What happens on Polygon stays on Polygon, unless you are using Across Protocol! Across is the fastest, cheapest and most secure Ethereum bridge! Huge milestone was achieved on the 16th of April, as Across reached $200MM in total bridged volume! Check the news and be up to date with what is happening Across the Bridge!

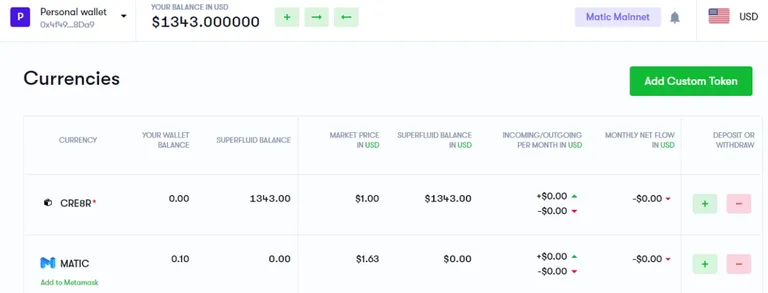

My Polygon journeys are now as interesting or hectic like on Binance Smart Chain but I am slowly catching up! The holdings were small as well, with a bag of CRE8R tokens and some MATIC dust! I bridged the $CRE8R to FANTOM and use it all to farm top rewards on BeethovenX. You could earn $CRE8R by joining the DAO and be part of the most amazing team of DeFi content creators!

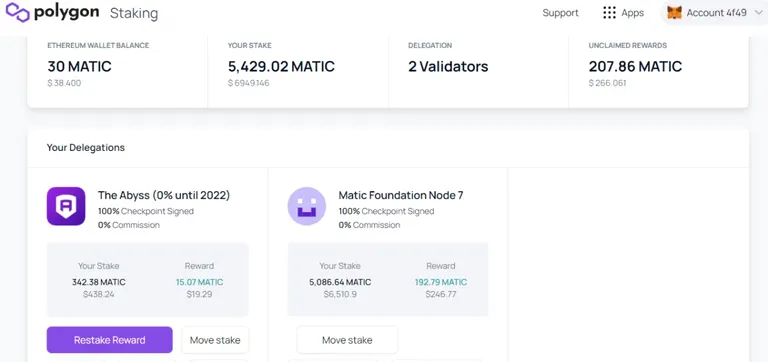

The large majority of my $MATIC was staked for ages, earning rewards in the background for nearly one year. Bought my bag in February 2021 to stake it on Celsius Network but I gave up when I seen what fees they were asking for the transfer. The $MATIC price back then was $0.04 and spent $210 to buy what it ended up into a Matic Foundation Node. MATIC rebranded as Polygon, the price surged and I was stuck with the assets on ETH.

One year later, at the start of February 2022, I was fortunate to find low fees and withdrew the pot. I chose to invest them in a new and promising play2earn game called Pegaxy! Swapped most of the $MATIC in USDC and went to buy some horses.

No point to expand on the $VIS story and how the tokens went from $0.04 to $0.26 ... only to crumble to under $0.001! No need to expand on how the pega price went to a floor price above $1000 and few months later some were sold for few dollars. Today I am covering the DeFi aspects on Polygon and how I farmed $VIS and $PGX Yield on Kyber Swap

