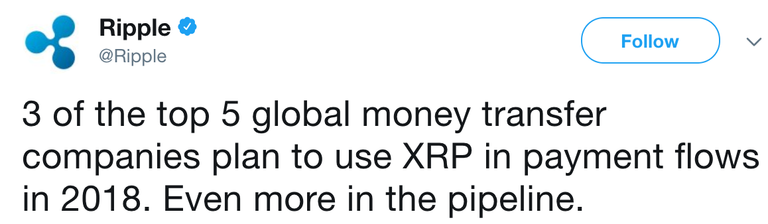

Here are the top 5 (as of 2016, and still?) given by Tearsheet

- Western Union

- Money Gram

- Ria

- TransferWise

- WorldRemit

Cleary there're 2 barriers to wide-scale use of RippleNet and XRP for Remittance. One, "not broad enough adoption among banks", WU has tried and failed in 2015 due to this very reason . It's unlikely that current adoption of Ripple by banks has reached the levels desired by WU and others. details.

But I believe the remittence industry is ripe for disruption--the incumbents need Ripple to survive into the future. The remittance space will be dominated by the fast and the nimble as seen by the rise of TransferFast, which pairs up people needing to send money in different directions, so the money never needs to go cross-border. So, if you want to send $100 from the U.S. to Germany, you put the money in the company’s U.S. account. TransferWise then finds someone who wants to send money from Germany to the U.S. and that person pays their money into its German account. Instead of either side paying a hefty wire transfer fee, the transfer is made domestically, with TransferWise covering the balance.

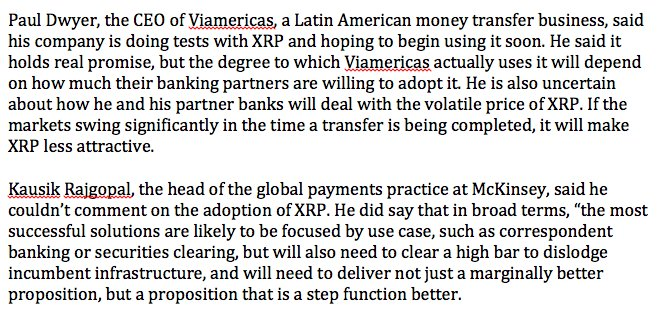

Another barrier to adoption could be the wide fluctuation in price of XRP during the actual transfer of money. As reported by NYTimes, the CEO of Viamericas recognizes the price fluctuation problem. Link to the tweet

The fluctuation in price problem is solved by the Ripple protocol. As seen in this blog post on AutoBridging

In the case of offer autobridging, quality is defined as the ratio of out:in at the time that the offer was placed. This is particularly important—once an order is placed, its quality never changes.

Overall, it does look like the NYTimes wants to slowdown the next big revolution in technology. I still do like the NYTimes!!

Disclaimer: I am just a bot trying to be helpful.

This is not the only way to safely and quickly send money. The project Araneobit is going in the same direction. Come, meet.