Hi Guys,

I already discussed my dividend analysis for the Property and Telco Sectors during the past weeks:

(For more details you may check out my previous posts by clicking on the links below)

Battle of the TELCOS: https://steemit.com/ulog/@willinvestph/philippine-stock-market-series-may-23-2018-dividend-analysis-battle-of-the-telco-s

Property Sector Dividend Stocks: https://steemit.com/philippines/@willinvestph/philippine-stock-market-series-property-stocks-dividend-analysis

Now i'll gonna be discussing my analysis for my two stock picks in the financials industry

Now to tell you the truth i was confused at first whether i will categorize them together with banks.

But after so much thinking i decide to create a separate thread for them since although in the PSE they are classified under Financials category their primary line of business is insurance, which is unlike banks offer a different array of products with insurance being only on the side (e.g. BDO has BDOLife, BPI has BPI-Philam etc)

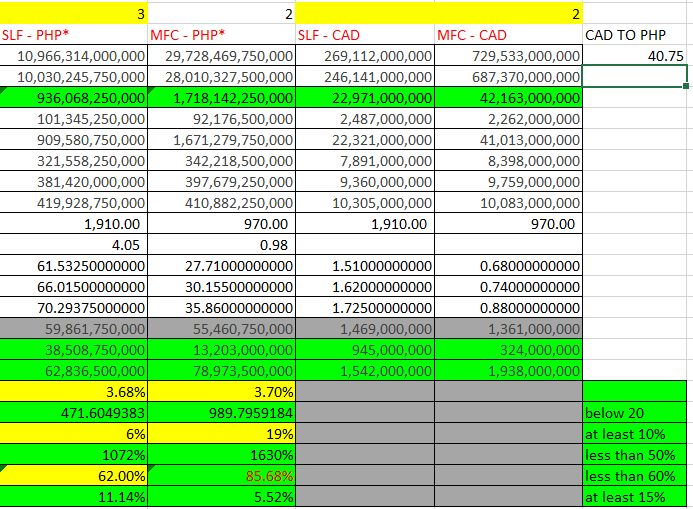

And secondly these are the only to life insurance companies that i saw listed in our very own Philippine Stock Exchange. What's so special from them as well is that the fact they give they give dividends in Canadian Dollars and on a Quarterly Basis! (NOTE: Since they are both in Canadian dollars i converted all of their financial numbers in PHP @ 1CAD = 40.75PHP exchange rate)

But before we start let's take note of my criteria below:

- Dividend Yield is at least 2.5%

- P/E Ratio is not over 20

- Dividend Growth is at least 10% from last year

- Consistently gives dividends for the past 5 years

- Dividend Payout is not over 60%

- Return of Equity at least 15%

So without further ado, here's my analysis for MLF and SLF

Personal Thoughts:

As you can see both companies performed well in terms of net income and dividend yield (3.68% and 3.70% respectively). Another thing to note is the dividend growth of 6% for SLF and 19% for MFC.

AS for the things to watch out for is the beyond than 60% dividend payout of MFC, i think the reason for this one is the lower than expected increase in retained earnings. But we will see next year on how it will perform. Since from my perspective this is only an isolated case.

Sources:

http://logo-logos.com/manulife-logo-914.html

http://www.680news.com/2018/01/12/sun-life-expects-200m-one-time-charge-in-q4-due-to-u-s-tax-changes/

Tags:

#Philippines

#SteemPH

#StockMarket

#Ulog

FULL DISCLOSURE:

CPG,FGEN,FLI,GLO,GMA7,MER,MFC,SLF,TEL,VLL

DISCLAIMER: These articles are for educational and informational purposes only and do not constitute to any advice to buy or sell investments. To each is his/her own decision if they will do the recommendations stated here

This is great! thanks for the info :)