Ripple : A Long-Term Play in a Sea of Speculation

What is Ripple?

Ripple is a privately funded, for profit company headquartered in San Francisco.

RippleNet is a global payment network invented by Ripple

XRP, also referred to as “Ripple” (yes, very confusing), is the native currency of RippleNet. It is currently valued at about $.21 per XRP.

What is Ripple’s goal?

As the largest holder of the XRP currency (currently holding over 60% of the supply), Ripple’s long term goal is to increase the value of XRP.

How?

By creating a payment solution to problems plaguing the financial services industry in 2017:

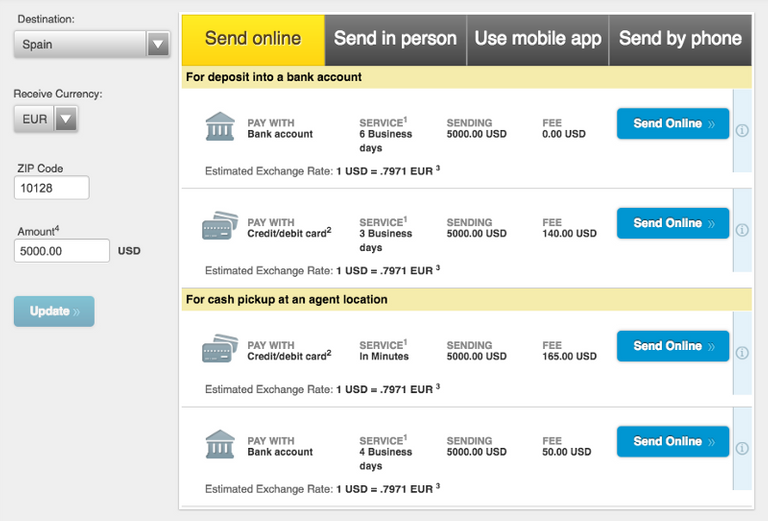

High Fees and Lengthy Settlement: To see where Ripple can add value, let’s see what our options are for sending $5,000 from the United States to Spain in 2017. Using Western Union (the most popular international money transfer agent) this is a lose lose situation.

We have 4 options:

- Wait 6 business days, pay no fee, and receive an awful exchange rate. (The current exchange rate of USD to Euro is 1 USD = .861 Euros. While this rate is subject to some volatility over the 1+ week transfer period, Western Union’s estimated rate of .7871 is an 8% markup over the current exchange rate).

- Wait 3 business days, pay $140, and receive an awful exchange rate.

- Wait a few seconds, pay $165, and receive an awful exchange rate.

- Wait 4 business days, pay $50, and receive an awful exchange rate.

Using XRP we really only have 1 option:

Wait 4 seconds and pay a $.0004 transaction fee.

So clearly, this technology has the ability to deliver lower fees and faster settlement. But how quickly can consumers reap the benefits?

If they go onto the exchange and purchase XRP it will take about 1 week. A few days to clear the compliance checks and a few days to transfer money from their bank account to purchase their XRP. Once in possession of the XRP it will take 4 seconds to see the benefits.

If they do not purchase XRP directly, it could take a very long time. While banks are beginning to adopt the technology, we’d be foolish to expect them to transfer the cost savings to consumers right away. Industry wide adoption would allow banks to reduce costs, keep fees high and reap big profits before consumers demand lower fees.

Interbank Deposits: Just like customers hold deposits, banks hold deposits at other banks to settle transactions. Rather than sending cash payments each time someone at Bank A wants to transfer money to someone at Bank B, both banks just update their deposit balances with each other: Essentially maintaining a running ledger of IOUs.

Considering that no money actually changes hands in these scenarios, banks trust that their deposits with each other can easily be converted into cash. Which is fine when times are good but dangerous when times are bad. If Bank A goes bankrupt, there is a big chance that Bank B’s deposits at Bank A cannot be recovered for cash. In isolation, this is not the end of the world.

