Let's say you have to pay $1.79 for a cup of coffee and you choose to pay with your card. What if there will be an app between you and the card, that will round up the value of that transaction to $2, and put the remaining $0.21 in a special savings account? It's like saving without even bothering about it.

That's exactly what Revolut launched today. In an email to their card holders it announced "Vault" a service which rounds up the value of any transaction and puts the remaining in a special savings account. Here's what they said about it:

Vaults are the easiest, fastest way to save for your financial goals. Whether you choose to round up every transaction, set up a recurring payment or simply make one-off contributions, you’ll be able to set up a Vault in seconds and immediately start saving.

As you can see, there are three ways in which you can use Vault: rounding transactions, setting up a recurring payment (like a normal savings strategy) or making a one-ff payment.

Revolut become relatively popular a few months ago, when it introduced the ability to buy Crypto from within the app, but the commissions and prices are still a bit too high (at least in my opinion).

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

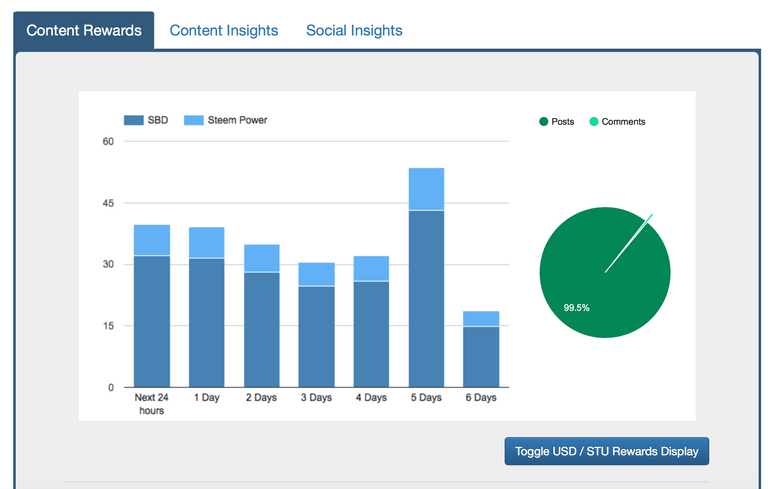

Wanna know when you're getting paid?

|

I know the feeling. That's why I created steem.supply, an easy to use and accurate tool for calculating your Steemit rewards |

Good news thanx

It is really a cool idea to save the pennies in a vault and those little drops make the mighty ocean .

Mighty ocean........You can say that again!

Cool i didn't hear about revolut before thank you for sharing

Revolut is a very useful innovation, a lot of time we choose to close our eyes to these small changes left at the back of the price, now there is a better use of it, savings, for future, excellent innovation

This is a great information about revolut. I am happy to heard it has launched today. Thank you @dragosroua for sharing this post with us.

good news

It will be great cause Revolut will accept about 25 currencies.

The London-based fintech has highlighted that users can save in any of their 25 supported currencies, as well as Bitcoin, Litecoin and Ether. One-off or regular payments can also be added to a Vault at anytime in just a few seconds via the Revolut app. If users feel like saving more or less at any point, the Vault settings can be easily adjusted in the Revolut app and money can be withdrawn instantly at anytime.

woww thats nice to know..

Its such a good news..thanks

Very informative post about Revolut. Thanks for sharing the details about Revolut thats very useful for all.

I got a Revolut card a little while back, I haven't used it yet but will give it a try! I am not sure I fully understand the benefit of this vault though. I don't know if people now days really want a third-party to do the saving for them. It seems a bit 60s idea, unless I am completely missing the point :)

Revolut is a great app. I use it to send Euros to Coinbase Estonia.

Banks charge, Revolut is FREE for SEPA transfers.

What a good app, I find it very useful thanks to you I know it exists and I can use it

I only use my Revolut account for buying Euros at the beginning of a trade so i don 't have to pay the high fees from a standard bank account.

If I remember rightly, if you buy cryto with Revolut you can only sell it again there, you can't trade it for something else, so it's no use to me in respect of buying Steem.

Wow interesting use concept that is awesome thanks for sharing

Revolut are balling like ain't no competition. If commission is higher than industry standard, it is like 50% benefit and 50% extortion in perspective of customers.

salut, mai merge treaba pe steem ?

I like the idea of rounding up a purchase automatically and then saving the difference. I can definitely see more people saving this way. Setting up a reoccurring payment to a savings account is a cool idea, too.

The thing about rounding up the purchase to the nearest whole dollar, though, is that it not only has the advantage of putting something, if just cents, into your Vault/savings, it also has the bonus of making it easier to balance your checkbook with whole dollar amounts (that is still a thing, right?).

The buying crypto would be an added bonus if the fees were lower or actually non-existent, but I don't mind people making something for their work. :)

That's... interesting, the rounding up for saving idea. I've just found out about Revolut yesterday, seems I'm a bit behind about new e-payments tools.

Revolut currently allows customers to open an app-based current account in 60 seconds, receive instant spending analytics, hold and exchange 25 currencies with the real exchange and send free international money transfers.In the last few months alone, Revolut has rolled out a number of new products including geolocation travel insurance, instant credit and a cryptocurrency offering that allows customers to buy, hold and sell cryptocurrencies instantly at the best possible rates.

So it's like Acorn but accepts crypto? That's cool. I gotta be honest it's difficult choosing a savings home base these days. There's a lot of free online savings accounts and some pay decent interest. Then there's better interest options with CDs and some credit building "loan to yourself" kinds of programs that pay back interest. For me accessibility is really important and understanding the conditions of the savings program and how to access the funds and any penalties. I'll check out Revolut. Thank you!

I think Bank of America has had a program like that for a while. Any purchases from your debit card are rounded up and sent to the savings account. I don't think it works with credit cards. Haven't really looked into it.

I don't know that it's a necessary application, but if people have trouble saving money, it could be a good tool for them. One potential negative side (and you might even see it in the app's marketing) is that it could encourage people to spend more because they will be "saving more." People could end up in a lot of credit card debt while trying to save. Uh oh!

Also, is that considered a cash advance on the CC, or is it a purchase of a savings instrument? I know my card has different limits on cash advance.