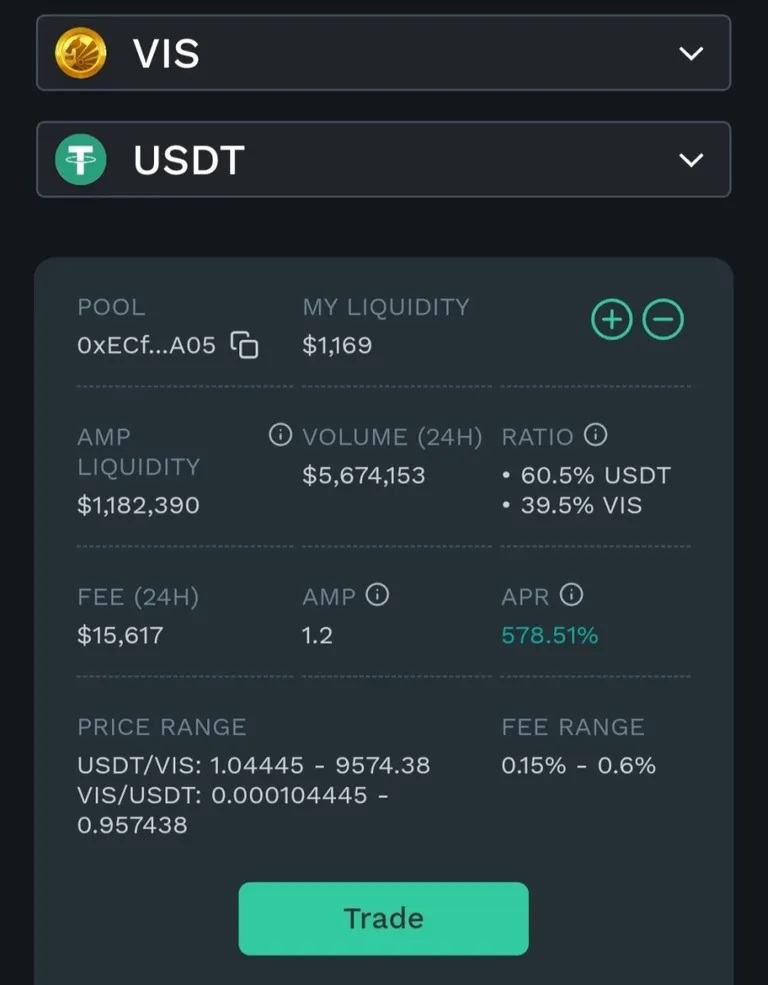

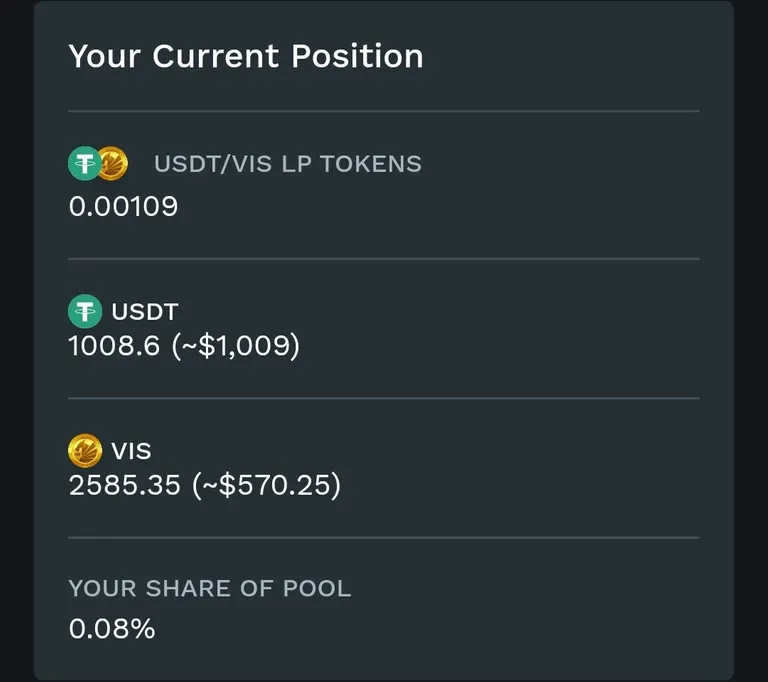

The attraction was instant, as the $VIS - $USDT pool on Kyber Swap had 578% APY. With no hesitation I paired $VIS with $SDT, and added all into the pool. The liquidity value on entry was $1169 and it grew beyond predictions.

I didn't fully understood the Kyber farms, but somehow the value kept growing while the tokens were pumping. The pool ratio kept changing, making the investments less affected by impermanent losses.

The price of $VIS started pumping and the trend kept going for few weeks! It recorded new ATH on a daily basis and the Pegaxy players were living the dream! In only few days, my LP raised by 40%!