But what happens when Bank C wants to withdraw its deposits from Bank B? Having lost cash due to Bank A’s failure, there is a big possibility that Bank B won’t have cash on hand to deliver to Bank C and so on. Failure of one bank has direct effects on other banks.

Clearly this is problematic.

The Ripple network has the potential to eliminate the need for these deposits. Rather than maintaining running IOU’s with each other, banks could settle up in real time with a hard asset: XRP. By sending and receiving XRP in real time, banks would no longer need to hold risky deposits. This would not only limit bank’s risk exposure to other banks, but reduce systemic risk in the economy: A win for everyone.

XRP as an Investment:

While Ripple (the company) wants the price of XRP to go up, price will be determined the same way it always is.vSupply and demand.

Ripple Supply:

The total amount of XRP in existence is and will forever be 100 billion XRP. Like bitcoin’s total supply of 21 million, this number is set in stone and will never change.

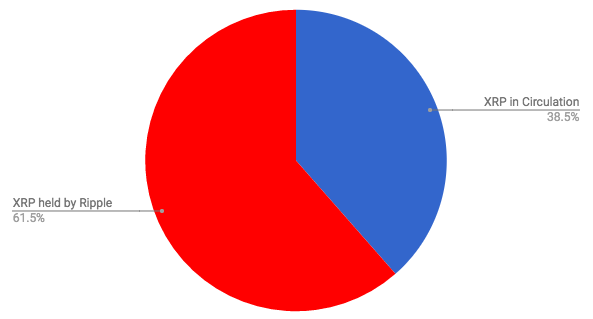

Currently 38.5 billion XRP are in circulation and 61.5 billion XRP remain in the hands of Ripple (the company).

Clearly this is worrisome. One entity controlling 65% of anything sounds problematic. So how did Ripple reduce this uncertainty?

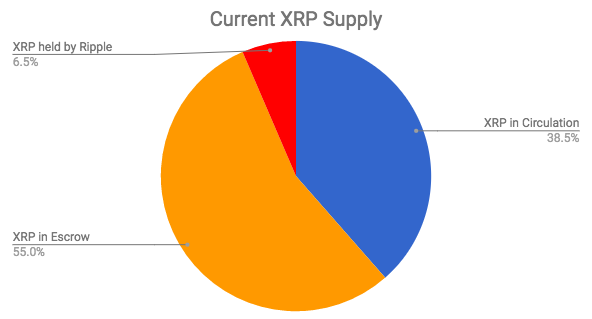

By leveraging the escrow feature of its network, the company committed to release 1 billion XRP for sale each month (with 55 billion total being released): removing a massive degree of uncertainty from the network.

The main goal of this release schedule is price stability. XRP will only find their way into circulation (the secondary market) if someone is willing to buy them. If only 300 million XRP find buyers in the primary market, only 300 million XRP will be added into circulation. This eliminates the risk that the owners of Ripple will cash out and flood the market with all of their XRP at once.

While price stability is not a major goal for most crypto investors. It is a big plus for Ripple’s target audience: Banks

Ripple Demand:

Who will drive the demand for XRP?

Speculative investors: Like Bitcoin, investors are buying and holding XRP in hopes that its price will go up.

Banks: If banks are going to use the RippleNet payment system, they will need to use XRP. Rather than holding deposits in fiat currency at other banks, banks using the network could stockpile of XRP to facilitate these 4 second transactions or go out into the market and purchase XRP each time they need to make a 4 second transaction While the network effect has yet to kick in, the incentives to adopt the RippleNet payment protocol and XRP are strong.

Conclusion:

Overall, the XRP cryptocurrency is a fundamentally different investment when compared to bitcoin and other cryptocurrencies.

Ripple has:

A company headquarters

A long-term mission of growing the value of the XRP currency

An experienced compliance team that is working with regulators

A realistic solution to some problems in the banking industry today

Scalability: RippleNet can handle the same transaction volume as Visa (50,000 transactions per second)

While it may be a tough pill for crypto-enthusiasts to swallow, this pro-bank, profit seeking company could come to dominate a large portion of the payments industry: Making its owners and holders of XRP very happy along the way.