thought on how you want to grow your wealth over time. By understanding that the index runs on the top 10 to 15 shares, we should generally consider re-balancing our investments. If we want to beat the market and even the gurus of the market over time, considering the top 10 to 15 stocks will be the way.

If you do consider to buy the top 10 Index shares, be very watchful in the way index is changing. Many time the index weightage will change and hence we also need to make sure we make the same changes to our portfolio. If one of the stock is out of the top 10 or 15 in the index, consider selling it and buying the one which made a fresh entry in the top.

Like how Yahoo was kicked out of the index. Tesla was added and so on…..

I would recommend (Please do your research) a systematic investment in the top 10 to 15 index shares. You can do so with the help of M1Finance and other such brokers.

This will grow your wealth faster than the ETFs or other index funds.

Thank you for Reading. Leave a comment if you have any recommendation or feedback.

The same has been published on Medium, Blogger

The same shall be shared on Steemit.