As I reported last week, I’ll be posting my weekly property market update toward the end of the week now. The preliminary auction clearance rates reported by CoreLogic at the beginning of the week have become too unreliable.

Agents appear to be repeatedly overinflating the results to make the market appear stronger than it really is to hype the Monday morning headlines. The final results are posted on a Thursday, so look out for my weekly update within a day or two after.

I hope to be posting more frequently with other write-ups, but life will be crazy for the next few weeks. I'll be speaking at a big conference in Sydney in two weeks but may need to take a trip to the UK for a family funeral before then :(

The Latest Auction Activity

Auction supply rose to its highest level since early June. Sellers offered up 2,270 homes at auction across the combined capital cities. The clearance rate was on par with previous weeks at 68.3 percent.

Melbourne remains the most active market for auctions and also the city with the most housing demand. Melbourne’s dominance is likely due to population being roughly the same as Sydney but home prices in Melbourne still being about 13 percent more affordable.

source

Recent Changes in House Prices

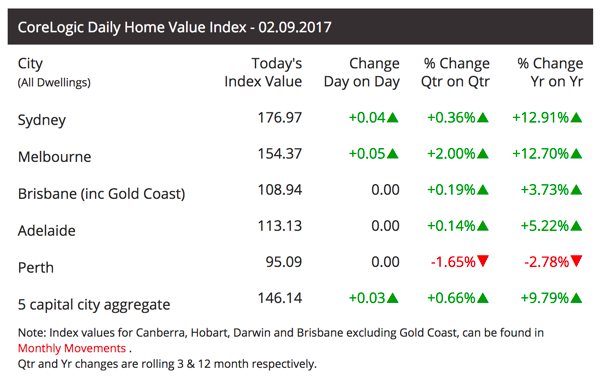

As of yesterday, CoreLogic, the premier data source for the Australian housing market, has “improved” its home value index. Supposedly, the new index better reflects true market conditions and reduces volatility.

The outcome is a lower level of home price growth than we’ve seen through the previous indexing method. Whether this is a more accurate reflection of true price movements or not, I’m sure our regulators (the RBA, APRA, and Canberra) are thankful for a measurement that reflects a more moderate level of house price growth (that is, if you can call 13 percent per year “moderate”).

The fact remains, home prices are still rising. According to the daily index, both Sydney and Melbourne continue to set new at all-time highs.

Here’s the latest chart from CoreLogic with the figures from the new indexing method:

source

Market Analysis

During the winter months, home sellers tend to go into hibernation. But this year, we’ve seen an unusually high level of activity. The higher than usual level of auction volume shows that supply continues to be pulled forward from the future. Sellers are likely speculating that home prices have peaked, and they’re looking to realise some gains.

This could mean that there won’t be many sellers left in the Spring. However, with plenty of downsizers yet to come to market, I don’t expect to see a lack of supply over the coming months. Time will tell.

On the demand side, as long as interest rates remain low, I expect home prices to continue rising or at least flatten out. With the Aussie dollar strong against the Greenback and growth in wages bordering on anemic, the RBA will likely cut rates again. This would require tighter lending restrictions from APRA to keep the housing market from forming a bubble.

Oh, wait… too late for that.

Sooner or later, the final Jenga block will be removed when Aussie household debt becomes too top heavy; that is, if the overseas bond market doesn't shake the table first.

Jason Staggers

Great info @jasonstaggers. I'm not living in Australia but this post gave an idea what it's like to buy a house there ^^. Keep up good work :)

Thanks for stopping by :)

Nice post....

Another excellent report Jason, highly appreciated. Please help me understand your services Jason? Do you consult people looking to buy properties and do the negotiation? Upvoted and resteemed.

Thanks, mate. Yes, I do consult investors on property purchases, but I mainly coach them on doing the negotiation themselves. I walk them through the whole process to help them avoid mistakes and achieve their goals.

Any online training of yours on Udemy etc.?

The housing madness has gone on longer than I thought it would. But in Tucson we haven't even went higher than the 2008 housing crash yet. Pretty much another lost decade.