If you've walked through a Big W or spoken to the owner of an ING Orange card, chances are you've heard of the Barefoot Investor. He's the every day Aussie with a cold following of ING Orange yielding, superannuation saving families across the nation.

Source: https://barefootinvestor.com/

Overview

Author Scott Pape sets the stage for this book with the gripping anecdote of his 'financial fire' , wherein his family home burn down during a bush fire. The conversational, yet descriptive tone that this anecdote is delivered in is followed throughout the rest of the novel. While Pape's relatable, every-day language choices and humour will have you smirking, it can come across as too casual and rambled at times. Furthermore, this book breaks down basic financial advice well and is presented clearly by Pape with his '9 steps to financial freedom'. Apart from covering the financial basics of debt being bad, compound interest being good, and the importance of superannuation, Pape struggles to give sound advice for would-be investors, as the title implies.

The whole premise of only reading one financial advice book ever is a broken one that Pape contradicts himself. For that future-proof investment advice, you'll need to purchase Pape's Barefoot Footprint, at an additional cost of course. Likewise, if you're growing a family, you'll need to splurge on The Barefoot Investor For Families. Funny purchasing a sequel to the only financial guide you'll ever need, right? Nonetheless, this book offers some basic sound knowledge for people who want to organise their finances.

Pape offers a strong emphasis on saving money by avoiding fees. He swears by ING's everyday orange card, and Hostplus as a superannuation fund, as these services are both associated with minimal fees. Aiming to inform readers with the importance of superannuation, Pape tells readers to salary sacrifice 5% of their wage into a superannuation fund. You'll need to sift through a whole chapter of anecdotes from his past customers, and broken down examples to find this one chestnut of wisdom, as you will with the rest of the book.

A confused audience

This book lacks a specific target audience because it tries to market itself to everyone. Pape stresses the importance of boosting a superannuation fund, despite emphasising on the significance how much time there is until a reader's retirement. Because of this broad audience, Pape's advice can be too generalised at time. One great example is his idea that a couple should share the same bank account - perhaps a recipe for disaster for unmarried couples. When Pape informs readers that he '[doesn't] care if you're in your 20s or your 70s,' for instance, it shows that not even the author knows who his audience is. You can't write a book to please everyone, especially a financial one. The scope is far too broad and Pape could've benefited by finding a more specific audience - couples in their thirties.

Simple advice, because you're simple.

Other financial advisers think you're an idiot. The difference with Pape? He knows you're an idiot. He doesn't go treating readers like they're idiots by speaking down to them. Instead, he offers a simple conversational tone and broken-down, in-depth examples of everyday scenarios that make sense to those who cannot swallow financial jargon. This makes readers relate to Pape, which builds his ethos appeal and makes consumers more willing to accept this advice.

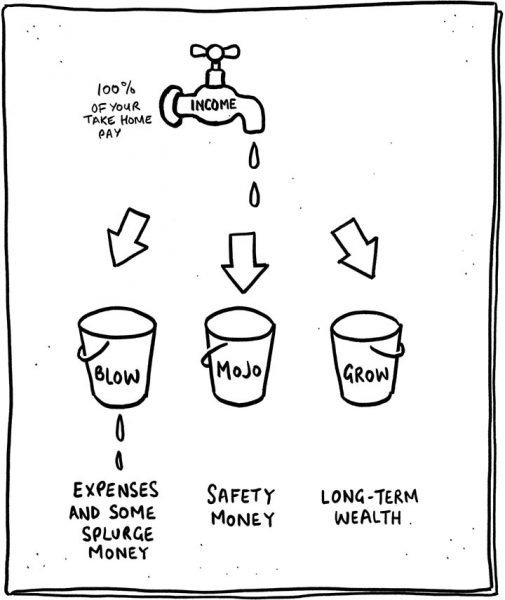

Buckets, buckets, buckets.

Source: Google Images.

In step 2, Pape instructs his readers to set up their 'buckets' so that they can auotoma their finances. He presents the idea of having funds as 'buckets'. Spending accounts are labelled as 'blow' while two additional savings accounts are called 'mojo' and 'grow'. In non bare-foot terms, an emergency and investment fund are required to achieve financial freedom. Sound, easily financial advice that Pape has branded as 'buckets' so that he can sell this advice. His advice for obtaining a $2000 'mojo' (emergency) fund? 'Do whatever you can to find this money,' offers Pape. Gee, thanks for that that really helps. Perhaps he could've offered some ideas to readers instead of commanding them to spawn $2000. Criticism aside, having 'buckets' is a solid system that works for most households, as is reading this book.

Final Thoughts

Remember that $2000 you were commanded by our lord and saviour, Scott Pape in his book The Barefoot Investor: The Only Financial Guide You'll Ever Need? Here's how to get the first $28 in your fund: don't buy this book. I'm not saying don't read it, just don't buy it. Pape has already sold a smooth 1 million copies of his book. Chances are someone you know owns it. Borrow it off your Nanna, a local library, or use the internet to find a .pdf, you naughty thing. ... Maybe don't submit to piracy, it's illegal after-all wink.

This book offers some sound basic financial advice. It is great for families who want to build a foundation to start investing in the future, or for people who live pay-check to pay-check. A simplified tone makes it easy to digest; however, Pape can be too thorough at time and over explains basic concepts like compound interest. The whole idea that this is the only financial guide you'll ever need is silly. By trying to reach a broad target audience, Pape contradicts this idea by not offering individualised financial advice. Trying to reach a more specific audience could've helped make his advice more effective.

Perhaps I am the issue here. I'm only eighteen. I already have an investment fund and top up my Super. I don't plan on buying a house anytime soon, nor do I really want to stress about my retirement. I just feel like this book could've been better suited to families, or people who live week by week with their money.

Have you read this book? Did you enjoy it? Please feel free to upvote, re-steem, comment, and consider following me for more content.

All Steem Dollars from this post will be donated to @teamaustralia to support the #hayrunners initiative. Please consider donating any amount of STEEM to @teamaustralia.

Sound advice! 😁

This is actually a really good review. I like how you've managed to pick out an audience who might find it useful. I can't see me finding it very useful myself. I'd like to think I'm way beyond that. I'm glad I read this before I considered the book.

Posted using Partiko Android