As the property market takes a breather for the holidays, we can see some storm clouds on the horizon that may make 2018 a not-so-stellar year for Aussie property investors.

Key Property Market Highlights:

- The number of sellers remains high as we approach the end of spring.

- Auction clearance rates have waned, showing buyers can afford to be a little more patient.

- Home price growth continued to slow last month, with prices falling in Sydney for a third consecutive month.

- Questions re-surface about the quality of mortgage loans and Brisbane apartment buyers are struggling to settle on contracts.

The Latest Auction Activity

Last week, the number of auctions across the country rose above 3000 for a third consecutive week, pushing the combined capital city auction clearance rate to its lowest level in two years. A total of 3,291 homes were auctioned off, and only 60.3 percent found winning bidders.

Melbourne’s clearance rate dropped to the mid-60’s, while in Sydney buyers barely cleared 56 percent.

Here are the latest results for all the capital cities:

In Sydney, not even the beloved Eastern Suburbs could break out of the mid-60s. In Melbourne, only the North West sub-region could muster a result above 70 percent.

With over 3000 auctions scheduled again for this coming weekend, expect clearance rates to continue to fall. I expect to see a nationwide result in the high 50’s.

Recent Changes in House Prices

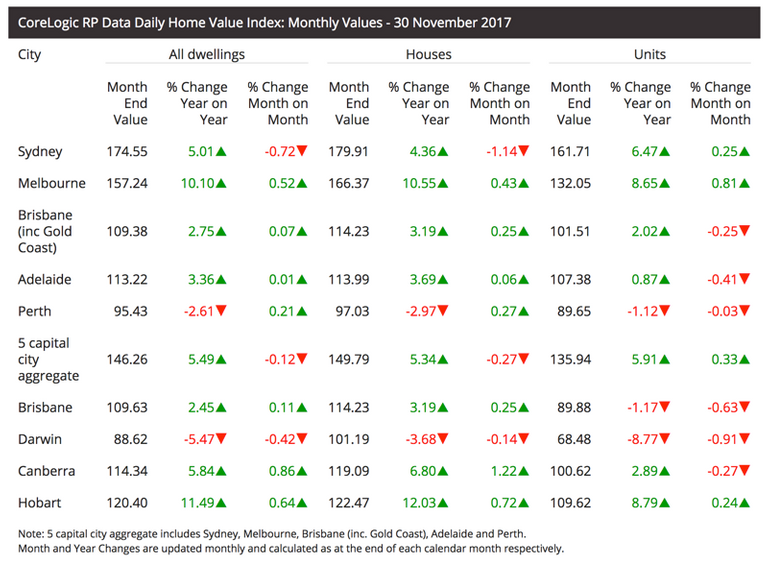

CoreLogic’s latest monthly property market data is out, showing a further decline of over 1 percent in Sydney house prices. Sydney units faired a little better, showing price growth of a quarter of a percent month-on-month. While Melbourne as a whole remains up 10 percent over the past twelve months, Sydney’s price gains for the year have declined to 5 percent.

source

Market Analysis

The story hasn’t changed much from previous weeks: the market has plenty of sellers, but nowhere near as many buyers as this time last year.

Sydney buyers seem to be reaching their breaking point of what they will tolerate as the median house price there has fallen for three consecutive months.

Melbourne homes prices, on the other hand, have continued rising, albeit at a slower pace than previous months. In light of Victoria’s lower median house price, this reinforces the fundamental truth that affordability matters. If there’s a lesson in the Sydney-Melbourne contrast, it’s that people can only afford to pay so much, unless wages rise or interest rates fall further.

Looking to our smaller capital cities, home price growth in Brisbane and Adelaide has barely kept up with inflation. This means that negatively geared investors have gone backward in real terms.

Speaking of growth after inflation, Sydney hasn’t fared much better. Negatively geared investors there have essentially sat in neutral through 2017, after accounting for cash flow losses.

With the RBA keeping rates on hold this week at 1.50 percent and home price growth beginning to stall across the country, most investors are struggling to find a reason to be hopeful for capital growth in 2018. Considering the dark clouds looming on the horizon, the best case for the next twelve months may, in fact, be a flat market.

Dark Cloud #1:

Concerns are swirling about the fallout from settlement risks in Brisbane as foreign buyers are struggling to access the money to close their deals. According to research from investment bank UBS, one in five apartment buyers in the Queensland capital are failing to settle.

Beijing has tightened capital controls, cracking down on investors wanting to send money overseas. Chinese individuals are now capped at sending $50,000 a year overseas and banks must report any foreign currency transfers of $10,000 or more. Add to that the changes in bank lending rules here in Australia for foreign investors, and it seems now 20 percent of Chinese buyers are walking away from their deposits.

That’s a manageable figure that can likely be absorbed by developers. They will respond by lowering prices to move their stock, which means we haven’t seen the bottom yet for Brisbane units.

But the greater risk is that 20 percent becomes 40 percent, in which case Brisbane developers will struggle to meet their obligations to lenders and mezzanine investors. If that happens, it’s anyone’s guess what contagion could result, but it wouldn’t be pretty. The best case is Brisbane house prices start falling too. The worst case is banks take a hit and capital dries up across the country.

Dark Cloud #2:

Speaking of bank woes, earlier this year, UBS calculated that up to one-third of Australian mortgages, that’s about half-a-trillion dollars’ worth, were approved based on incorrect information. That means either brokers or applicants or both, were lying.

In response, NAB just completed an internal investigation and found 2300 of these “liar loans” on their books. They’ve now sacked 20 of their bankers responsible for writing these loans and disciplined another 32.

It stands to reason that these liar loans are at a greater risk than others of default, should interest rates rise or we come upon tougher economic times. But hey, we're Australia. It's been 26 years since we've experienced a recession here, so maybe we're immune.

How do you see 2018 playing out for the Aussie property market?

Jason Staggers

Hey jason, great report as usual thanks for that. I read in the paper today that rents are starting to fall across Sydney as well, more bad news for the investors with those massive loans, cheers mate.

very thorough and well thought out. In the US we are still booming in real estate - especially in the areas hit by hurricanes - investors are snapping them right up - but even without that hurricanes -we had a pretty strong market with plenty of demand and very little inventory.

Congratulations @jasonstaggers! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations! Your post made this weeks 1 Post Top 5 Real Estate Posts on Steemit This Week .

hello friend, I had not seen its publication, and precisely December 3 was my birthday, I hope things are good for the country, in my Venezuela is every day there is more disorder at the economic level, my hope is set cryptocurrencies and steemit has been very helpful in my life and my family, greetings friend, here I send a big fraternal embrace.