Image Source

When considering retirement, often times the popularized financial plannings strategy is to save as much as possible for as long as possible. There is certainly merit to this approach. It mitigates fear of running out of funds in elder years and provides a cushion for health problems that may arise. It assures financial independence late into life as long as a moderate income is achieved throughout the lifetime of an individual.

This is the approach endorsed in The Millionaire Next Door, a informational book written by Dr. Thomas J. Stanley after a nationwide search and analysis of the spending and saving patterns of everyday millionaires in the U.S. What was found was that most millionaires do not earn an enormous yearly salary, rather they put significant effort into their saving and investing habits while not prioritizing material goods. The book stepped through the spending patterns of these savers, as well as their approaches for those to adopt that will give them the best shot at amounting $1,000,000 by the age of retirement, securing financial independence. Most suggestions involved denouncing materialism. No need for the shiniest, newest model car. Or the solid gold watch. Or the most expensive shoes. Or the most prestigious schools. Or the finest dining. Maybe it was my upbringing, or just my approach to life, but I didn't find these points all that insightful, other than that most millionaires are doing these things. Seems somewhat intuitive that if you want to amass a large sum of savings that you wouldn't spend at every chance that you get. Nonetheless, The Millionaire Next Door is full of financial wisdom and provides some outlook on the possibility of achieving a net worth of a million dollars -- a goal that some may think sounds impossible... a goal that others stive towards, maintaining frugal spending habits, diligent in investing along the way.

A newer book, Die With Zero, published in 2020 by Bill Perkins takes a radically different view on saving across the lifespan than The Millionaire Next Door philosophy. Perkins's message is that one should not deprive themselves of experiences in the present to delay gratification all the way until retirement age. Central arguments of the book boil down to:

- Experiences are important to invest in, as they make a person whole... they help us live life to the fullest.

- Earning is not static throughout life, but that doesn't mean spending can't be. Rather than saving income when working an hourly entry level job, one should expect their wages to increase in years to come, thus they should not deprive themselves of needs, and experiences in order to save for the future in which they will have more money.

- Old age will limit what will be able to be done with your money, so experiences requiring physical health and activity should certainly not be pushed too far into the future.

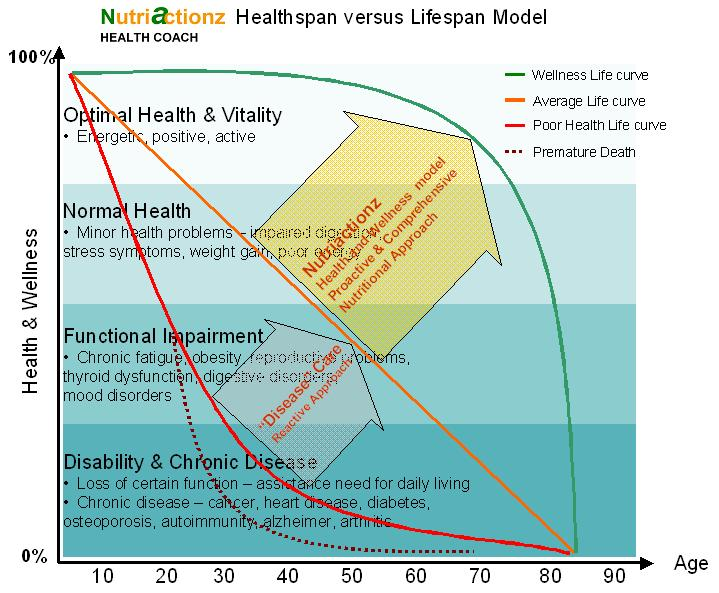

Perhaps the most valuable piece of knowledge from this book was the idea of a trinity of requirements for one to have experiences. One must have physical health, financial means, and free time. None of these attributes are constant throughout the lifetime of an individual, thus we should take this into account when planning our life course, things we wish to achieve, as well as our spending habits.

Image Source

Image Source

Image Source

Image Source

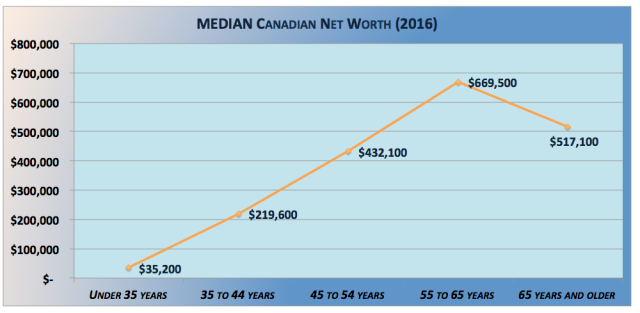

The two graphs pictured above illustrate how net worth and health vary with age. The dominant trend is that net worth tends to increase while vitality tends to decrease linearly. Factoring in free time -- most individuals have the most free time after retirement age and before entering the workforce. These three trends should be factored into our outlook on life... giving us more perspective and more structure to how to live the most optimally, not missing out on doing things that we wish we could have done if we just had greater health, more money, or more time.

While on the surface, these two books may seem like they are juxtaposed, there are a few parallels between them that can be drawn out.

- Investments in experiences are more valuable than investments in material items.

- Living optimally from a financial perspective requires looking far into the future and considering all possible outcomes.

Most differences in the two works can be attributed to differing philosophies and outlooks. While The Millionaire Next Door closely tracks the values of millionaires in America, Die With Zero is most concerned with living an efficient life, prioritizing experiences, and planning out the life course around the pillars of stages of life and finances.

I personally enjoyed each of these books and found something of value within both. I thought Bill Perkins's book was a little bit more entertaining read and introduced me to some new concepts I had not really given much consideration prior to reading. The Millionaire Next Door really just reinforced some presuppositions about my thoughts on how to save money, things to value, etc., and honestly it seemed to drag out for a long time with endless comparisons between so called Prodigious Accumulators of Wealth and Under Accumulators of Wealth near the middle of the book. Nonetheless, each book has some valuable lessons within their binds, and I would recommend each to many of my college friends, as exposure to the balance of saving and spending and thinking about our life course and how to optimize it is enormously important and can serve to benefit us in the years to come. As with anything, the true optimal point to be at is somewhere between the poles of spending and saving, a point that is likely different for each individual -- a golden mean so to speak.

Congratulations @dbruce! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 50 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!