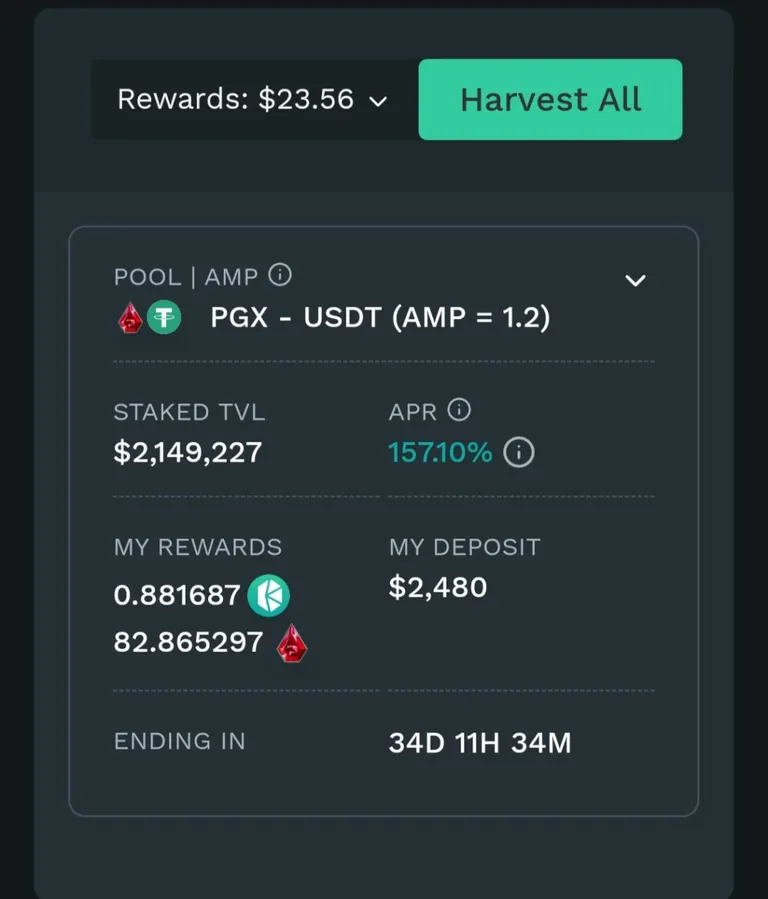

One week of farming and the value of my deposit doubled. The reward lost some of the APR, dropping at 157% APY but I was still under the VIS pumping spell.

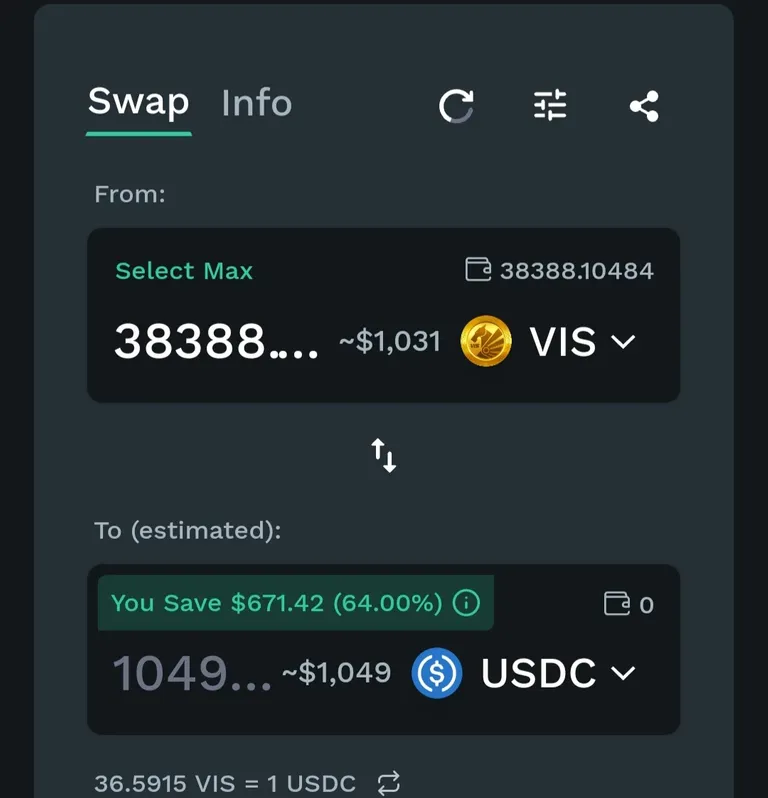

The value of my deposit kept building up, as part of the fees were automatically distributed to the LP, and $VIS was still pumping like crazy. Made my first claim and used it as a safety net! Swapped 38,388 VIS for 1049 USDC and my initial investment was almost covered.

