Week #7 - Super Bowl

Topic Covered today:

- This week's coming dividend (week 7 of 2025)

- Last week's results

- Last week's moves

- 401K (Feb 5 update)

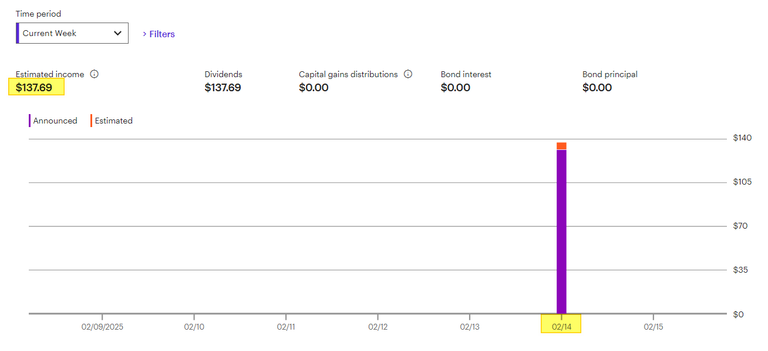

This week's coming dividend (week 7 of 2025)

I am expected to get $137 this week. I love the flexibility of what #dividends give me. I can reinvest or sell the dividend and not feel bad about selling off my position.

Last week's results

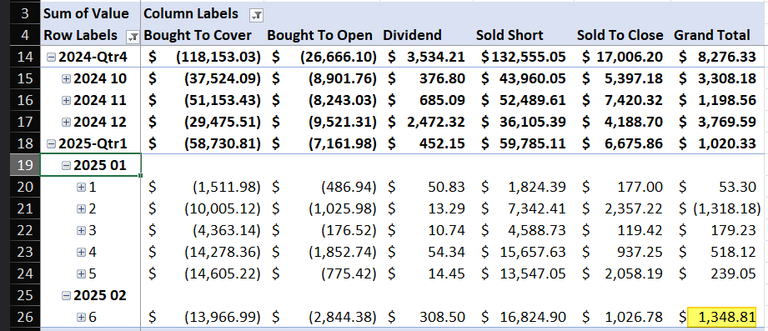

Last week, I made about $1300 from trading #Options, but I had one EARLY Assignmen from AMD put credit spread for a $1K loss. This nets out to about $300 in profit from option/dividends trading.

If you remove the $308 from dividends last week, I only made about $40 from trading because of the AMD put credit spread. Now, that sounds bad, but if I only lose 2 or 3 times a year and I make between $200-600 a week, then that averages out to a Positive Expectancy!!

How do I know this? I been tracking my trades for multiple years and I can tell you that I might have one or two bad months in a row, but I generally don't have a losing QUARTER or a losing TWO quarters in a row. This is the value of tracking all your trades and knowing why you MAKE or LOSE money.

Last week's moves

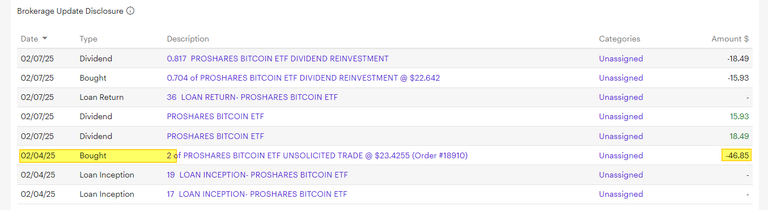

Last week I sold some dividend stocks and turned that cash into more BITCOIN exposure.

In the short term, it is hard to see the wisdom in that move. The issue is most people don't have $100 or $200 a month to buy Bitcoin each month. I'm in a similar position if I was only USE extra CASH at the end of the month after paying down the BILLS. For me to buy more #BITCOIN, I use the RENTAL income from NFT Gaming and I use some of the dividends I get from Stocks. On average I get about $13K a year in dividends, but I sell off between 7K-9K currently. I use that CASH to buy QQQM, WING, and BITO. That will be the plan for 2025.

The logic is fairly simple: if BITCOIN can return a move than the DIVIDEND being INVESTED, then it a good move. Dividends also reduce some of the risk as I doing this using a Dollar Cost Average over a longer investment period (2-5 years). If BITCOIN goes to zero, I will still have the dividend from the STOCK that I still own since I generally only sell OFF what I received in DIVIDENDS.

401K (Feb 5 update)

My 401K balance is about the same from Jan (148K), and so far this year I added about $942 with a 3.478% return so far in 2025.

If I continue at this pace:

- I will have saved around 7K into my 401K for 2025

- I will have purchased about $2K worth of BITO for 2025 (Mostly from Dividends)

- I will have purchased about $4K worth of QQQM for 2025 (mostly from dividends)

This week I have considered collecting #POKEMON again. I have some cards from a few years ago, but mostly because I was driving my kids to the local library to play against other kids. Now I want to use that experience to SHOW my kids that a hobby can be profitable if you understand why cause the PRICES to move up (or DOWN).

I don't have any new cards as I need to learn what method I want to use:

- Buy sealed ETB and Booster box and hold?

- Buy CHASE cards (cost between $50-2000 each).

- Buy SIR (Special Illustration Rares) cards?

- Buy only $1-10 full art Shiny Rare, or Ultra Rare?

- Buy Tins for holding and flipping?

But the goal is to bring my 3 kids into my hobby and show that something fun can also be profitable. I have no idea what I going to do yet, but if you are a collector of TCG, let me know what has work over the last 5 years.

Have a profitable and SUPER week!

Posted Using INLEO