So, in case you've missed the topic de jour of the last week, Binance was hacked by a worldwide spread group of hackers successfully stealing over 7k BTC by abusing and taking advantage of some of Binance's security flaws (mostly, 2FA hacks, accounts control, etc). VHCEx technical team is looking closely at the ongoing revamping of Binance security system in order to make sure the same thing does not happen to VHCEx. The main discussion people got caught on was: "Is it indeed possible to pull back confirmed blocks of transactions in Bitcoin network?"

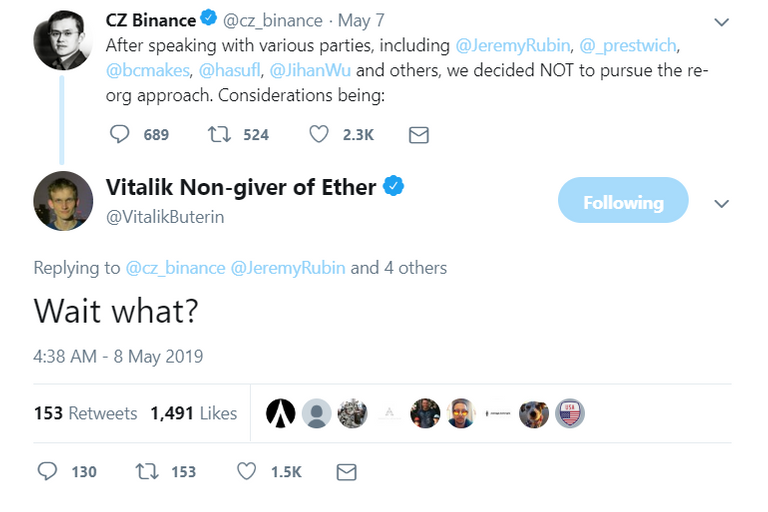

The overall reaction of crypto community may be smoothly encapsulated by Vitalik Buterin's reply to the proposal:

And Vitalik is not the last person who comes to one's mind when thinking about the blockchain revamp. In case, some of you have come to the blockchain industry too late and don't remember how exactly Ethereum Classic came to being, we would like to enlighten you. In 2016 Ethereum community was in outrage over Vitalik's decision to execute the roll-back of the blockchain in order to return 3.6 mln ETH hacked in the infamous DAO hack. A large portion of ETH community disagreed with that and decided to execute a hard pre-fork, thus giving birth to Ethereum Classic - the blockchain where the stolen funds were where they were meant to be - in the hands of hackers. With this regard, we highly suggest you read the open letter by the hacker explaining why the reorg was a bad thing to do.

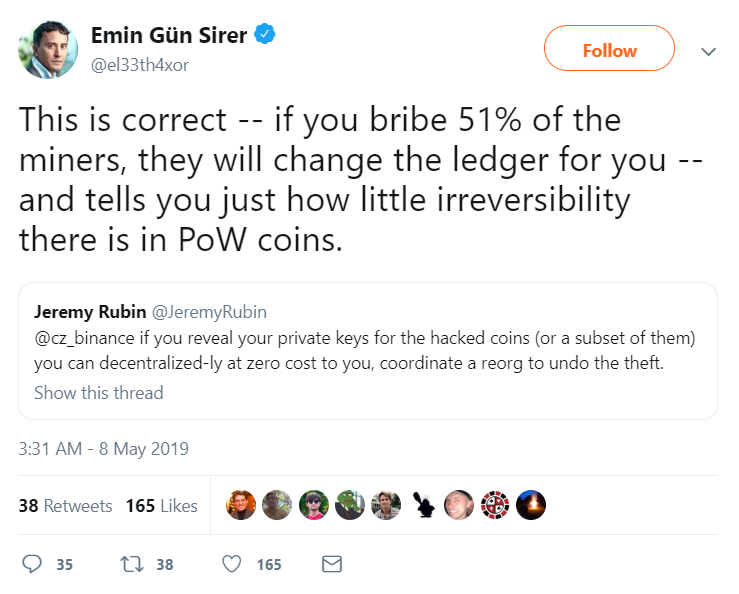

The brief description of what reorg is and how it can be done is presented by Cornell University professor and researcher in blockchain consensus protocols Emin Gün Sirer:

This, once again, confirms the stance of VHCEx regarding the flaws of PoW protocols and the need to global move towards PoS, or DPoS protocols in coins.

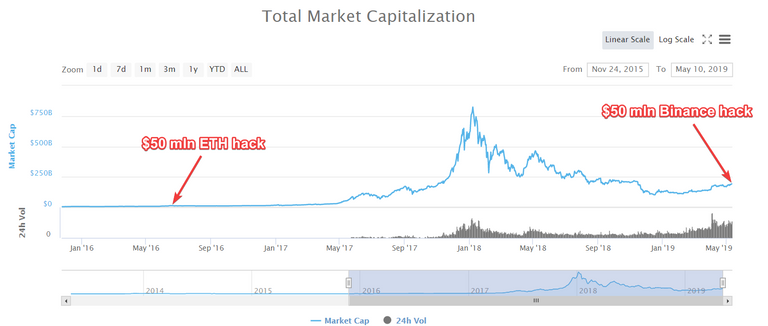

Some people suggested that the reorg for Bitcoin in the present case would not be too bad of an idea also citing the similarities with the Ethereum DAO reorg. However, there can be drawn absolutely no similarities in that matter.

- Total market cap in the summer of 2016 was $12 bln, now it is $185 bln. So, the $40 mln Binance has lost a couple of days ago is by no means comparable to what happened to Ethereum three years ago.

- Hashrate of Ethereum network, or, in other words, the difficulty to pull off the reorg was a meager 4k at the time of ETH pre-fork. Today, the hashrate of Bitcoin network is at 50 mln.

Even if someone can actually bribe the majority of the world's Bitcoin miners in order to pull back the unwanted transactions (together with making all other transaction void), this only shows the weakness of PoW protocol.

I think they were 7000/21000000 late for the hack worth reorging

i think the difficulty of ETH/BTC hashrate does not really matter since it is all about what mining pools you will get to work together with you

it's more about the number of transactions of innocent people that get nullified

imagine two businesses have conducted a deal, processed the money and then their transaction got cancelled without their consent. this would undermine the whole trust to blockchain as technology

yeah, you're right

Binance influence is scalable anyway

sign of weakness by binance

they were just raged and a bit nuts in the immediate aftermaths of a $40 mln hack, you could tell what they felt

ahaha, I remember this mess with Ethereum community in the middle of June, 2016

everybody hated Vitalik

those pre-DAO blockchain are already derelict