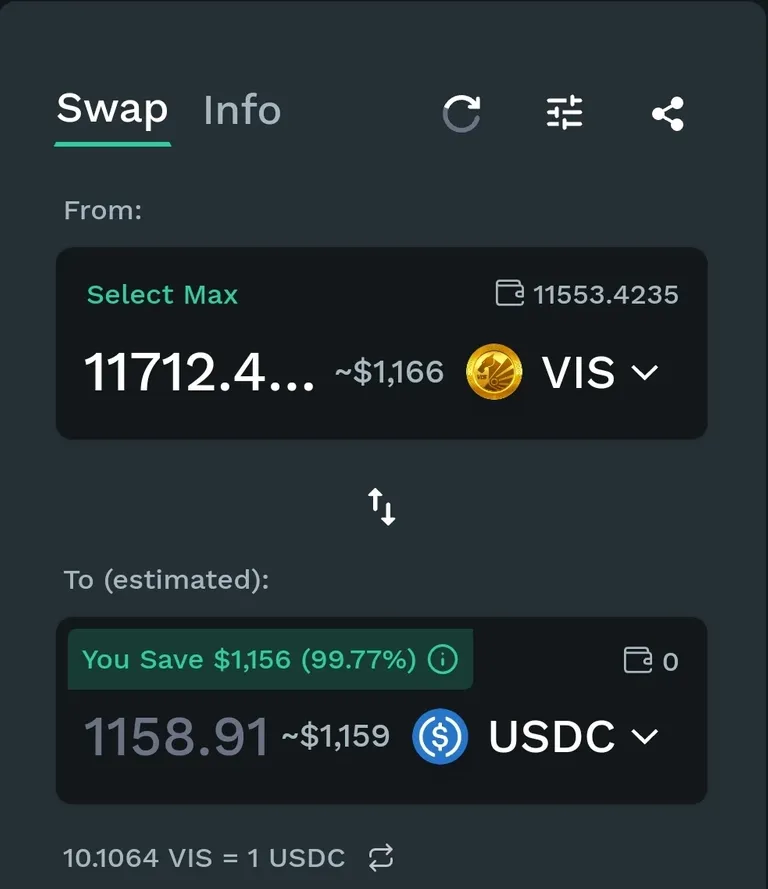

Two weeks later and my second Pegaxy claim was swapped for 1158 USDC. Being on Polygon made staking easy and cheap to use. Guess what I've done with all those stables? I invested in my stable and got more pega to race... just before the price went into a spiral of death and didn't stop until the token had the value of a financial advice from Donald Trump.

