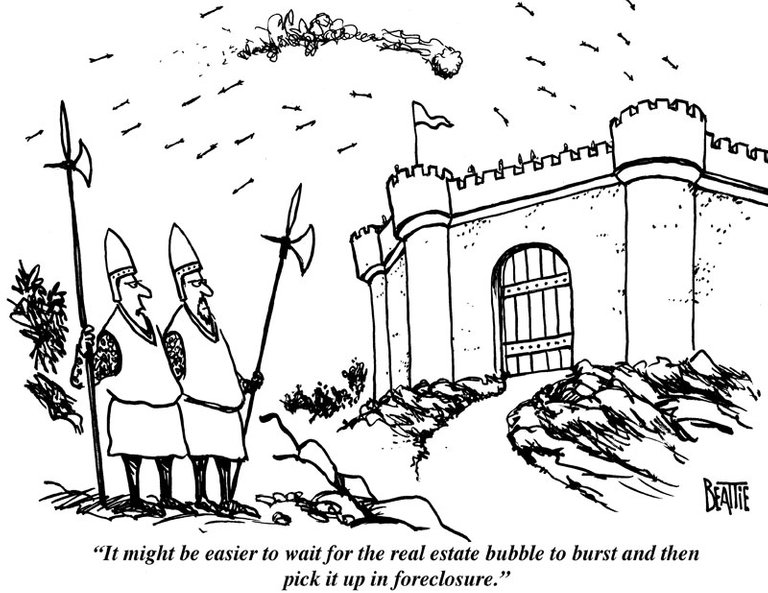

The "F" Word: dun, Dun, DUNNNN......FORECLOSURE

A new series of articles devoted to the subject of realizing the American Dream of home-ownership and the potential to lose it to foreclosure or back taxes. These posts serve to introduce readers to the various reasons foreclosures happen, and to the options available to homeowners.

In this edition, we explore the most common situations homeowners face. No matter what stage someone is in, it is wise to have an understanding of the entire Foreclosure Process.

Why do people lose their property?

36% of households in The United States have $0 in savings set aside for emergencies. And 83% of American households have less than 3 months of expenses in savings; including mortgage payments. Pretty staggering statistics when you think about it. Sadly, one interruption of income, or increase in expenses can lead many to face a difficult situation.

Job Loss / Transfer or a major life event such as an inherited property, divorce, death, or birth can many times lead a homeowner to feel screwed in the you know what.

Late payments: Mortgage or taxes.

If you are lucky enough to see it coming, you have many more options available to avoid more costly problems.

What is Pre-Foreclosure & the Foreclosure Process

The specific foreclosure (or tax lien) proceedings are different in each country, state, county/parish, and even vary city to city.

It is important that homeowners educate themselves on the actual process that their Lending Institution (bank) or Tax Office follows. These institutions have set protocols and specific time-lines that guide employees through each step of the foreclosure / seizure.

This information is not always (if ever) easily accessible, but it is well-worth the time invested to research and educate yourself.

The Grief Process

Having money trouble sucks: it's embarrassing, stressful, and even downright scary to lose your house. It's good to have a clear-minded third party (friend and/or real estate professional) to guide you through the process; and/or a shoulder to cry on like a counselor or priest.

An important thing to remember is that banks do not want to foreclose on your property. It is a tedious and costly process. The bank representatives are just following protocol. But fret not! There are multiple ways to stop your property from going to foreclosure. Follow @HammockHouse and check future posts to learn more!

I've been through this process. You're right, it's not fun. We used to live in Florida. Received an invitation to serve on the pastoral team of the church where I currently serve. We ended up doing a short sale. Was a scary experience. We paid a little over $200k for the house. It ended up selling for just a little over $100k. Sigh. What was even more stressful, though, is that one week after we closed on the short sale, we received a foreclosure notice in the mail. Apparently, different departments at the bank were at work without speaking to each other. Thankfully, we were able to show them the short sale papers and they didn't foreclose. By God's grace, never again.

Amen. We have met many with similar stories, it is a relief when its over. Even if there are a few scars, they do heal in time :)

Welcome @hammockhouse aboard the steemit express. This is a great platform to express yourself just like any other social media outlet except this one pays its users for interacting with each other. Post good content and your rewards can be limitless but always stay true to yourself.

@slickhustler007 #minnowtowhale #minnowsupport

click here!This post received a 4.2% upvote from @randowhale thanks to @xtrodinarypilot! For more information,

Well thanks for the upvote guys

Congratulations @hammockhouse! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP