This was my first post of the Digital Nomad Quest Interview Series! This weekly series will feature influencers and people I admire. Specifically, my goal with the series is to teach people what it’s like to be a digital nomad, how to start, and how to pick up skills that can enable you to be location/financially independent. To kick off the first episode I’d like to introduce Anita Dhake/Thrifty Gal from The Power of Thrift.

How I Found The Power of Thrift

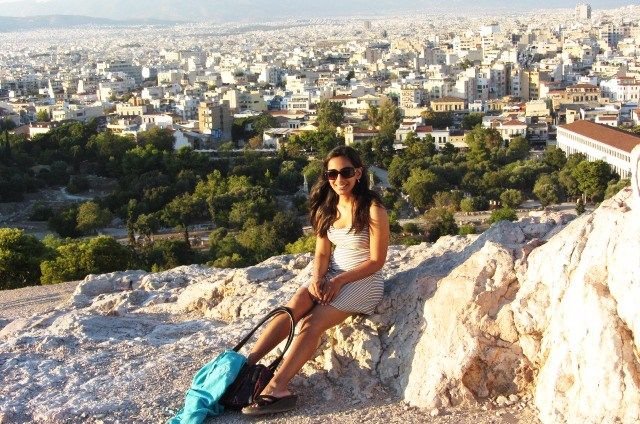

I came across Anita Dhake – the girl who retired at 32 and left to travel the world – while randomly perusing my Facebook feed. I was hooked after reading her Forbes article, and I started reading post after post on her blog. I get extremely hyped when I see girl bosses killing the game. And this particular girl boss was living my dream! She’s achieved financial independence and is traveling the world, working on her bucket list and pursuing her passions as she enjoys her freedom.

How I Met Anita Dhake / Thrifty Gal

If there’s one thing I learned from Tim Ferriss, it’s to reach out to people even if you don’t think they’ll respond. Turns out Anita Dhake was kind enough to speak with me! And the crazy thing was, I found out she was coming to Bucharest so we ended up meeting up for drinks and lunch the next day:

.jpg)

.jpg)

Anita was extremely nice and a delight to hang out with. I know we’ll keep in touch after our hangouts!

So without further ado, here is my interview with Anita 🙂 .

How to Retire Early with Anita Dhake from Power of Thrift

.jpg)

Sharon: So do I call you Thrifty Gal or Power of Thrift?

Anita: You can call me Thriftygal or Anita or Ms. Gal or TG or “Hey you – eating that burrito.” 🙂

Sharon: Tell us about yourself!

Anita: I am a 33-year old lover of travel and writing and reading. I’m trying to fill my days with the things I love and that seems to, not surprisingly, make me love my life. I enjoy trying new things and meeting new people and sleeping longer than you. I have worked as a corporate lawyer, bartender, waitress, flight attendant, insurance claims handler, phone survey taker, photographer, paper delivery girl, administrative assistant and perhaps other things I’m forgetting. The flashier headline is that I worked 5 years as a corporate lawyer and managed to pay off my student loans and build a large enough nest egg to theoretically never have to work again.

.png)

Sharon: I know you have been traveling a lot! Where are you currently located?

Anita: Right now I’m in Laubach, Germany. I’m doing a volunteer program called “English House” where I hang out with German people talking to them so they can get more comfortable speaking English. On Friday I go to Berlin. And then Romania. Then Bulgaria. Then NY. Then Chicago. Then Colorado. Then…(I could go on, but I see your eyes glazing over).

Sharon: How long have you been traveling? Do you get tired of it or do you see yourself doing it long term?

Anita: I love to travel, so I don’t think I’ll get tired of it anytime soon, but only time will tell. I’ve taken one too many international trips every year and domestic trips whenever I can. I was a flight attendant before law school. I took a year off and traveled after law school. Maybe I’ll eventually hang out in one place for a minute, but I think I’ll always be traveling.

Side note: Anita’s been to over 50 countries!

Sharon: How did you calculate how much you needed to retire? How much have you saved up for retirement/what is your net worth?

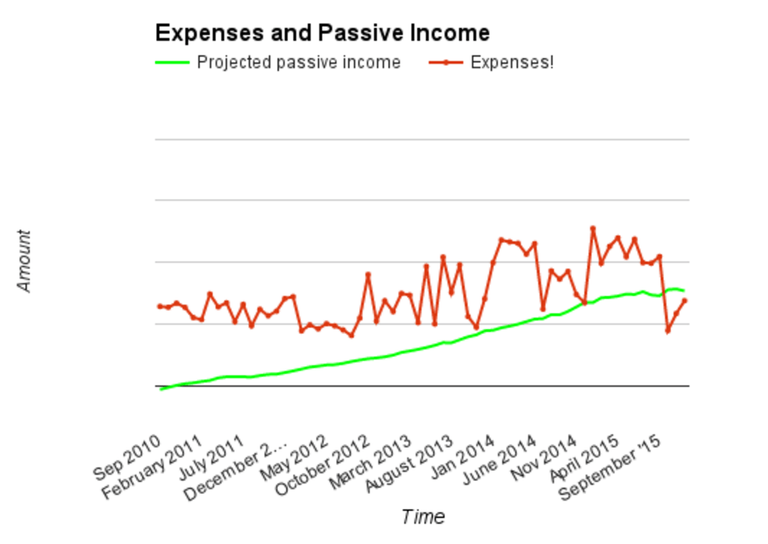

Anita: I started a wall chart of my expenses and projected passive income. I stole the idea from the book Your Money or Your Life. I saved up $700,000.

