We are in the quiet period before the Italian elections. No public opinion polls are published in the last two weeks of an election cycle per Italian law. Consequently, there is a bit of a news lockout on the subject.

These are the most important elections in Europe this year – laying aside the possibility of a German re-vote – and the amount of coverage it is getting is disturbingly scant. Articles like this bit of pablum from Bloomberg is what passes for analysis, purporting to tell you “What You Need to Know about Italy’s March 4th Elections”

Even as the specter of populist revolt recedes elsewhere in Europe, Italy’s anti-establishment, Euroskeptic Five Star Movement is seeking a breakthrough.

That’s a lie. And a bald-faced one at that. There hasn’t been one election in Europe in the past two years where populism hasn’t been a major and rising factor. The fact that Italy’s President dissolved parliament early and moved elections up from May to March 4th is proof they are scared of the trend.

Because the trend is against them. Five Star Movement or M5S continues to rise in the polls and another two months would put them in a position to put a government together.

The writers of this article push a lie that M5S is uninterested in forming a coalition government. The rules for this election were changed to allow the parties to fight as coalitions to freeze out M5S from ruling, even if they win the most votes.

The last polls taken had the Northern League tied at 15% with Silvio Berlusconi’s Forza Italia. These two are campaigning together. And the intention, clearly expressed by the Bloomberg writers, is to create a ‘grand coalition’ a la Germany, which no one in Italy wants except the political elites who back further integration with the European Union.

Bond Posturing

These are the real stakes in the Italian elections next week. And despite the gaslighting of the Bloombergs and worse, the Los Angeles Times, trying to tell everyone that M5S has no chance at winning, traders in the sovereign bond pits aren’t buying it.

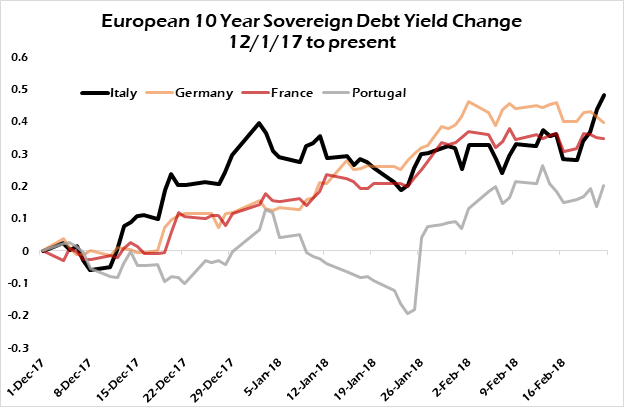

Since the beginning of December European bond yields across the board have been rising. The chart below is the magnitude of the rise in yields for Germany, France, Portugal and Italy.

Note how for most of February yields have been rangebound, treading water. This is most likely the European Central Bank in there buying up supply to keep yields from rising despite the steady march higher of yields in the U.S.

Italy’s debt, however, is in free fall. In the past five trading days Italian 10-year debt has risen a whopping 20 basis points. Rising yields equals lower bond prices and the bond vigilantes are calling the bluff of the media and the ECB by selling Italian debt with impunity. They are rightly scared that the polling numbers are far worse than what we’ve seen at this point.

Traders are Selling Italian Debt Faster Than the ECB Can Buy It

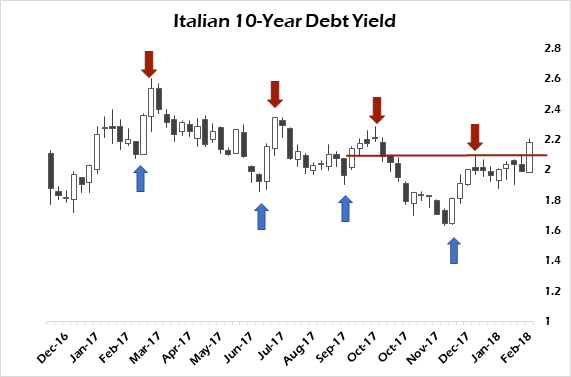

Italy’s 10-year debt is now trading well above recent high at 2.10% (see chart below). More importantly this week’s price action broke a long-running trend of lower highs and lower lows in yields, indicative of a bullish market.

The Break Above 2.10% is Very Significant, Technically.

Now, it’s hard for that market to not be bullish when the ECB is the only marginal buyer of Italian debt and heretofore, traders bet on that behavior continuing in perpetuity, front-running the ECB’s buying.

But, rising yields means that the net volume of selling across the spectrum of European sovereign debt is more than the ECB is willing or allowed to buy. So, what’s happening is the ECB is managing the rate of the rise in sovereign bond yields and that is clear in the chart above.

What is also clear is that it is losing control of the Italian bond markets.

Coalition Party Bingo

So, what’s next? While new polls will not be published between now and the election, polls are being taken. Someone has seen them. And, by inference, the Italian bond market is telling us that those numbers are either far worse than we’ve been led to believe at this point or some traders are simply nervous.

I believe it’s the former, otherwise yields wouldn’t have pushed through 2.1% to the upside. If the Northern League and M5S can pull off something close to a clear majority together that would be a big blow to Brussels’ plans to control coalition talks.

Moreover, if this last bit of news about M5S candidates standing for specific seats gaining ground is accurate then the renegade party will have a much stronger hand to play as it will pick up more seats than poll watchers were anticipating.

The natural alliance here is the Northern League and M5S. Berlusconi, I feel, has been acting as a stalking horse for the established political powers to freeze M5S out of coalition talks and hand a weak “cartel” government to Brussels for upcoming debt relief and banking reform talks.

NL leader Matteo Salvini has wrapped himself fully in the populist flag, echoing Donald Trump. One of the few things the Bloomberg article linked above gets right is all of the parties backing off from a referendum on the euro.

For now that is off the table to get votes but Salvini and his M5S counterpart Luigi Di Maio both know that Italy’s path to prosperity lies through either a massive write-down of its sovereign debt, something German voters are clearly not in favor of (and are becoming moreso every day) or leaving the euro and depreciating it away.

Given the rate at which rates are rising that is moving that timetable up considerably. And with no government in Germany yet that creates a lot of uncertainty for investors, who rightly, are beginning to panic that those in charge really aren’t.

A firming dollar and U.S. equity markets would also imply that we’re seeing capital begin a panic move out of Europe in case the populists win.

In any case, the markets will tell us what’s really happening even if the politicians and the media won’t.

That's good luck ...

Thanks dear sharing the valuable information. I alwys see your post and follow you..

True, the markets tell what's really happening, even if politicians and the media try to pretend it isn't so.

It's sort of like the admonishment, "Watch what they do, not what they say."

Relevance:Financial Markets Reacting to Political RealityCurated for #informationwar (by @openparadigm)

Thanks of that post - I wasn't even aware of it happening. (doh!)

The centralized governments are really panicking, as the emperors clothes are being seen for what they are.

An illusion they have been selling us( and we have been agreeing to see), for far too long...