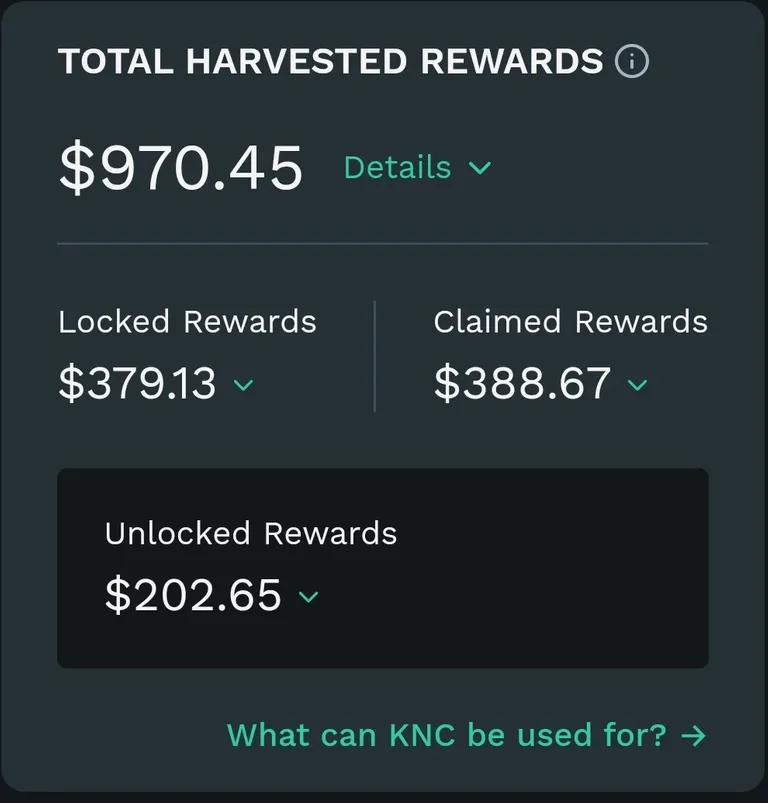

The $VIS and $PGX was reflected into the fees paid on Kyber Swap, as value of my deposit grew three times. The amazing farm concluded but the LP was still eligible for rewards, from the market fees. The total harvested reward was $970, slowly unlocking each day until all become claimable. I kept cashing out the rewards, while I was also breeding pega to raise my stables. This time being a HODLer sucked .... badly! All those earnings are now worth less than $20 and feel stupid for not cashing out. I knew the Pegaxy reward system is unsustainable but still greed made me wait too much!

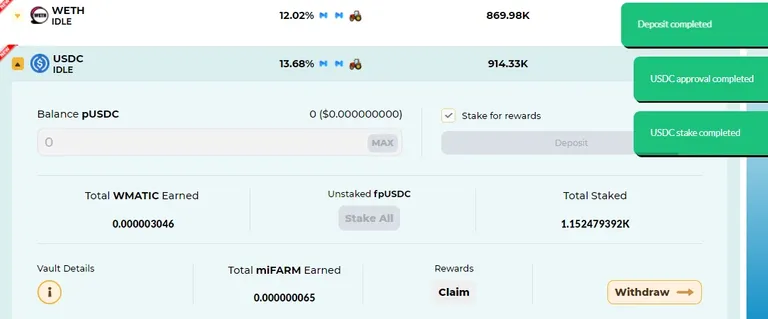

Went All-In on the Polygon side of Harvest Finance. The BUSD was shifted in USDC, and staked at 13% for miFARM, wMATIC and auto-compounding USDC. Everything was good compared to ETH mainchain ... the APY, the gains and the fees!

