What Makes A Token Desirable

Many tokens tout their special features when they ICO. Some only mint a limited number of tokens to shown their rarity on the market. Others entice with yearly buy back or yearly burn as way to increase the desirability of the tokens whilst others offer financial incentives as “dividends” or a share of the profit for holding the tokens. Guess what? PPT is all of the above and a little more.

• Populous PPT tokens only numbers 53,200,000 tokens. A breakdown of the number of tokens can be found in my previous Populous post.

• Populous will carry out a yearly buy back of it tokens to maintain its value and hence its desirability. A buy back to maintain PPT price is necessary since PPT tokens are used as collateral within the Populous Invoicing Factoring Financing Platform.

• Populous will distribute 10% of profit to PPT tokens holders each year through buy back/burn. It is not called dividend per se because it is not a security and the 10% is variable and depends on profit made for the year.

The Secret Sauce In Action

Now that PPT have passed the above initial criteria for desirability there is one thing that will make you fall in love with PPT and as the title of the post suggest, there is nothing like a “A Plate of PPT with Plenty of Secret Sauce”.

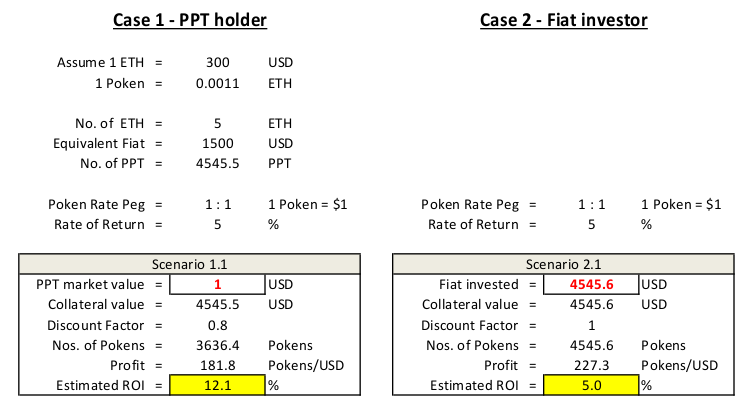

The way “The Secret Sauce” work is best demonstrated by simply comparing the ROI of a fiat investor as opposed to a PPT holder on the populous Invoice Factoring Platform. The outcome will speak for itself.

Since PPT are held as collateral and will be returned to you, you can then re-collateralized the PPT and reinvest month after month after month. Just imagine, if you played your cards right, you can potentially make a ROI of 12.1% a month based on a PPT market value of USD$1 every month.

Note that as a PPT investor you will likely not get the full face value of the PPT tokens based on its market value. As I mentioned in my previous post about Populous, PPT are held as collateral and since the value of PPT will fluctuate the PPT value held as collateral will need to be discounted to allow for this fluctuation in value.

But wait, this gets better. What happened when the value of PPT goes up in prices. See below!

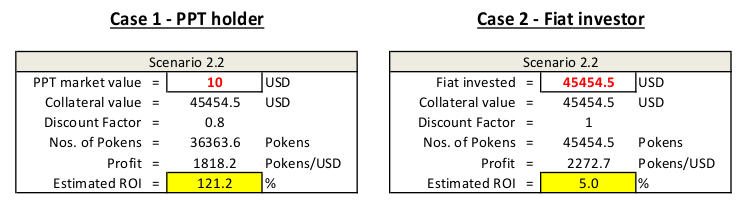

Just look at the ROI for PPT holders as opposed to fiat investors. Which one would you rather have, a 121.2% ROI or a measly 5% ROI? It’s a no-brainer!

Not wanting to beat a dead horse, if the PPT value goes up even further then the returns goes up even higher and this is all based on your initial pre-ICO investment of USD$1500.

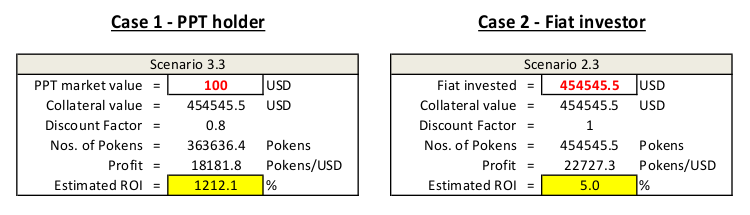

The last example above is based on pre-ICO token prices whereby you are using USD$1500 to make a USD$363,636.4 investment! As a PPT investor, you could potentially be making a monthly ROI of 1212.1%. So again, congratulations to those have been able to purchase PPT tokens in the pre-ICO.

Other Publicly Available Resources

Don’t take my word for it. You can also read about “The Secret Sauce” here by Populous and also watch the video by Joe In General below.

PPT look like the gift that just keeps giving and is the ultimate tool for financial leverage. PPT is definitely a token that you should have in your portfolio.

This is NOT Financial Advise

In my humble opinion, the risks to the downside are small compared to the potential upside rewards. This should not be construed as financial advice but an opinion only. As usual do not invest more than you can afford to lose as these investment can go to zero and always do your own due diligence.

