Hi,

Thought i'd write a quick bit on the Australian Property 'bubble' note the quotation marks. Every piece of internet journalism on story I see is a story on the property bubble, and its getting a little old i think.

Yes prices in Sydney CBD, and Melbourne CBD are expensive if you are to only look at the big number. There are many other areas, Newcastle, Canberra, Hobart, Perth, Brisbane, Gold Coast, where property can be purchased very affordably at very low interest rates with employment with accomodation costing less per week than it would cost to rent a similar property.

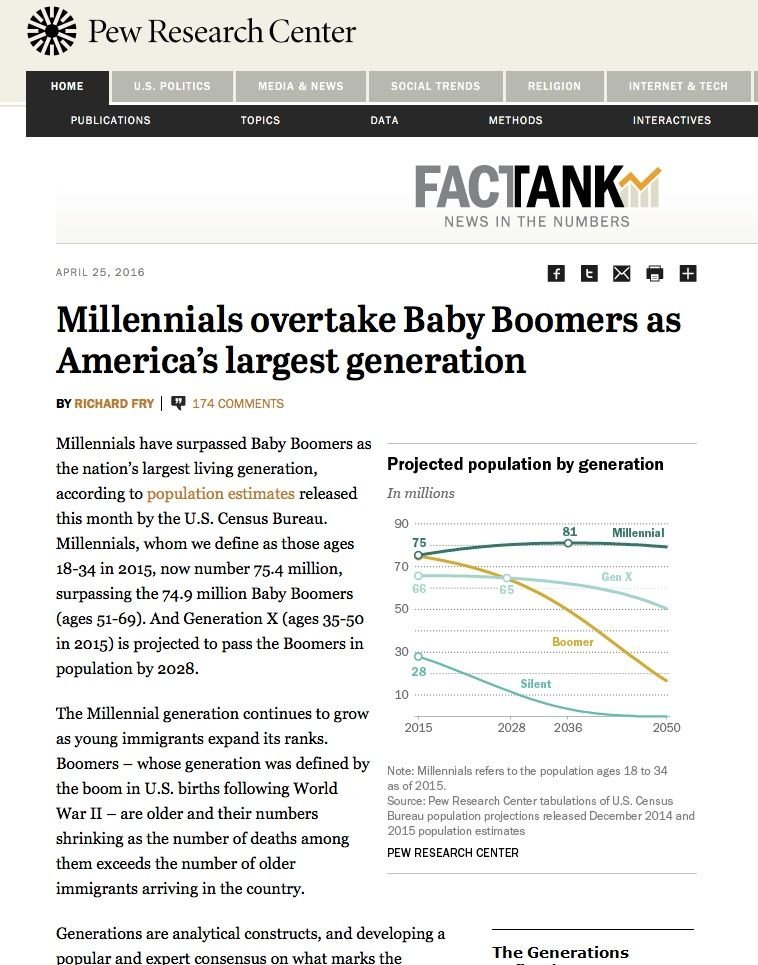

I would also like to point people to demography, that is the age groups that are both entering and exiting / downsizing their homes. Currently we have a mass of Baby Boomers, who due to tax reasons, have been keeping a significant portion of wealth in their PPOR (principal place of residence). The government has just changed the rules slightly, so that it encourages these people a little more to downsize, therefore adding some supply to the market and putting a hold or even a drop in prices.

Millennials are set to surpass the boomers post WW2. What happened to real estate prices post WW2 ??? was there a housing collapse? No in fact housing got so overheated at one point mixed with deficit spending we had 21% interest rates to cool it or slow it down.

Were investors worried ? NOT AT ALL. We actually had a situation during that period with high unemployment AND high property prices / interest rates. So employment and property prices during that period was not synonymous.

The people that had concern were tenants, and people who were paying a mortgage for their PPOR (principal place of residence) investors / landlord simply raised the rents inline with the inflation at the time.

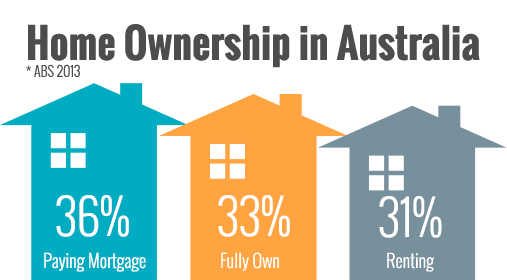

There is generally about 33% of households in australia that own their homes outright, another roughly 36% are paying a mortgage, 24% are renting from a landlord and 4% are in state housing. I was quite surprised by both the level of freehold ownership, and the level of state housing when i learned this. Opposite ends of the scale but i found both numbers interesting.

So 33% of household or 1/3 of houses everywhere you see HAS NO MORTGAGE !!! Their only weekly liability is their water, rates, insurance etc. These people have a minuscule cost of living so are no risk to the mortgage market.

so that leaves another 1/3 who are mortgaged, now the Millenials are both having children at a faster pace, and have reached the age of 34 where they are approaching their job promotions, buying first, and perhaps second house, etc. These peoples incomes / investing will continue to rise until about 45 when they will be at their peak.