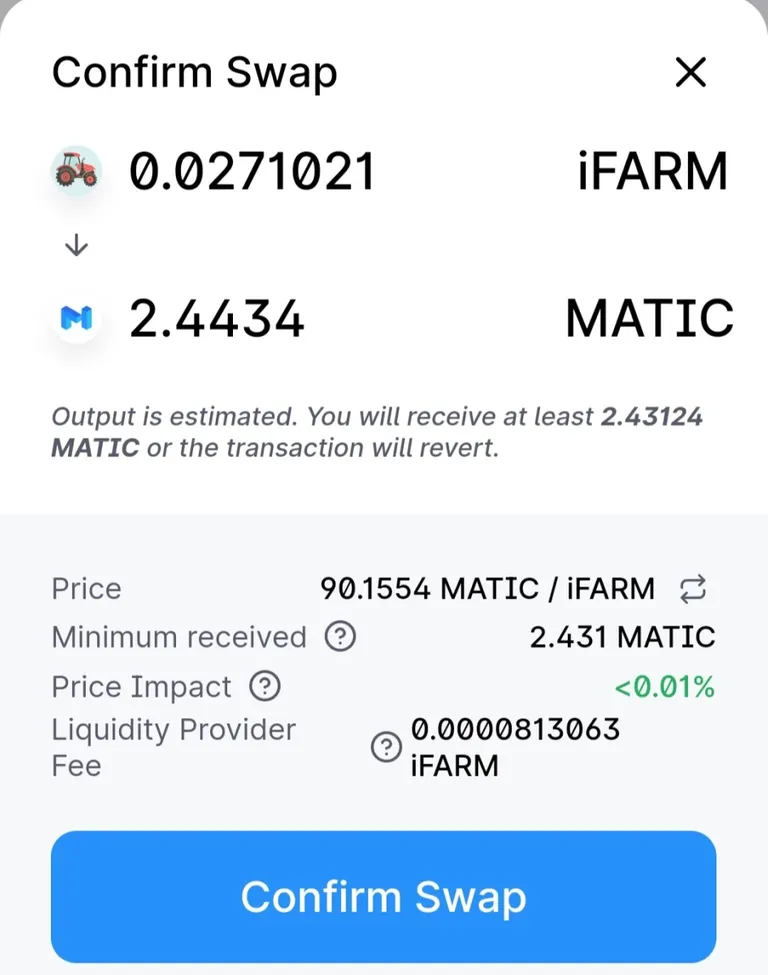

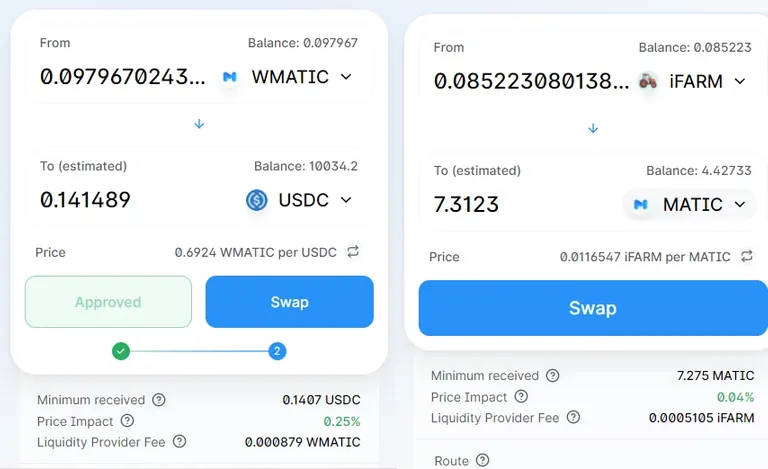

Swapped some of the iFARM for MATIC, to cover Pegaxy fees. Price impact under 0.01% on Quickswap! It's not much but is honest work!

I let the reward accumulate and claimed only when the pool was closed. I earned $7 in USDC, few cents in wMATIC and enough iFARM to swap for 7.3 MATIC. There are now no stablecoin pools on the Harvest Finance cheap chains!

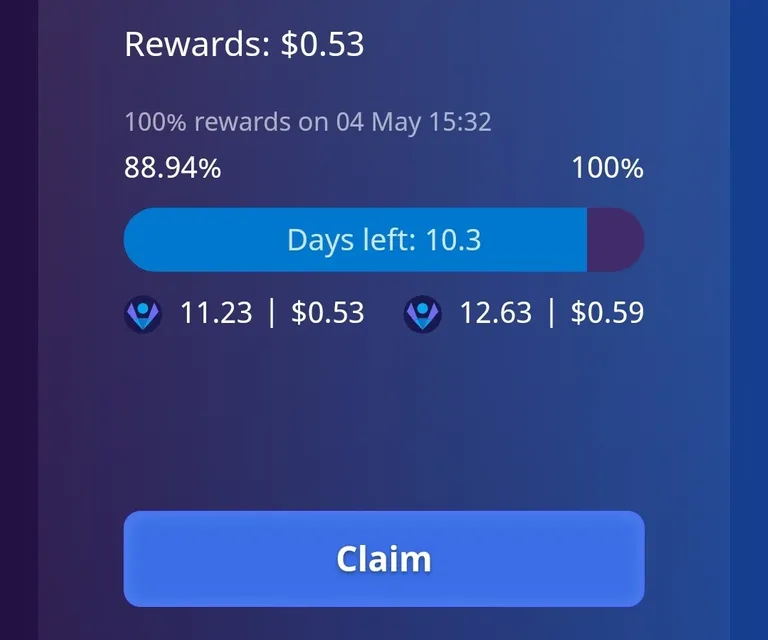

Because what happens on Polygon stays on Polygon... I looked for a staking alternative. I found Tetu, with some innovative earning opportunities. Takes a while to claim the full rewards but is better than keeping lazy crypto!

Residual Income:

DeFi bounty at CakeDeFi with $30 DFI for new users

The fountains: PipeFlare ZCash, GlobalHive ZCash & Get.ZEN

!LUV

The rewards earned on this comment will go directly to the people(@pvmihalache) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.