The Russian government is inside the method of finalizing the federal law for the regulation of cryptocurrencies and preliminary coin offerings. The draft regulation has now been formally posted. It regulates the advent, issuance, garage, and movement of cryptocurrencies.

Legal Crypto Definitions

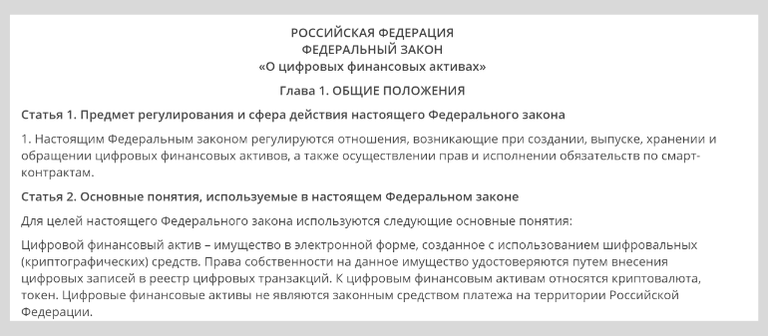

The Russian government has officially published the draft federal law entitled “On Digital Financial Assets” which regulates cryptocurrencies in Russia.

This draft regulation become delivered by the usa’s finance ministry on the give up of December. It changed into followed through a great deal dialogue and amendments to the bill earlier than it changed into finally released to the public on Wednesday. Article 5 of the document states that “This federal regulation shall enter into pressure 90 days after the date of its reliable booklet.” in keeping with the file:

This federal law regulates the relations arising in the creation, issuance, storage and circulation of digital financial assets, as well as the exercise of rights and performance of obligations under smart contracts.

The draft law presents Russia’s professional cryptocurrency-associated definitions for the first time together with the definition of cryptocurrency, tokens, clever contracts, crypto exchanges, and mining.

Russia Finalizes Federal regulation on Cryptocurrency RegulationCryptocurrency is defined as “a kind of virtual financial asset created and accounted for in the distributed registry of virtual transactions by using contributors in this registry in accordance with the rules of maintaining the registry of virtual transactions.” meanwhile, a token is defined as “a type of a virtual economic asset that is issued through a criminal entity or an individual entrepreneur (hereinafter referred to as an company) so as to appeal to financing and is recorded inside the registry of digital information.”

As for mining, it's miles deemed “an entrepreneurial activity aimed toward growing a cryptocurrency and / or validation so that you can get hold of repayment in the form of a cryptocurrency.” Mining sports are eventually defined as “legally valid” actions.

Rights to Exchange to Other Assets

The document clarifies that Russians have the right to trade their cryptocurrencies for other digital assets and for fiat currency, stating:

Holders of digital financial assets have the right to make transactions for the exchange of virtual financial property of one kind for digital financial assets of another type and / or the alternate of digital financial belongings for rubles, overseas forex and / or other assets simplest thru the exchange operator of digital monetary property.*

“citizens of Russia can be able to buy and sell cryptocurrencies and tokens simplest via professional individuals of the securities market,” Forbes Russia emphasized.

Exchanges and Wallets

After providing the definition of cryptocurrency exchanges, the document proceeds to explain, as also previously reported

Operators of the exchange of digital financial assets can only be legal entities.

The exchanges ought to be “established according with the law of the Russian Federation and carry out the types of sports specified in Articles 3 to 5 of Federal regulation No. 39-FZ of April 22, 1996 ‘at the Securities market’.” rather, they also can be “prison entities which might be the organizers of alternate according with the Federal regulation of November 21, 2011 No. 325-FZ ‘On prepared trading’.”

The document additionally puts regulations on wallets. A wallet is defined as “a software program and hardware device that permits you to keep statistics approximately digital records and provide get admission to.” however, the draft regulation states that a wallet ought to be “opened by way of the operator of change of digital economic belongings handiest after passing the procedures of identification of its owner according with the Federal law of August 7, 2001.”

Token Sales and Their Investors

A huge part of the record addresses preliminary coin services (ICOs). It specifies policies for token sales which includes the issuing procedures and what files and facts need to be disclosed prior to the income. For every ICO, the company have to also provide an funding memorandum containing all facts related to the provider and the tokens. The rules state:

A suggestion for the discharge of tokens, an investment memorandum, guidelines for preserving the register of digital transactions, in addition to other files…ought to be published no later than 3 operating days before particular inside the offer for the discharge of tokens.

Moreover, tokens “won't be offered to potential clients in any shape or via any method using advertising” previous to the booklet of a proposal for the release of tokens. similarly, the draft regulation imposes regulations on non-certified buyers, pointing out:

Folks who are not certified buyers in accordance with the Federal regulation No. 39-FZ of April 22, 1996 ‘on the Securities market’ should purchase tokens in the quantity of now not extra than fifty thousand rubles within a single issue.

The only thing governments want is more control. When governments are creating cryptocurrency "laws" or "regulations", understand that is not to help the people. It is to control the monetary system. Just look at China. They banned crypto trading and ICOs because the money was pouring out of their domestic FIAT Yuan and into alternative forms of currency. The governments hate this the most.

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

our discord. If you believe this is an error, please chat with us in the #cheetah-appeals channel in