So while you have baby boomers potentially looking to downsize, you have a much larger group of people upgrading their accomodation, buying their first or second home, and another 11 years of significant population and income growth.

When you read about the Sydney, or Melbourne market, particularly on the online forums and Facebook, all you will hear is about how INVESTORS are buying up everything in sight and First Home Buyers cannot get a fair go. So which group of people do you believe are the most educated about property ownership is it :

A: First Home Buyers

B: Investors

C: The internet trolls

I am going to go with group B. who are the most experienced, and have the most wealth at their disposal to put into any given asset at a time of their choosing.

Warren Buffet said "When people are fearful be greedy, and when people are greedy be fearful" All I see online Facebook, or even specific property forums is an almost total domination from internet trolls talking about a property bubble. There is rarely if ever a comment from an investor or home owner. If their critique of the property market was at a higher standard, I might be taking some notice. I will choose however to focus on the sheer number of cranes dotting the skylines of our major cities.

So the market generally I would say is still FEARFUL. INVESTORS are greedy, but they do not, and nor have they ever driven the majority of market behaviour, the largest group of purchasers are the FHB.

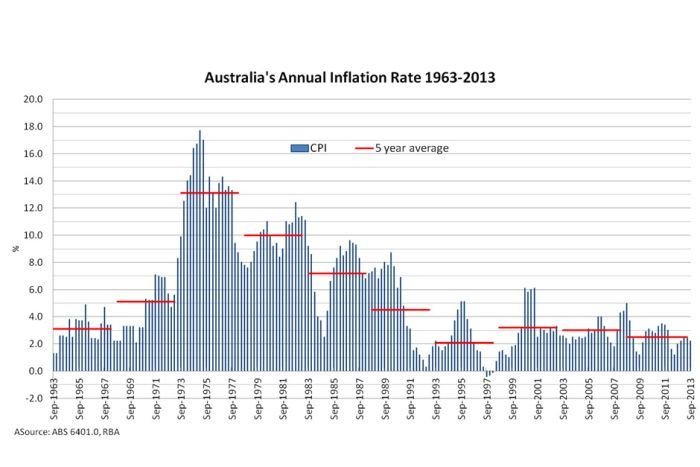

Also some interesting data on inflation, take note of the 1970 - 1980 period. We are somewhere around the 2.1 - 2.5% CPI currently. 3% is widely considered to be the ideal CPI rate for Australia.

Historical interest rates in australia.

Recent policy changes in particular from the NSW government (thats sydney for those that are overseas) has seen stamp duties significantly reduced which is actually putting probably somewhere in the range 40 - 100k straight into property owners hands, assuming they are already saving for a home, as they are not having to now front it to buy.

This is a government tax that has been in place for some time, that has just been slashed almost completely for First Home Buyers. There is also other regulatory changes allowing first home buyers saving into their Superannuation (overseas 401k equivalent) a $15000pa additional pre-tax contribution that can be used for a first home. While dropping the First home grant by I believe $5,000.

Superannuation article:

http://www.news.com.au/finance/money/costs/first-home-super-saver-scheme-has-opened-for-business-to-help-firsttime-buyers-stash-a-deposit/news-story/3d29ea43da2f5b40241ffed2115daeff

So they have just pretty much given lets say $100k to first home buyers in the sydney area to use an easy round number, give or take, this is money that is both giving them a tax deduction as per the superannuation reducing taxable income which can be put into a first home in two or 1 years time.

This works out to say a first home buyers grant being somewhere in the 3 - 6+ times being put in place by stealth. For those that have watched these policy changes and understand what they mean it is a significant thing for the Australian Property market.

The value is what it currently is, they have just removed the stamp duty component for FHB in NSW.

New South Wales:

http://www.switzer.com.au/the-experts/john-mcgrath-property-expert/nsw-affordability-package-stamp-duty-savings/

Victoria (just happened)

https://www.domain.com.au/news/prices-will-rise-for-victorian-firsthome-buyers-following-stamp-duty-cut-experts-say-20170630-gx048c/

I would tell anybody who is subscribing to the property bubble talk, to first ask where this information is coming from? Is it coming from a current affair or tabloid journalism, a Facebook page, or is it coming from an investor with decades of experience...

Article in Gold Coast Bulletin 2004, first home buyers grant was just added to existing property. Gold Coast and Brisbane are both in Queensland for overseas readers, the two cities pretty much join up together. They are not near Sydney or Melbourne. Brisbane is also one of the largest cities in the world by land area and the capital of Queensland.

Lastly, donald trumps US infrastructure spending. I wonder what would happen if we put one of the biggest real estate investors in existence, in charge of the largest economy in the world.

NOT FINANCIAL ADVICE DISCLAIMER

Added a few things keep finding things so check back.