All sounds great for those of us who got into the ICO. But what our little community continues to miss/avoid is the question: where's the value for those who are discovering PPT now. If you're going to buy to speculate on PPT price that's one thing. But buying PPT as a vehicle to participate in factoring? I'm still failing to see the pull. This is what worries me. I got in at ICO. These projections are based on the market valuing PPT AFTER the ICO not before it. What's critical then is ensuring there are benefits to holding the token post launch such that PPT maintains a market value driven by new participants who seek its unique utility - post launch of the platform I see no unique utility. Unless you think the buybacks are going to take care of demand? What Populous aught to have done is tie the PPT token into the invoicing process such that it is a requirement and not an option.

Do the same experiment as above for someone buying in now and the % gap between PPT vs. Fiat soon falls away.

I hope I'm wrong.

Remember Populous only raised $10.5 million in the pre-ICO. This is pittance compared to what is required to funds the invoices expected. In my opinion, the funds raised are used to setup the team, offices, equipment etc. and most importantly to be able to buy trade insurance. Without trade insurance the project cannot get off the ground.

Therefore the money for funding invoices will come from elsewhere and only Populous will know where and fiat investors will be required. If the price of PPT on the exchange is $100, it does not benefit Populous because the money changing have is between the seller and the buyer with the exchange taking a small commission, Populous does not receive anything from this transaction because this money does not go into the liquidity pool. So making PPT a requirement to invest in Populous will not work because there is no liquidity as a result of the price going up.

Populous will still survive even if PPT goes to $0 because the liquidity pool is what is important. As the liquidity pool increases then PPT will also go up relative to it.

You are right, the percentage gap will fall away as the price of PPT increases in value. With the lower prices now compared to what they may be will still give you an advantage as opposed to those who just invest in fiat. Buy PPT at low prices then compound your Pokens.

PPT will always give you the edge over fiat but as time goes by the edge i think will be due to buy back/burn each year. So your allowable investment will increase by (say) 10% each year as compared to fiat investor who do not benefit from the yearly increase.

Investor who hold PPT and not use the platform will hold PPT for yearly price appreciation through buy back/burn. If you want to trade PPT then I think it will be difficult to make money because by then no-one will want to sell when they realise the money they are making on the platform.

So it is a good time to buy PPT when the price is low compared to where the price may be after the beta. Fingers crossed that beta will be a hit. Would want to invest in fiat when as a PPT holder you get just that bit more even if you buy PPT after the pre-ICO and the price has gone way up.

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond Please consider upvoting this comment as this project is supported only by your upvotes!

Do they trade on Bittrex?

Not on Bittrex. You can get PPT on EtherDelta and Mercatox. I think they are going on HITBTC in the next few days.

That's great. Thanks again!

I've only just seen this! Thanks for the video shout out mate!

Joe, no problem, just need to spread the message.

Thanks for the all the work put in to spread the information on Populous. I made a link to your article in my recent post. Please have a glance.

https://steemit.com/populous/@seenmidnight/hidden-gems-part-1-populous-ppt-this-is-the-income-producting-cryptocurrency-token-you-should-be-buying-now

Saw your post, more posts like these are great to spread awareness.

But I want PPT all for myself!

Hi, Thank you for the write up.

But I don't understand, the return is still 5%, so what is your 121% is about in second case ? A PPT holder has the choice of selling his PPT on an exchange. So if I have $4545 worth of PPT ($10 on exchange), I can sell it and use the cash to lend on the platform, and get 227 pokens, compare to use the PPT, with 20% loss in value (0.8 factor) I then get 181 pokens interests. So why you say it is better ?

Could you help define ho you calculate the ROI ? please use current PPT price, let say $10...it can't be compared to $0.3 ICO price because at any moment one can decide to sell its PPT on exchange and we are evaluating the investment opportunity as holding or not holding PPT token as today (ie PPT=$10 for the example).

The ROI is based on the intial amount invested. PPT is held as collateral and never sold unless you choose to sell your PPT. PPT is used to access the liquidity pool (see my other posts) to funds the purchase of invoices. When the invoice settles the PPT is return back to you + the interest. Once PPT returned to you, you can re-use the PPT again to access the Liquidity Pool to buy more invoices. Repeat, wash and rinse.

Have you heard about the "Secret Sauce"? When PPT is $10, you have $8 purchasing power. When PPT is $100 you have $80 purchasing power. You take advantage of price appreciation of PPT when buying invoices.

If you use fiat to purchase invoice worth $4545, you need $4545 and return is 5%, the ROI is also 5%. If you purchased PPT at very low price at say $0.33 and the value of PPT goes up to $10 (say, in the example) then you have a purchasing power equivalent of $4545 for initial investment of $1500. Hence return of 5% but ROI of 121%.

where is the literature stating Populous will do a buy back and token burn?

thanks

The buy back and burn used to be presented in the Whitepaper but have since been revised and no longer considered since it may mean PPT will be considered a security.