Sharon: I noticed you make passive income but I have trouble finding out what your income streams are. Are these all stocks? Mutual funds?

Anita: I buy Vanguard Total Stock Market Index Fund (VTSAX). I basically own a piece of every single company that I can in the United States. This way I’m tracking civilization. Some companies may go bankrupt and drop out of my fund, but others make money hand over fist and distribute it to me in the form of dividends. Also, the appreciation of the fund. I like Vanguard because it has the lowest fees.

Sharon: Could you explain how we should read the charts on your blog as there are no numeric values? Or is this mainly for your own personal tracking? Do your passive income streams cover your expenses? What do you mean by “projected” passive income?

Anita: I didn’t put any numbers in my charts because I don’t want people to fixate on the numbers. My enough will be different from your enough which will be different from that guy over there’s enough. I use the 4% rule which has been written about pretty extensively. Theoretically, my investments will increase 7%/year on average and inflation will be 3% per year/average That means, theoretically, I can pull out 4% and the principle will not dwindle. Projected passive income is just that 4% rule. My expenses are the red line from the past 5+ years and the green line is based on the 4% rule. As the green line is higher than the red line, I don’t have to work!

Sharon: Thanks for teaching me about the 4% rule 🙂 Since you worked until 32, do you feel like your thrifty living may have forced you to sacrifice some happiness in your 20’s or do you feel like you were able to budget while maintaining happiness?

Anita: The only year I felt was a sacrifice was the year I spent paying down my student loans. From October 2010 until October 2011, I didn’t travel. Can you imagine how horrible that was? 🙂

Other than that though, I’ve never felt deprived. I’m lucky in that I know what makes me happy and those things are fairly simple. I buy whatever I want. I just don’t want that much.

.png)

Sharon: Now that you are retired, do you ever get bored? Is there something you long for? Or do you feel you have reached a state of happiness/not wanting more?

Anita: I’ve never felt bored. Honestly, I wonder how I had time to work! There is SO much in life to see and do and I want everything. I do occasionally wish I had a partner in crime to travel with, but the vast majority of time I’m simply counting my blessings and feeling awed that I get to live this life.

*Side Note: Though she gets hit on all the time, I’m just going to put it out there that Anita’s single and on the market! Go say what’s up 🙂 *

Sharon: Who is your biggest hero and why?

Anita: My mother has always let me live my own life and been a source of support and encouragement. She and my father moved to the United States when they were in their 20s from India. They had very little in terms of money and I saw how hard they worked and I’m so grateful that they showed me the value of money and time.

Sharon: I know you said you aren’t currently monetizing your blog, but it looks like The Power of Thrift has had huge success so far as it has been featured on Forbes and other sites. What’s your secret? Do you have advice for bloggers?

Anita: Just keep writing. If you don’t enjoy the writing, nothing else matters. I didn’t start this to make money. I started this blog as a place I could point to when people question how I’m retired. I continued it because I liked to write. I don’t have any idea how I’m doing numbers-wise as I don’t like checking, so I’m not sure how successful it is, but as long as you keep writing and have useful content, I think people will find their way to you. I think. Honestly, I have no idea what I’m doing most of the time.

Sharon: What’s something you’ve learned from your travels?

Anita: The world is huge and tiny. People are vastly different and exactly the same. Every culture has some aspect of life that it seems to be doing right and that you can pilfer from.

.jpg)

Sharon: Besides saving, what other tips do you have for beginners who want to reach financial independence?

Anita: Distinguish between a want and a need. Almost everything is a want. Pick a couple of wants that make you happy and ditch the rest. You’d be surprised by how little you need and how much is window dressing. Most stuff doesn’t add to your life. People and relationships and experiences add to your life. Expand your worldview and don’t compare yourself to your neighbor. Compare yourself to where you were a year ago.

What I love about Anita is her realness. If you check out her blog, she’s not afraid to say what’s on her mind, and I found this quality to be true even in-person. I asked her if she were ever going to monetize her blog. Anita told me that she is torn when it comes to this topic, because she loves the notion of minimalism and not needing more. Yet, monetization can be quite easy with her site as she’s now gaining tons of traffic from multiple blog and TV interviews. At the same time, she doesn’t worry about site traffic and chooses to avoid concerning herself with numbers. I love that even though her site has blown up, she stays humble and honest.

Anita – if you monetize your blog, I won’t judge you at all. Go for it! And thanks again for speaking with me!

Follow Anita:

Website – The Power of Thrift

Twitter – @powerofthrift

Instagram – @evlpeace

Resources Mentioned:

Your Money or Your Life by Vicki Robin

This was reshared from my blog. :)

Very interesting interview!

I like Anita's down-to-earth and adventurous personality.

Yeah she was super cool! We've stayed in touch and were going to hang out a few days back while I was traveling around Chicago (but had scheduling issues). Thanks for reading!

Forgot to add: Digitalnomadquest is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon.com and affiliated sites

:)